The industry said this drop was "entirely expected" following the stamp duty land tax holiday during the pandemic.

But UK Finance’s Household Finance Review published today (March 7) suggested it was “somewhat lower” than drop offs following previous stamp duty rate changes, such as the surcharge on additional property which was applied back in 2016.

Mortgage approvals decreased 5.3 per cent in the final quarter of last year, compared to the previous quarter, down from 394,158 to 373,381.

This figure is lower than pre-pandemic levels, when the number of mortgage approvals recorded in the last quarter of 2019 was 379,221.

Jonathan Stinton, Coventry Building Society’s head of intermediary relationships, said overall activity remains “strong” despite what he dubbed a “slight dip” in mortgage approvals.

“It’s likely that we’ll see fewer surges in house purchase activity, but large mortgage maturities throughout the year,” said Stinton.

“Brokers’ clients will need support to find the right mortgage for their needs with rising mortgage rates, living costs and house prices to contend with.

“Plus, we’d expect to see first-time buyers making up a significant proportion of the market this year, which will provide opportunities for brokers to demonstrate their expertise and add value at a crucial time for their clients.”

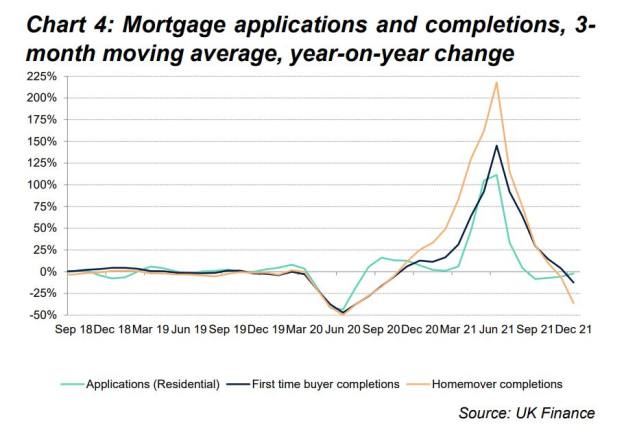

In the final quarter of 2021, first-time buyer activity was down 12 per cent year-on-year, exacerbated by a shortage of housing, record high house prices, and raising barriers to affordability.

However, the contraction in lending was significantly greater for home mover activity than for first-time buyers, according to UK Finance.

The greatest contraction was seen in the south east and south west, the trade body said, with these regions having seen some of the strongest growth figures over the previous year. This was driven in large part by homeowners looking to move or buy additional property further away from London and the traditional commuter belt.

Looking ahead, UK Finance said mortgage application data suggests house market activity in the first few months of 2022 is likely to be lower than at the start of 2021.

But the trade body was quick to add that the drop off “is likely to be relatively modest”. Some experts are concerned, however, that Russia’s invasion of Ukraine could have unprecedented impacts on homebuyer activity this year.

“One of the main reasons this could affect house prices is due to the West turning its back on Russian energy,” said Karen Noye, mortgage expert at Quilter.

“At a time when energy costs were already set to soar, prices may go even higher than predicted. Even food could get more expensive with the price of wheat also set to rocket.

“All this means that first-time buyers and prospective home movers simply have less cash to splash making them think twice about embarking on the expensive process of buying a new house, which could financially destabilise them at the worst possible time.”

Noye added that any deposit for a house will be “continually eroded” by inflation reducing people’s spending power.

Prior to the Ukraine-Russia conflict, the Bank of England predicted inflation to peak at 7.25 per cent in April. “But the war may cause it to go higher and stay that way for longer,” said Noye.

ruby.hinchliffe@ft.com