The energy transition – the world’s efforts to replace fossil fuels with low carbon energy sources – is well underway.

Solar and wind generation now account for more than 10 per cent of global power generation, up from effectively zero just 10 years ago.

This growth has been catalysed by declining costs of renewables and broad political and regulatory support to decarbonise.

As part of ongoing decarbonisation efforts, more than 70 countries globally have signed net-zero pledges; these account for roughly 76 per cent of global emissions, according to the UN.

Underpinning support for renewable investments are government-backed policies, such as the US Inflation Reduction Act 2022, which offers substantial tax credits for renewable development.

As a result, we see an increasing number of infrastructure companies, particularly electric utilities and renewable developers, as beneficiaries of the commercial opportunities the transition offers.

Net-zero targets

Despite all the tailwinds renewables are enjoying today, we believe 2050 net-zero goals are largely unrealistic given grid reliability and structural supply chain challenges.

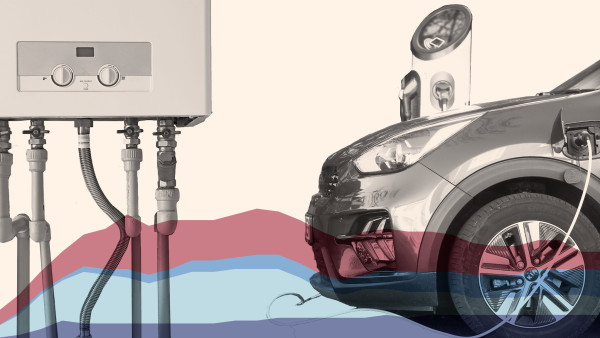

This delayed energy transition will result in a long, useful life for conventional generation. Specifically, we believe natural gas will remain critically important for home heating and power generation. In essence, the market is understating the cash flow durability of traditional generation.

Investors must therefore strike a delicate balance between investing for the future and appropriately valuing critical fossil-based infrastructure today.

It is our belief that traditional energy sources, such as oil and gas, will play an important role for decades to come, as completely shifting to net zero would be impractical for a number of reasons.

The prolonged energy transition will create ongoing challenges for companies straddling the line between investing for a low-carbon future while maintaining the infrastructure needed to support traditional energy.

Investment opportunities in the energy transition

Two sub-sectors where we see considerable opportunity are electric utilities and midstream energy.

Electric utilities will not only be the largest owners of renewable generation, but they will also be tasked with upgrading the electric grid to accommodate and integrate new energy resources.

These concepts – transmission and grid modernisation – will create substantial investment opportunities and higher earnings power for the sector.

Indeed, the International Energy Agency’s 2022 five-year forecast for renewable capacity additions increased 30 per cent over its 2021 forecast.

Select utilities may also benefit from extending the lives of existing conventional assets. Restarting nuclear reactors in developed nations underlines the point that traditional energy will be part of the longer-term generation solution.

Specifically, Germany, France and Japan are assessing whether to extend the lives of their nuclear fleets. We note that the Inflation Reduction Act includes a tax credit for nuclear energy as well as renewables.

Despite the coming renewable buildout, it is clear, in our view, that there is a long runway for the use of natural gas in both power generation and home heating.

In fact, natural gas emits nearly 50 per cent less CO2 than coal. As a result, midstream energy companies are well positioned to expand pipeline infrastructure networks, which should provide cash flow certainty for investors. However, the sector should also benefit from opportunities as the world decarbonises.

One opportunity involves the usage and blending of renewable natural gas, which is created from biogas, with natural gas streams.

Another involves transporting hydrogen through pipelines. These are early days for hydrogen transportation, however, and midstream companies will need to understand how to repurpose their legacy assets to accommodate lower carbon fuels.

Carbon capture, utilisation and storage (CCUS) is an example of a technology that midstream companies are investing in as the world decarbonises.

Specifically, these assets capture carbon dioxide emissions and ensure they do not enter the atmosphere.

The carbon is then sent via pipeline to be stored deep underground or utilised and turned into a low carbon fuel.

We believe certain midstream companies that are early movers in clean fuel and CCUS are well positioned to participate in growth from the energy transition, while also generating strong cash flows from their existing asset bases.

Finally, in addition to a delayed energy transition, we believe investors will have to directly navigate risks and opportunities associated with climate change.

Infrastructure companies will have to strengthen and harden their systems to protect against coming hazards.

We believe active managers are best positioned to manage climate risk, and are prioritising investments in companies that are already taking initiatives to protect their asset base.

The world is undeniably moving toward a lower carbon economy, but the question that remains is the pace of the transition.

We believe 2050 net-zero goals are behind schedule, and this will extend the life of fossil-based assets. With that said, momentum is clearly building for renewables with broad political support.

Tax incentives, emerging technologies and increasing consumer demands are all clear tailwinds in the energy transition.

It is critical that politicians and business leaders, along with investors, understand traditional and renewable energy need to work hand-in-hand to solve the world’s energy problems.

We believe that cheap, plentiful natural gas and an aggressive ramp-up in renewables are the foundation for the world’s energy supply.

There is a place in the market for both the renewable developers, who will benefit from the growth that the transition offers, and the owners of conventional resources that will generate strong and durable cash flows for investors.

Benjamin Morton is executive vice-president and head of global infrastructure; and Christopher DeNunzio is vice-president and managing analyst on the infrastructure securities team at Cohen & Steers