A research paper by Zanna Iscenko, published as an occasional paper by the FCA this week (May 22), explored whether such mortgages — chosen by borrowers when there were better alternatives in the market — were concentrated within a small range of lenders or were evenly spread across the field.

This followed Ms Iscenko’s paper in May last year which showed that almost 30 per cent of UK mortgage customers chose products that were "worse on all price dimensions" than an available alternative which had “comparable features” and for which the borrower was eligible.

In the latest paper, research showed that every lender had at least some transactions where there was a better alternative available to the borrower and there were only a couple of very small suppliers where every customer could have gotten a better deal elsewhere.

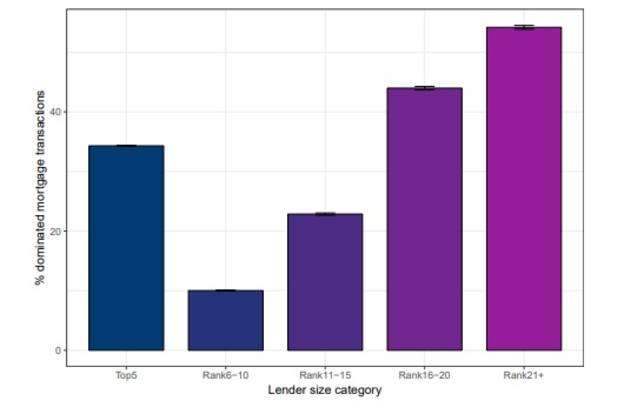

The paper put lenders into categories: top five, rank six-10, 11-15, 16-20 and 21+.

The lowest proportion of such mortgages — where there was a better deal in the market — was seen among the second-tier lenders, ranked between six and 10, as less than 10 per cent of customers could have found a less costly alternative.

Smaller lenders, who fell into the 11 to 15 group, were not too far behind with about 23 per cent of transactions having a better counterpart in the market.

Lenders who fared worst in the research fell into the smallest categories, ranked 16-20 and 21+.

More than 40 per cent of customers who took out a mortgage from the 16-20 group could have found a better deal while the majority of borrowers who borrowed from lenders in the 21+ bracket — about 55 per cent — would have been better off elsewhere.

Ms Iscenko said this reflected smaller lenders’ higher costs due to lack of access to lending economies of scale.

But the top five banks bucked the trend. More than 30 per cent of their mortgage transactions had better alternatives in the market, meaning the top five lenders were actually ‘mid-range’ when it came to best deals.

Source: FCA occasional paper, further evidence on choices of dominated mortgage products, Iscenko (2019)

Ms Iscenko said these findings could suggest that getting a mortgage from a top five bank offered additional benefits that borrowers valued but also stressed it was possible that the largest lenders were a natural focal point for borrowers who are less able or willing to search.

Further research in the paper showed that deciphering which lenders were offering these “better deals” was more complex and there was no single ‘superior’ lender or category responsible for putting them in the market.

On average, each supplier put forward a “better alternative” in fewer than 5 per cent of cases.

Even for the five lenders who most frequently supplied these alternatives, they only supplied alternatives in less than a quarter of cases.

Nick Morrey, product technical manager at John Charcol, said: “The criteria used in this paper may not fully reflect the same criteria we see at the coalface.

“For example, you sometimes get a situation where the borrower could get a cheaper deal elsewhere but that lender could be very slow at processing.

“If you’re in a chain or in a rush, the borrower could be happy to pay a little bit extra to get a deal through quickly.”

Another scenario Mr Morrey pointed out was where smaller banks, that may have market leading deals, would not be able to process anywhere near the same level of activity as a big lender.

“But,” he added, “as the data has shown, maybe some brokers who do not have a broad lender mix may want to review how they give advice and take a look at their lender mix to consider whether they are actually ‘whole of market’.”

The FCA use occasional papers, such as this, as a source of evidence the regulator may use to inform its views.

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.