Article 3 / 4

Investing in multi asset strategiesAre bonds still an effective diversifier?

So are we wise to continue allocating to fixed income in a multi-asset portfolio, or should we use less-correlated alternatives?

Bond yields are low. Despite yields dipping into negative territory in some cases, common sense suggests that fixed income assets have a loose upper limit to their potential valuation, meaning we are presented with a heavily asymmetric payoff profile.

As a function of united central bank action over the past decade, there has been an increase in asset class returns as the wall of money pushed everything up in unison.

If government bonds and other fixed income assets offer less diversification benefit, it is prudent to question why we still hold them in portfolios, given the downside risk looks so skewed.

But before judging the contribution, or indeed lack of it, that bonds play in portfolios for retail investors, we must look back to the reason for allocating to fixed income in the first place.

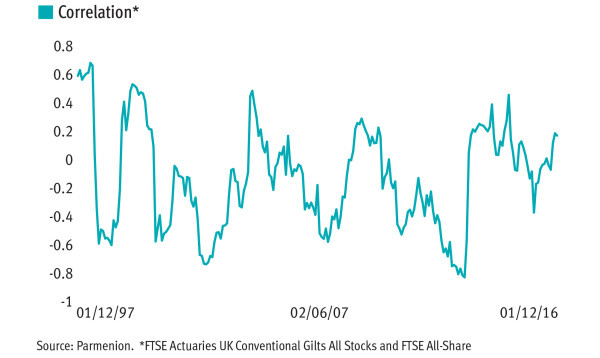

Primarily, the role of the asset class is to provide protection in risk-off markets. But with correlations increasing of late, this protection is being questioned.

It must be remembered that in ‘normal times’, equities are expected to drive portfolio returns. During these periods it is common for short-term correlation for fixed income assets to increase, and for alternatives such as property, commodities and emerging markets to exhibit a reasonably lower level of correlation.

It is natural for investors to extrapolate this into a perceived diversification benefit of alternative asset classes over traditional bonds.

However, it is only when under stress that we fully appreciate our bond allocations, and it is during periods when equities are consistently falling that our portfolio of uncorrelated assets starts to work.

Research conducted by Antti Ilmanen – a noted US commentator on finance and portfolio construction – found that as volatility rises and equities fall, bond correlations tend to be at their lowest, with many other academic papers confirming this. Furthermore, those apparently uncorrelated risky assets experience a much higher correlation.

Mr Ilmanen’s explanation for these changes in correlation is that “the causality from bond prices to stock prices is positive”, meaning falling bond yields tend to also reduce equity discount rates, while the “causality from stock to bond prices is negative”, meaning equity weakness can prompt monetary policy easing and a bond market rally.

We can also view correlation changes as stemming from increased systematic risks overshadowing the asset-specific idiosyncratic risk, and therefore pushing correlations towards 1 for risky assets, while forcing safe-haven bonds to their most negative correlation.

Despite the current perceptions, correlations are not that high at present. In particular, the past six months have seen asset class correlations, sector correlations, country and stock correlations all reduce sharply.

Bond correlations in particular are low, and therefore can remain a strong diversifier within portfolio structures.

While we must accept bond prices are historically high and seem to offer an unappealing asymmetric payoff profile, it is not true that their diversification benefit has been lost. Correlations will fall to their lowest in times of stress, specifically the point when they are most required.

Retail investors do not display much flexibility in their capacity for loss. Despite having our cake and eating it under the beneficent protection of quantitative easing, we shouldn’t look to hold bonds over the longer term as a driver of our portfolio returns, even in the good times.

When determining an allocation to bonds, a thought to remember is that return diversification can be achieved through risky uncorrelated assets, but risk diversification is achieved through holding high-quality bonds.

Timothy Willis is an investment manager at Parmenion