Initiatives to increase housing supply often go hand in hand with those to boost home ownership, such as the planning bill outlined in the Queen’s Speech.

As rising property prices add to first-time buyers’ pressures, new-build properties – often targeted at would-be homeowners – can also attract a premium.

Figures from the latest UK House Price Index show the average price of a new-build was £312,065 in February, over a quarter more than an existing resold property at £247,624.

The ‘new-build premium’

According to guidance from the Royal Institute of Chartered Surveyors, the term ‘new-build premium’ has garnered two definitions:

- Any extra amount that a buyer is prepared to pay for a residential property that has not previously been occupied, reflecting benefits available to the first owner, as well as those that can be sold on to the next;

- The difference between the value of a new property compared with that of an identical or similar resale or second-hand stock, reflecting benefits only available to the first owner.

Access to government initiatives such as Help to Buy, incentives offered by the developer and benefits of buying a property without an onward chain are some of the potential ‘first-owner benefits’ listed by the professional body.

‘Resale benefits’, meanwhile, can include a high energy-efficiency rating and modern design.

John Doughty, financial services director for Just Mortgages’ new-build division, likewise points to the value of modern living offered by new homes.

Doughty says: “New-build homes reflect modern living, and developers build to accommodate modern tastes. If you look at the bulk of new-build properties now, you will see open plan living. This is something that many homeowners with older homes are investing thousands in renovations to achieve.”

Indeed, amid an interest in home improvements during lockdown, the Construction Leadership Council in late June listed timber and roof tiles as some of the products that continued to be in short supply and a factor feeding into price inflation.

However, KPMG UK’s head of infrastructure, building and construction, Jan Crosby, says price increases of materials will likely reduce builders’ short-term profits rather than dent homebuyers’ bank balances.

Crosby says: “The pricing for new-build houses is largely set by house sales in the local market. As the second-hand housing market is typically about 10 times as large as the new-build market, on its own the new-build market does not set prices.”

Market variations

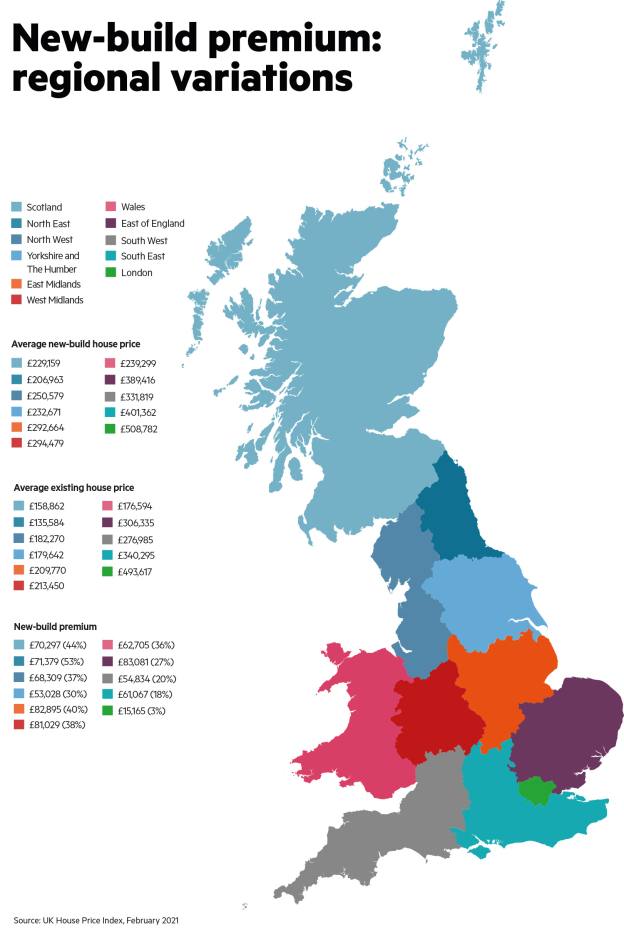

New-build premium analysis from property manager Warwick Estates has found the greatest average gap of 53 per cent in the North East, compared with 3 per cent in the capital.

Kate Faulkner, managing director of Designs on Property, remarks that in areas where there are lots of new-build and second-hand homes in potentially better locations, such as near a station, the latter are likely to be priced higher.

She continues: “In other areas, where it's the first time they are seeing new-builds for some time, it can be the other way round.”

Faulkner also suggests looking at the sold price history of former new-builds, citing examples of flats in a Nottingham development where subsequent sold prices had declined compared with the figure as a new-build.

At the same development, the sale price of an original new-build flat had fallen by more than 40 per cent in five years, from £114,750 as a new home in 2006, to £65,000 in 2011, as recorded in HM Land Registry.

However, many factors can affect the price of a property, such as the seller’s individual circumstances, regardless of whether the property was formerly a new-build.

Surveyor Arnold & Baldwin’s managing director, Joe Arnold, says that whether an original new-build premium applies in the case of a stable, flatlined market will depend on how well the property has been maintained.

And according to Just Mortgages’ Doughty, many clients have been able to clear their Help to Buy loan within five years and remortgage.

Meanwhile, Aldermore’s head of intermediary distribution, Nick Parker, also highlights regional variations that can affect the magnitude of any new-build premium.

Parker says: “The UK housing market historically has consisted of a series of regional markets that vary greatly in supply, house price growth, and investment potential. While new-build properties generally command a higher price than second-hand homes, the difference can vary greatly across the UK.”

He adds: “It’s important that would-be buyers do their research of house price differences in their target areas to see if they feel the benefits new-build properties provide are worth the slightly higher price associated with it, alongside reviewing house price growth over time to assist in gauging the investment potential.”

Chloe Cheung is a features writer at FTAdviser