Article 3 / 4

What will the next stage of ESG investing look like?What opportunities are opening up for ESG?

There may be threats and limitations to environmental, social and governance investing, thanks in part to the regulatory landscape and lack of clear analysis around it, but there are also plenty of opportunities for investors.

These come in a variety of forms, ranging from ways to invest to more choice available, thanks to emerging nuances in ESG.

Other opportunities include the ways in which an adviser’s role relating to clients can readjust to take into account new potential investments on the horizon.

One of the first things that advisers could discuss with their clients is the benefit of ‘double materiality’.

Double materiality – the double impact on financial and societal issues – holds great promise for ESG and people are becoming more aware of how a company’s actions can improve both the profit margin and the world in which it operates.

European regulators have come up with this measure as a way to help assess an investor’s need for greater information about ESG issues and whether such factors are financially material to a company’s success.

While the UK is behind in such regulatory thinking around sustainability in terms of both ESG and profitability, this is something that many fund managers are considering.

Masja Zandbergen-Albers, head of sustainable integration at Robeco, explains: “The use of the term ‘double materiality’ in regulation is making the industry need to think more about the real world impact they are having on the entire book of business.

“It also requires putting more effort into showing how this real world impact is being achieved.”

Thus, this concept is about honing an investor’s understanding of impact the of ESG, and sharpening fund managers’ analysis and perceptions of what a fund or company is doing, and what impact it can have.

Integration

Robeco also works intensively in the field of ESG integration. Such integration draws the presence of ESG into a wider portfolio, which is a portfolio not limited to responsible, ethical, impact or thematic investing but that includes an aspect of these.

ESG integration is expanding the possibilities for ESG to be present as part of a wider portfolio.

This is increasing the standing of ESG, especially ethical investing – which screens out harmful business – and thematic investing.

Because Zandbergen-Albers is very clear that such integration of ESG needs to be evidenced and measured, it makes ‘real’ the ESG element, and means it has scope to become a thing on its own for those investors who perhaps aren’t completely committed to it now.

Flexibility and holistic relationship

At the same time as growth in ESG integration and awareness of double materiality, there are more products to suit different investors.

Therefore, there is increasing recognition that ESG can be a flexible tool for doing good. It doesn’t have to be a blunt instrument that is restrictive, but can penetrate portfolios and the investment sphere from varying angles and approaches.

Zandbergen-Albers identifies the greatest opportunities for ESG in the holistic relationship between all three strands: environmental, social and governance.

She acknowledges that climate change is massive in the public eye, but feels, like Dunbar, that other factors and considerations have to be borne in mind as well.

Zandbergen-Albers says: “Climate change is, rightfully so, a big focus. Also, biodiversity as a topic is being researched more and more.

“These issues are pressing and for investors, not only indicate clear financial risks, but also clear investment opportunities, which make them interesting from an investment perspective.

“At Robeco we have always looked at sustainability holistically, so governance and social issues are also relevant. We are currently in a process to improve our human rights framework, for example.”

She said the company focuses on all Sustainable Development Goals and not only on the environmental ones, adding: “In our environmental engagement work on palm oil for example, labour standards are also very important and in our climate change approach we also ask companies to put in place policies on just transition.”

Clients’ choice

When it comes to the advice industry, it is the customer’s awareness and preferences that need to hold the most sway.

Ashley Hamilton Claxton, head of sustainability at Royal London Asset Management, says that opportunities for ESG depend largely on what the end customer’s objective is.

She says: “Some customers simply want to avoid investing in certain industries, and therefore an exclusion approach is perfectly acceptable.

“Others want ESG risks taken into account and therefore a standard risk-based approach is suitable. Alternatively, some people may want to create change through their investments – again, this would lend itself to a different type of investment product.

“We should be talking about what the end customer wants and checking that the products are suitable to their investment style and preferences.”

Across finance, from investments to advice to pensions savings, there are younger customers in their 20s and 30s.

