Robo advice for mortgage applications has been deemed untrustworthy by the majority of consumers, according to a new report, despite contrasting research that suggests many favour its efficiency.

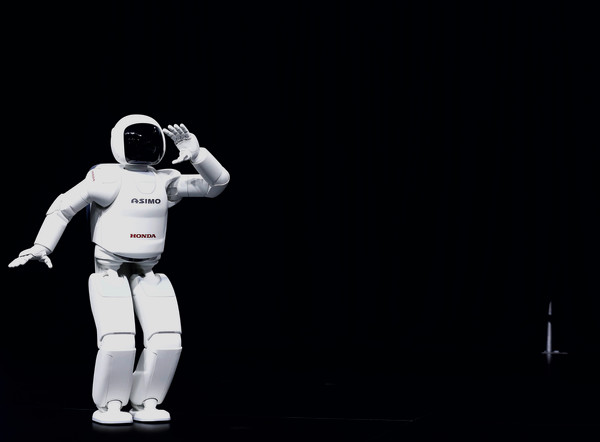

A survey by HSBC concluded that only 21 per cent of people would trust a robot to give them mortgage advice, with 41 per cent saying they put faith in a human broker. The report found that consumers were even more sceptical about using a “humanoid” adviser – a robot designed to look like a human – with only 8 per cent trusting this approach.

In contrast, research conducted by Digital Change and Mortgage Borrowers revealed that 40 per cent of customers believe that robo advice will be faster and more convenient than talking to an adviser.

However, it also discovered that human advice is preferred for more complex products, as two-thirds said they value the opportunity to ask questions and receive a personalised service in such circumstances.

Matthew Harris, chartered financial planner at Dalbeath Financial Planning, explained that while checks could be put in place, there could be a greater risk of robots failing to spot a fraudulent mortgage application.

Mr Harris said: “A human broker has the chance to speak to the client and get a feeling that something just isn’t right. Also, there would be a risk that a robo wouldn’t understand all of the requirements, and couldn’t challenge clients when these requirements are possibly not in their long-term interests.”

A number of developments in the digital wealth management world have emerged in recent weeks, culminating in BlackRock – the world’s largest asset manager – purchasing a sizeable stake in robo adviser Scalable Capital (see page 30).

However, those developments relate to investment services, and penetration of the mortgage market remains limited. Mr Harris said that although plenty of his clients use best-buy tables for mortgage advice, he was unaware of any that have sought advice from a robo adviser, and questioned whether any such services had got off the ground.

craig.rickman@ft.com