Over the past five years, from 2016 to 2021, interest rates have been lowest on average in the final quarter of the year, according to FCA data collected by financial planning firm Prosperity Wealth.

In Q4, rates sat at an average of 2.08 per cent over this five-year period, compared to 2.16, 2.15, and 2.12 per cent in Q1, Q2 and Q3, respectively.

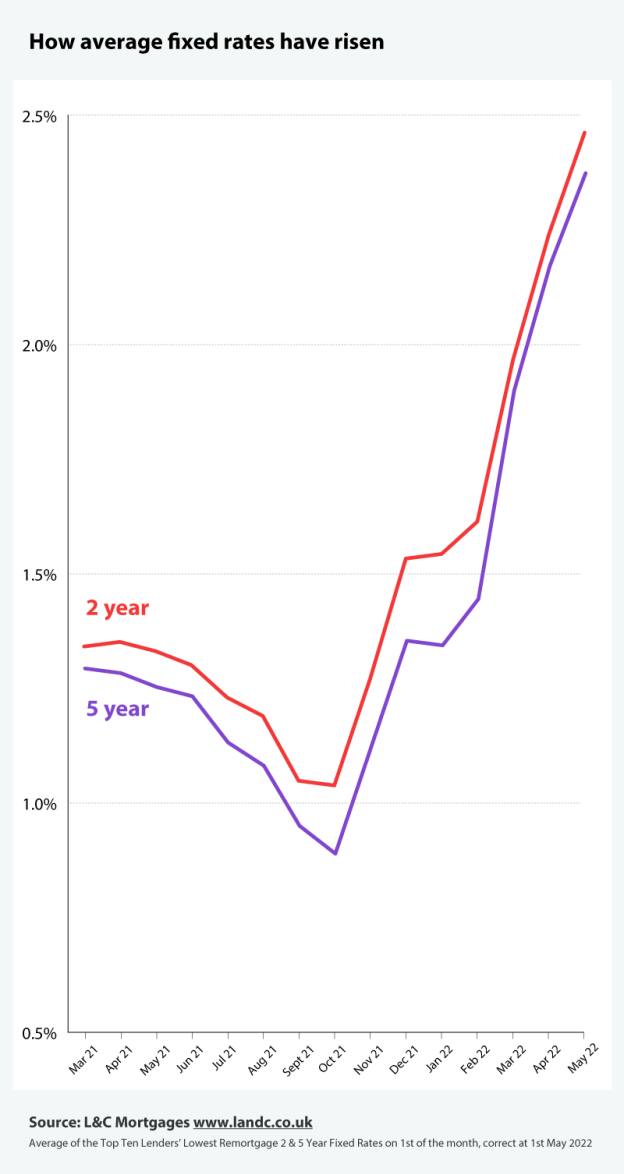

However, with four base rate rises since December, the housing market is no longer on an interest rate decline, but rather on a steep incline.

This has prompted some advisers to question whether the trend of end-of-year low interest rates compared to the rest of the year will continue.

| Quarter | Interest rate % |

|---|---|

| Q1 | 2.16 |

| Q2 | 2.15 |

| Q3 | 2.12 |

| Q4 | 2.08 |

Regulated residential loan interest rates by quarter for years 2017 – 2021

Director at Just Mortgages, Carl Shave, said the final quarter of the year is typically a time on the calendar when lenders will assess their borrowing levels for the year and - to ensure targets are met - adjust rates accordingly to attract the business.

"Perhaps akin to the car market when at certain times of the year dealers look to offer incentives to attract buyers," he explained.

But he pointed out that the period the FCA data covers which Prosperity Wealth has analysed does not take into account a market with rising interest rates. The base rate has jumped from 0.1 per cent to 1 per cent over the past six months.

"As such, whilst I suspect we will still see lenders keenly price their products to fulfil their lending quotas for the year, everything is relevant to the price of rates at the time," Shave said.

"Therefore interest rates available in Q4 could still be higher than that on offer earlier in the year for 2022. But these will be proportionate and still be keenly priced to encourage borrowing."

Director at L&C Mortgages, David Hollingworth, said rates have moved "really quickly" and that there’s no sign of a slowdown in the volume of lender changes.

Data analysed by Hollingworth's advice firm shows mortgage rates have more than doubled since historic lows in October 2021.

By mid-May, the average of the keenest low loan-to-value two and five-year remortgage rates from the top 10 lenders were both well above 2 per cent, at 2.36 and 2.46 per cent respectively, having risen from the historic lows of 0.89 and 1.05 per cent respectively last October.

"Lenders have often sharpened their remortgage pencil as the end of the year begins to loom on the horizon. There will also often be a maturity spike at the end of the year so lenders may target that group of borrowers starting to shop around a few months before," said Hollingworth

"That may still hold true this year but in the current climate rates are on the rise, so even if lenders are pricing as keenly as they can mortgage rates may well have risen further before the end of the year.

"We’re tending to see borrowers look to lock in a deal earlier than they normally might as they’re aware of the sharp turnaround in rates and want to bag a deal now, even if they are as much as six months from their deal expiring."

'We can't just look at interest rates'

Director at brokerage Private Finance, Chris Sykes, agreed the market often sees lower rates in the latter quarters of the year due to lenders having to be more competitive as the year goes on.

But even if interest rates are more competitive, Sykes said there are other things to consider. "Any difference in interest cost is significant, but I don’t think a buyer should make their decision on a property," said Sykes.

"When to buy based on a small interest rate variance throughout the year as if originally looking to buy in Q1 then deciding to buy in Q4 due to rate movements, they could perhaps save 0.08 per cent.

"However, the property may have gone up in value 3 per cent, costing them thousands. Lots of factors go into buying a property. It isn’t quite this black and white."

Sykes said the same is the case for remortgages. "With remortgages, it is often either you refinance when your rate runs out or you’ll end up on a standard variable rate which costs you significantly more so you don’t have all that many options often," he explained.

Data analysed by Prosperity Wealth highlighted interest rates hit a five-year low in 2021, sitting at 2.09 per cent across all regulated residential loans.

| Year | Interest rate % |

|---|---|

| 2017 | 2.17 |

| 2018 | 2.21 |

| 2019 | 2.21 |

| 2020 | 1.97 |

| 2021 | 2.09 |

Interest rates of regulated residential loan for years 2017 – 2021

Many lenders made history last year, reducing rates to record lows at sub-1 per cent. But this year, brokers have highlighted the constant rate increases and withdrawals being put in place by lenders with just hours notice, keeping many of them up late into the night to secure the best rates for their clients.

calum.kapoor@ft.com, ruby.hichliffe@ft.com