Young clients and interconnectivity

Dunbar sees young people as a conduit through which ESG can flourish and grow.

Just like Hamilton Claxton and Eugene Krishnan, chief financing officer of US digital health organisation Jaan Health, Stuart Dunbar, partner at Baillie Gifford, also sees the need for an element of interconnectivity: not only between E and S and G and between stakeholders, but between generations.

Young people have a passion for ESG, and to some degree are more at the mercy of the long-term impact of climate change and the consequences of societal inequalities than older generations.

For this reason, many are more likely to be seeking information about ESG investing of their own volition.

Dunbar explains: “When we ask some of our youngest clients ‘where do you want to invest your pension; where do you want to put [your money]?’ they will typically give an answer such as, ‘I want to put it somewhere that is responsible’.”

He says that this kind of conversation has moved on from 20 years ago, illustrating how today’s younger generation is more clued up about their agency in investment for social and environmental change.

For Dunbar, older generations tend to have the wealth, but less will to invest responsibly. Therefore, there may be an opportunity to improve ESG knowledge by getting old and young in the same room, talking finance with each other.

He believes there is scope for advisers to do this, and to facilitate engaging conversations between younger people and older generations in a family to work out where to invest.

Advisers are in a good place to hold these conversations in family financial planning, and there may be more regulatory nudges towards this in the future.

Having the conversation

Tim Morris, IFA at Russell & Co, believes that having conversations about ESG with all clients is really vital. He says “I’ve included the ESG question for clients for quite a few years.

“It’s been part of our fact-find since last year. And now there is an in-depth questionnaire on our risk profiling tool. I have some clients who’ve been passionate about investing ethically for well over a decade.”

Recent research by consultancy the langcat in 2021 pointed to this. Its 30-page report, ‘Crossing the ESG Event Horizon’, showed advisers and clients are increasingly having conversations about ESG and sustainable investing.

According to the report, which featured YouGov research from more than 1,807 real-life consumers and more than 316 advice professionals, 42 per cent of advisers have a process in place concerning ESG requirements to assess suitability and bring this into the fact-finding discussions.

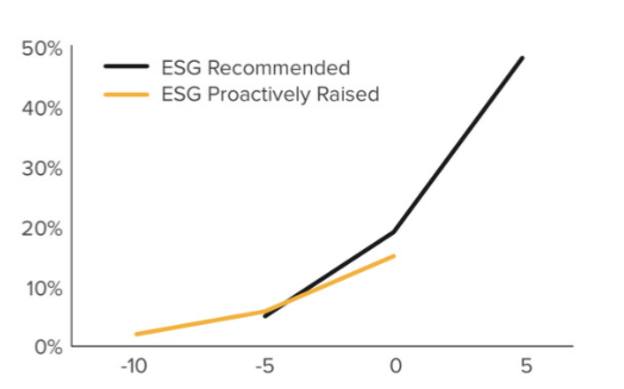

The graph below shows the rise in advisers actively discussing ESG with clients over the past 10 and five years, and predictions for the next few years.

Moreover, Morris says: “Clients have not had to sacrifice returns, and they have experienced a renaissance period in recent years, with a plethora of sustainable funds coming to market.”

Morris believes that ESG is not a hindrance, and at the very least provides a landscape where useful, constructive and probing questions can be asked to work out clients’ preferences and leanings.

Long-term solutions

Dunbar is passionate about the opportunities implicit in applying ESG to investment portfolios.

He says: “We don’t think about growth and value but about timeframe. It’s an element in this conversation, because those companies that are going to benefit from opportunities in the E and S space are the growth companies.

“If you had to put it in a box, a growth approach is likely to provide the solutions that allow people to live well.”

He feels that we should see ESG more as a “positive process of change, where more and more people are looking at it, more and more people are caring.

“Some of the companies will be hugely successful. It’s about companies that are reflecting back something of the world we want to live in.”

.png)