However, closer examination suggests other factors may have as much or more influence on current market activity.

Undeniably there has been a slowdown in both residential and buy-to-let markets over the past 12 months.

UK Finance recently reported that while buy-to-let remortgage activity has soared, the total number of buy-to-let purchase completions in 2018 was 11.2 per cent less than in 2017.

Meanwhile, their figures for January 2019 showed a 1.5 per cent reduction in the volume of residential lending, compared to the start of 2018. Put simply, people were choosing to sit tight and rely on the private rental sector rather than buy their own homes.

Key Points

- There has been a slowdown in the buy-to-let sector

- There has been intervention by the government in the buy-to-let market

- The number of buy-to-let products shows lenders are positive about the outlook

For many who are renting, the prospect of saving for a deposit remains an almighty challenge.

The Ministry of Housing, Communities and Local Government’s recently-released English Housing Survey for 2017-18, indicated that the private rental sector has remained unchanged for the past five years at 4.5m households, which equates to 19 per cent of the total.

The latest survey revealed that 58 per cent of renters expected to buy a property eventually, with 26 per cent anticipating this will happen within the next two years, while 41 per cent suggested it will take five years or more to accomplish this goal.

Those timescales suggest that Brexit is not a major consideration.

Meanwhile, landlords have been dealing with more immediate and tangible concerns.

The past three years have seen substantial government intervention in the buy-to-let market, with the introduction of stamp duty on additional properties and the reduction and gradual replacement of mortgage interest tax relief perhaps the biggest financial changes.

But factor in the new house in multiple occupation licensing laws and crackdowns on living standards, plus the imponderable consequences of the imminent tenant fees ban and it is easy to see why some landlords have decided to sell up or not invest.

In particular, it has been the smaller landlord, perhaps with less time to keep abreast of the changes or adapt their strategy, that has struggled with the changes.

Many landlords with larger portfolios may already operate with more organised strategies in place, particularly in light of the Prudential Regulation Authority changes that came into effect in October 2017.

These required a more rigorous approach to the underwriting of portfolio borrowing and resulted in such investors having to provide more detail at the application stage.

It is too simplistic to simply lay current property investment levels purely at the feet of Brexit. There are too many other elements at play.

Adopting a pragmatic approach to investment

There are still plenty of reasons why buy-to-let investments can offer opportunities to those looking for solid financial returns.

Firstly, depending largely on property location and type, many landlords continue to turn a profit, which currently outweighs those available from other types of investment.

Here are a few positive factors to consider if your clients are contemplating a buy-to-let investment:

• At the moment, there is a general sense of stagnation within the property market. This means that property prices are, in many areas, no longer accelerating at previous rates.

Consequently, there may be opportunities available on the market. If you come across a property that has historically been rented out, this might mean there is less work to do upon purchase to have it ready to let.

• Market sentiment, as highlighted by the government’s survey, suggests no reduction in demand for rental homes, as thousands put on hold their dreams of home ownership in favour of renting for the foreseeable future.

In February, London estate agent Foxtons reported that in 2018 there was an 8 per cent increase in renter registrations in London, compared to 2017.

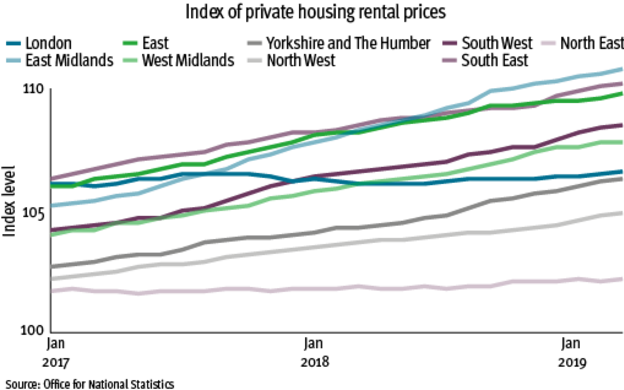

• There are big regional disparities in buy-to-let performance – and landlords are not bound geographically by where they own property. Buy-to-let yields and capital growth prospects vary across the UK, with the North West and the Midlands figuring prominently in recent data.

Since June 2016, when the Brexit vote took place, 10 UK cities have achieved double-digit house price growth, with seven located in the north of England.

• While Brexit has arguably had a negative effect on London and the South East, so too has the price of property for would-be buyers and, likewise, rent for would-be tenants.

With government investment in infrastructure, in particular the Northern Powerhouse, businesses have relocated to other parts of the UK and workers have followed suit. That has helped to create vibrant micro-economies for buy-to-let.

• Historically, house prices have recovered from any short-term economic or political unrest and proved resilient in the face of the financial crisis of a decade ago. Investment in bricks and mortar should always be regarded as a long-term strategy, in this context, well beyond Brexit.

• The sheer volume of buy-to-let products in the market place (1,162 in late February 2019, according to Moneyfacts), reflects a positive buy-to-let outlook from lenders. But the choice also comes with all sorts of incentives and competitive mortgage rates.

The Bank of England base rate remains historically low and rates for five-year fixed rate buy-to-let mortgages, for example, are more than 2 per cent less than in 2010.

The big question is how long lenders can sustain these low mortgage rates? By delaying investment in buy-to-let, some borrowers could run the risk of missing out on the lowest deals, should rates rise in the future.

We live in extraordinary times and Brexit presents its own unique set of challenges, but should not be confused with wider property market issues.

Perhaps never before has there been as much need for a buoyant private rental sector that serves the country’s escalating needs.

With low interest rates, infrastructure investment and growing tenant demand, Brexit may not present as big a challenge as recent tax and legislative changes. But, with a sound and responsive investment plan in place, buy-to-let landlords can prosper and Brexit offers no reason why that should not continue.

Andrew Turner is interim chief executive of Commercial Trust