Article 3 / 4

Guide to the return of subprimeAre we heading towards another subprime crisis?

The market may have adopted a new image and lenders may have re-entered the sector tentatively, but what are the chances of another subprime crisis being triggered?

If there were another crisis, who would be most at risk, given the prevalence of gig workers now and those with low deposit amounts?

In the past

David Torpey, chief operating officer at Bluestone Mortgages, insists the market now is very different from the pre-crisis years which he attributes mainly to regulatory changes.

He suggests: “Lenders, investors and rating agencies have learnt from past mistakes, and it is important to remember that the 2007 global crisis was largely caused by lax lending criteria and checks in the US mortgage market, and a poorly regulated and capitalised banking market.

“While UK lending was far from perfect, the performance of UK mortgages was not the tipping point in the crisis.”

He reminds advisers that since the crisis, the capital ratios of the banks in Europe have increased on average from around 8 per cent to 14 per cent.

It is not just the lenders in the credit impaired market who are operating differently now.

The profiles of borrowers have changed in the past decade too.

As Jeremy Duncombe, currently director at Legal & General Mortgage Club, points out: “The changing nature of Britain’s workforce and wider societal shifts are making specialist lending an increasingly important part of the wider market and it’s important to distinguish the sector from the subprime market of the past, as well as clarify the types of borrowers it serves.”

He goes onto say: “In many cases, borrowers seeking the support of a specialist lender are credit-worthy, but have complex incomes that require a more tailored assessment than traditional credit-scoring allows.

“Some may draw their income from a salary and dividends, or might be a freelancer with a varying income month-to-month, while others might have experienced minor difficulties in the past as a result of a redundancy, divorce, bereavement or illness.”

He adds: “These individuals aren’t normally repeat offenders and often have a good payment history before and after their credit event.”

Lenders are getting better at recognising different needs outside of the traditional borrowing requirements, which means they are better able to tailor their products as a result.

Too young to fail?

There are no signs the UK is heading towards another subprime crisis, according to Ray Boulger, senior mortgage technical manager at John Charcol, who observes the post-2007 emerging subprime market is still “very young and small”.

He echoes Mr Torpey’s sentiments about increased regulation in the aftermath of the crisis.

“With mortgage regulation being much tighter now and, in particular, self-certification being banned, the risks are much less than [they were] 10 years ago,” he explains.

“It should also be remembered that the prime reason for the banking crisis was the US subprime market, in which UK banks invested, not UK residential mortgage lending, either prime or subprime.”

A statement from trade association UK Finance acknowledges the role of regulation in helping to make the subprime, or credit impaired, market a safer and more robust sector for lenders and borrowers alike.

“The mortgage industry has successfully implemented regulatory and other safeguards to guarantee that their customers borrow only what they can afford to repay,” a UK Finance spokesperson states.

“2014’s Mortgage Market Review banned self-certification mortgages, tightened the rules around interest-only mortgages and required affordability to be checked more stringently.”

This was followed by the European Union’s Mortgage Credit Directive in 2015 which also put greater pressure on lenders and brokers to show proof of earnings and suitability.

Largely, the tougher rules around mortgage affordability appear to be working.

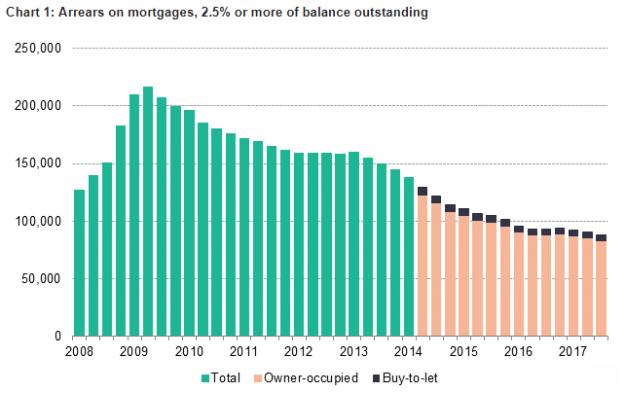

In November 2017, UK Finance reported that the number of mortgages in arrears of 2.5 per cent or more of the outstanding balance fell again in the third quarter (see chart 1 below).

Source: UK Finance

However, it confirmed that cases of repossession increased, albeit from an historically low level.

It reported: “At 88,300 the number of loans in arrears was 2 per cent lower than in the second quarter of the year (90,400) and at its lowest level since this run of data began in 1994.”

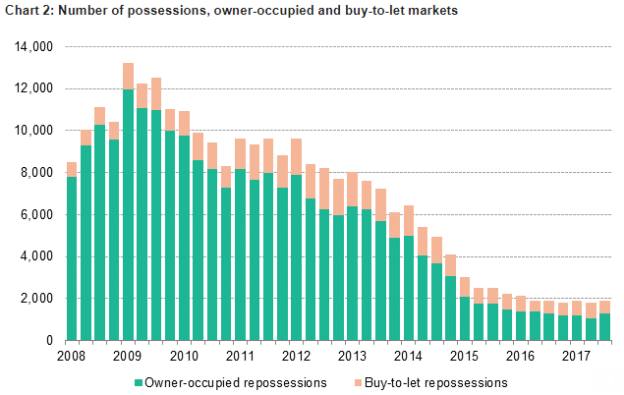

But the number of properties taken into repossession (referred to by UK Finance as 'possessions') in the third quarter of 2017 was 1,900 (see chart 2 below), or the same total as in the first three months of the year.

Source: UK Finance

In a press release, UK Finance’s head of mortgages policy, June Deasy, said: “Even a small rise in mortgage [re]possessions is disappointing but, after a long period of declining numbers, it was inevitable that they would rise again at some stage.”

Signs to watch for

What are the signs to watch out for should a potential crisis loom again and which types of borrowers would be most at risk?

Mr Boulger says: “Those with small deposits will be most at risk as they will have fewer options if they run into any difficulties, but this risk is mitigated by virtue of the fact that relatively large deposits are required for an adverse credit mortgage.

“Signs that the risks are increasing would be property prices falling, larger than expected increases in interest rates, especially if over a short period, and/or sharp rises in unemployment.”

Mr Torpey suggests: “If there were ever signs to look for, it would be a relaxing in lending criteria, excessive growth, high LTV [loan to value] lending and increased arrears, and none of these are prevalent in the market today.

“Existing customers served by specialist lenders would not necessarily be impacted by a future crisis as they have a term commitment from their lender, but it is likely that the availability and cost of new products for new customers would be severely impacted.”

He predicts self-employed customers, who typically make up 30-50 per cent of specialist lenders’ loan books, are likely to be disproportionately impacted by any charges.

eleanor.duncan@ft.com