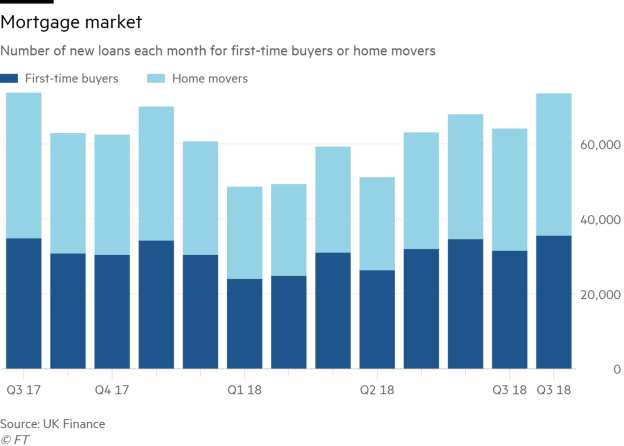

First-time buyers drove a largely stagnant mortgage market in August, with the latest figures showing this demographic hit its highest level since June 2017.

UK Finance’s mortgage trends update for August showed 35,000 first-time buyer mortgages were completed in the month, two percentage points higher than the same month last year and at a value of £6.1bn.

The same data found the average age of a first-time buyer was 30 years old with a gross household income of £42,000.

Meanwhile homemover activity dropped slightly in August with 38,000 new mortgages completed, a drop of 2.3 percentage points on last year, and remortgages fell by 0.3 percentage points to 37,100.

The value of homemover mortgages and remortgages remained the same year-on-year, remaining at £8.5bn and £6.5bn respectively.

Jackie Bennett, director of mortgages at UK Finance, said overall house purchase completions remained stable with the support of first-time buyer activity.

She said: "The homeowner remortgaging market has softened slightly, reflecting the many borrowers who had already locked into attractive deals in the months preceding the Bank of England’s base rate rise."

Amidst recent tax and underwriting changes buy-to-let home purchase levels continued to fall, dropping by 13 percentage points on last year’s figure to 6,000 mortgages in August.

But buy-to-let remortgages picked up in August growing by 4.5 percentage points since the same month a year earlier to 13,800 with a lending value of £2.2bn.

The introduction of an additional 3 per cent stamp duty surcharge in April 2016 was closely followed by the abolition of mortgage interest tax relief for landlords, to be phased down to a 20 per cent flat rate in 2020, further pushing the limits of landlord profitability.

Buy-to-let borrowers are also now subject to more stringent affordability testing under the Prudential Regulation Authority's tightened underwriting rules.

Ms Bennett said: "Buy-to-let remortgaging saw relatively strong growth in August, due in part to the number of two year fixed deals coming to an end.

"This suggests that while new purchases in the buy-to-let market continue to be impacted by recent tax and regulatory changes, many existing landlords remain committed to the market."

Mark Harris, chief executive of mortgage broker SPF Private Clients, agreed first-time buyers were keeping the number of overall house purchase completions at a stable level.

He said: "First-time buyers really are proving to be the lifeblood of the housing market.

"Lenders continue to offer competitively-priced high loan-to-value products to attract them and with property prices softening in some areas, there are good opportunities for those trying to get on the ladder for the first time."

Mr Harris said buy-to-let remortgaging remains strong as a core of experienced landlords remain committed to the sector, despite recent tax and regulatory changes.

He said: "Lenders remain keen to lend and product innovation continues. The Chancellor should leave the sector well alone in the Budget and give it time to recover from the onslaught it has been on the receiving end of in recent times."

rachel.addison@ft.com