As of May 1 the average fixed rates for two- and five-year deals stood at 2.09 per cent and 2.35 per cent respectively, but while rates have reduced in the lower LTV tiers, for 95 per cent LTV mortgages they have actually increased.

The products, which are most popular among first time buyers, increased by 0.10 percentage points for two-year fixed rates and 0.04 percentage points for five-year deals.

Moneyfacts believes the trend can in part be explained by the reduction in products available in this segment since the coronavirus pandemic started.

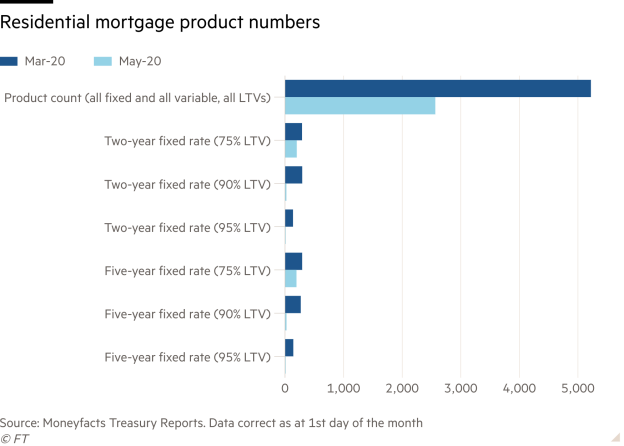

The number of residential mortgage products available at the beginning of May has more than halved compared to the start of March, from 5,222 to 2,566 deals, with many lenders having pulled out of the higher risk markets.

Eleanor Williams, finance expert at Moneyfacts, the level of products on offer in May was comparable to June 2011, when 2,534 products were available.

She said: “This recent, precipitous fall in product numbers can in part be attributed to lenders initially needing to focus operational resource on supporting their existing customers and managing the volume of mortgage payment holiday requests rather than looking to take on further new business.

"The fact that average rates in the highest LTV bracket have increased is probably due to the small number of products remaining in the market leaving a significantly reduced sample size, and also the fact that these products are priced according to the higher risk to lenders when borrowing with only a 5 per cent deposit or equity."

Ms Williams added: “First-time buyers are likely to feel the effect of the current circumstances even more keenly than most. These borrowers are more likely to be looking for a low-deposit mortgage product, which as a sector of the market has contracted significantly.”

Lenders have been asked to provide their clients with mortgage payment holidays to help them get through the crisis financially.

In turn, many lenders retreated from the higher LTV market, but some have made a comeback since.

Last month Nationwide extended lending via brokers up to 85 per cent LTV, after temporarily withdrawing the products to focus on supporting existing customers and processing ongoing applications.

Ms Williams continued: “We are now beginning to see lenders relaunching products within their ranges, and some providers have eased the LTV caps they put in place early in the crisis. Mortgage lenders are still open for business and, for those eligible, rates are low.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: "Lenders are clearly preferring those with substantial equity or a large deposit, as concerns continue around valuations.

"With surveyors currently struggling to value properties and desktop valuations not allowed on high loan-to-value deals, plus concerns about property prices at least in the short term after coronavirus passes, lenders are proving more cautious on higher LTV products, with many being pulled accordingly."

Clayton Shipton, managing director at CLS Money, said although products have dipped in the past few months due to lenders being unable to value properties at higher LTVs, he hoped there would be a “big jump in products coming back to the market” when valuers are able to return to work.

Residential mortgage market analysis | |||

Product numbers | Mar-20 | May-20 | Difference |

Product count (all fixed and all variable, all LTVs) | 5,222 | 2,566 | -2,656 |

Two-year fixed rate (75% LTV) | 291 | 201 | -90 |

Two-year fixed rate (90% LTV) | 294 | 24 | -270 |

Two-year fixed rate (95% LTV) | 137 | 11 | -126 |

Five-year fixed rate (75% LTV) | 293 | 196 | -97 |

Five-year fixed rate (90% LTV) | 269 | 26 | -243 |

Five-year fixed rate (95% LTV) | 142 | 11 | -131 |

Average rates | Mar-20 | May-20 | Difference |

Two-year fixed rate (all LTV’s) | 2.43% | 2.09% | -0.34% |

Two-year fixed rate (75% LTV) | 2.29% | 1.97% | -0.32% |

Two-year fixed rate (90% LTV) | 2.57% | 2.40% | -0.17% |

Two-year fixed rate (95% LTV) | 3.26% | 3.36% | 0.10% |

Five-year fixed rate (all LTV's) | 2.74% | 2.35% | -0.39% |

Five-year fixed rate (75% LTV) | 2.56% | 2.20% | -0.36% |

Five-year fixed rate (90% LTV) | 2.91% | 2.65% | -0.26% |

Five-year fixed rate (95% LTV) | 3.58% | 3.62% | 0.04% |

Source: Moneyfacts Treasury Reports. Data correct as at 1st day of the month | |||

chloe.cheung@ft.com