Tax changes and rising fears over affordability are threatening to cut the size of the buy-to-let market by one-fifth over the next two years, Aldermore has warned.

Charles McDowell, commercial director of mortgages for Aldermore, said all of the various changes to the buy-to-let market, including the 3 per cent stamp duty tax and more stringent underwriting criteria implemented by the Prudential Regulation Authority (PRA), has made investors feel more nervous.

Mr McDowell said this means many will simply pull out of doing new deals, while accidental or amateur landlords might leave the market altogether.

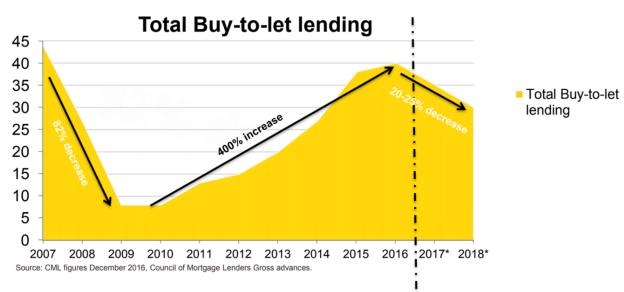

He said: "The buy-to-let market in 2007 to 2008 was going really well, about £45bn pre-crash, then it fell and grew up again back to about £40bn in 2016 - a really healthy market.

"But I think it is going to contract significantly over the next couple of years - I think by about 20 per cent", he told delegates at the Financial Adviser Mortgage Masterclass.

Mr McDowell said: "After 2018, what happens is anyone's guess. I suspect it will continue dropping, but probably not at such a constant rate."

One way for investors to overcome the PRA's stringent stress tests, rather than pulling out of the market altogether, is to take out longer fixed-rate mortgages, Mr McDowell said.

Mr McDowell explained: "In terms of the underwriting changes from the PRA, there is a little 'loophole' that says you do not need to stress [test] if you are taking a five-year fix, or you need to stress it as long as you are taking into consideration rebalancing risk.

"This means the affordability of using a five-year fixed mortgage is much better and therefore we have seen a flight to five-year fixes in the past nine months."

However, he added this would create another "interesting dynamic" in terms of the remortgaging data in the buy-to-let market.

Mr McDowell said: "Previously the market was full of predominantly two-year fixes, which were obviously coming back into the market every two years and being re-dealt.

"Because many people are now taking out five-year fixes, we will only see borrowers coming back every five years, so that will be an interesting dynamic."

One of the biggest reasons behind the tax, regulatory and underwriting changes has been the political push to owner-occupied housing in the UK.

According to Mr McDowell, politicians have been trying to improve the level of outright homeownership in the UK by cooling down the buy-to-let market and the private rental sector.

However, doing this has not addressed or solved the real issue: the fact there is a significant lack of housing available for purchase in the UK.

Mr McDowell said: "I think [the government] has had the wrong idea. This view is misguided.

"The way to help first-time buyers is to have a healthy private rental sector where there are rents that are low, enabling them to move out of the family home, save up for their deposit and then move into somewhere of their own.

"This works well in Europe, for example. But it seems the previous government of (former prime minister) David Cameron and (former chancellor) George Osborne were focused on the buy-to-let market."

He said government believed the buy-to-let market was "overcooking" because of the lack of affordable housing in the UK.

Mr McDowell's comments came as the Department for Communities and Local Government (DCLG) issued statistics on the housing supply.

According to the 21-page report, Housing supply - net additional dwellings, England: 2016 to 2017, annual housing supply in England amounted to 217,350 net additional dwellings in 2016 to 2017.

This was a 15 per cent increase on 2015 to 2016. The report stated 183,570 of the total number were new-build homes; the rest were from conversions.

However, there is still a shortage in supply of housing, and the market has not yet recovered from the effects of the credit crisis in 2008 to 2009 and again in 2009 to 2010, when there were significant year-on-year slumps in houses built.

There was an 18 per cent drop in 2008 to 2009, which was compounded by a 21 per cent slump in 2009 to 2010, resulting in just 144,870 homes being built.

This is significantly down on the 250,000 new homes needed each year, according to the 2014 Lyons Review, and even down on the 200,000 cited by the 2004 Barker review.

"Since then," Mr McDowell added during the masterclass, "data shows how far off that we are."

The lack of housing has been addressed by prime minister Theresa May, who said she was making housebuilding her "personal mission."

simoney.kyriakou@ft.com