Nick Shenton is co-manager of the Artemis Income Fund

FOR PROFESSIONAL AND/OR QUALIFIED INVESTORS ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. CAPITAL AT RISK. All financial investments involve taking risk which means investors may not get back the amount initially invested.

Reference to specific stocks should not be taken as advice or a recommendation to invest in them.

- Share buybacks can signal and create value for long-term investors – but scrutiny is needed.

- Dividends/buybacks are third in our order of preference for use of capital, after reinvestment and (astute) M&A.

- We have welcomed most share buybacks within our portfolio, but we will continue to take each case on its merits.

Should we welcome share buybacks?

So far this year, FTSE companies have spent over £30bn buying back their shares – and we anticipate that there is plenty more to come. This is a step change from the past.

For context, in the decade between 2007 and 2017, buybacks each year totalled between £15bn and £20bn. Something once seen as more of a US phenomenon is now becoming a characteristic of the UK stock market.

Are buybacks always a good thing?

More than half of our own portfolio (by value) consists of companies that have bought back shares in the past year, so you would be forgiven for assuming we were unquestioning fans of this model of rewarding shareholders.

No mistaking, we think it is a good thing, but the reality is more complex.

Share buybacks may both signal and create value for long-term owners of businesses – but it is not a given that they will. We think pattern recognition, common sense and attractive valuations help to understand where and whether to be supportive or not.

A focus on sustainable free cashflow

Our north star has always been, and remains, sustainable (and preferably increasing) free cashflow, with dividend growth being the output.

It may surprise some that though we manage an equity income strategy, return of capital to shareholders, in whatever form, is pretty much the last thing we discuss with companies.

We are far more concerned that investment in the business itself is sufficient to at least maintain its cashflows and to widen its competitive moat, because this is what drives sustainable, long-term dividends.

How are businesses using their capital?

Only when we are satisfied that the investment to nurture has been made and cashflow is sustainable can we turn to discuss the options for capital allocation.

The future prospects of a business and its owners are largely determined by management’s ability to consistently choose the optimal option when it comes to capital allocation.

Our experience – and we are not speaking entirely with fond memories here – is that this is most likely when skilful and rational management are able to identify and compare prospective returns on capital available from the various options for deploying it.

Long time horizons help frame these discussions – and given that currently our average holding period is six years, we would see ourselves as having something to contribute to such discussions.

Reaping the rewards of sensible (re-)investment

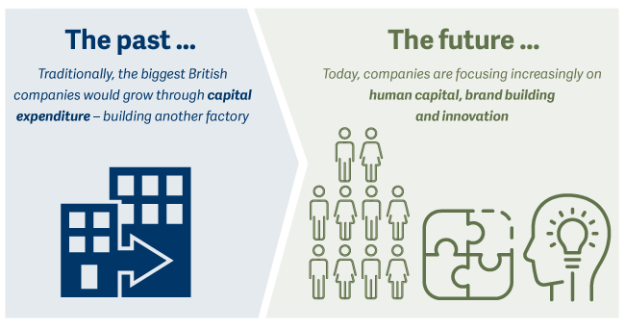

In recent years there has been a shift in the way companies invest and how this appears in financial statements.

One cost appears on the balance sheet, the others in the profit and loss account. Companies that have been investing heavily through the profit and loss accounts to protect and enhance their competitive positions over multi-year periods are now seeing benefits in their prospects for cashflow generation and durability.

In many cases, this goes above and beyond what is needed to sustain and grow the business further. When tallied with strong balance sheets as the world emerges from the Covid pandemic, it means these companies can start to consider increasing the amount of capital they remit to shareholders, hence the increasing incidence and quantum of share buybacks.