You probably want to grow your loan book, say by 10 or 20 per cent. That is a healthy ambition.

The issue is how on earth do you go about it when some of the bigger banks are absolutely knocking the socks off the competition?

There is no way that you can compete with HSBC or Barclays on price.

Ringfencing has given them a mountain of disposable cash and not even some of the other big players can keep up with them.

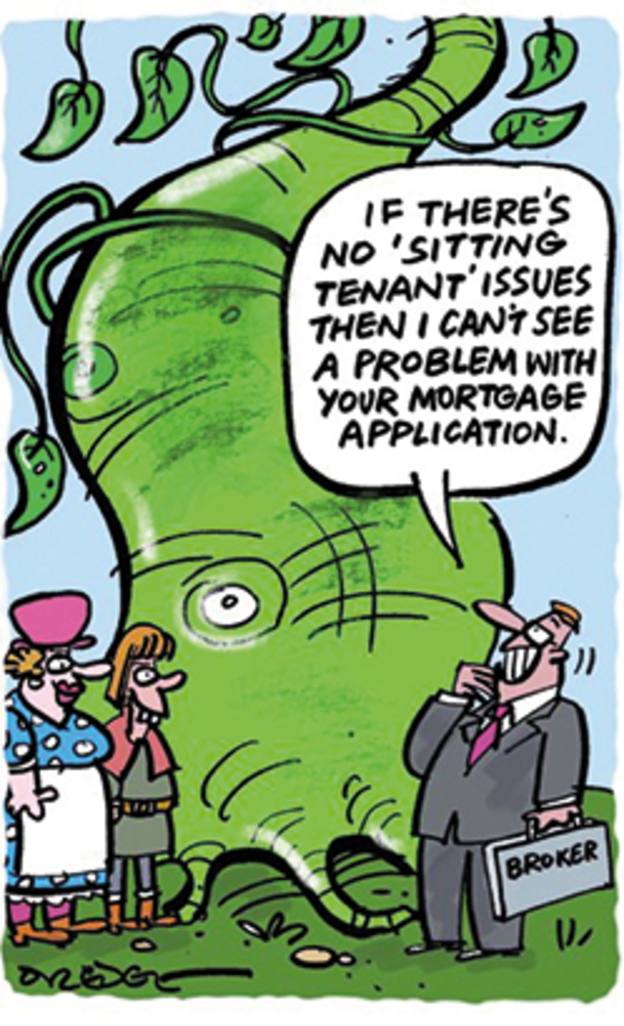

So, perhaps you want to look at other bits of mortgage lending – maybe coming up with new ways of underwriting differently on affordability, or by lending on types of property that you may not have lent on before.

But again, there is a problem, and this time in comes in the shape of the regulator.

Who wants to be the organisation that goes out and does something different?

After all, the rule in mortgage lending for decades has been, if Nationwide and Halifax do not do it, then neither shall we.

All of this creates a mortgage market that is in an awkward stasis.

Market exits

No wonder the Financial Conduct Authority in its sector view update a couple of weeks ago said it feared that some mid-sized lenders would drop out of the market, alongside some of those smaller companies that have already shut up shop.

We have seen reactions to regulation already.

A separate piece of work by the FCA published last month showed how, while the cap on income multiples of 4.5 times had been adopted in one way, in another way it has been stretched.

The actual value of loans above the 4.5 times cap had gone up – so, bigger loans for fewer people.

And it is movers and those on joint incomes who have benefited.

This is just the start of it all, as margin increasingly in this mortgage market comes from service.

The bog standard business is being gobbled up and so if you are a medium-sized player you are going to have to start offering something a little bit different.

We have already seen this in some form with building societies Cumberland, Ipswich and Family who are all carving out a reputation for clever underwriting.

You can slowly see it creeping elsewhere.

This is great for brokers, because again value is where this business thrives.

As the heft of Barclays and HSBC forces the market to narrow, the smaller companies must innovate to survive.

In return, we will see a return to more individual underwriting, and hopefully a demand for better record-keeping.

“As long as the books make sense, the regulator won’t mind,” one industry expert explained to me the other day.

This will help to reflect changes in the property market, where structures previously known as non-standard are becoming increasingly common – flats above shops and so on.

Lenders have to move with the times and they are providing loans for the types of business that is needed.

This is progress and it is to be welcomed. It is also innovate or die.

Trusting insurers

I just can not trust the insurance industry.

It demolished any faith I had in it during the widespread mis-selling of annuities, and then continued to eat away at it with the hokum pricing on general insurance products.

So when the Association of British Insurers issued a report on the pension freedoms, excuse me if I did not jump around with glee.

The ABI has much work to do before it ever convinces me that it is on the side of consumer protection, rather than the safeguarding of its own members’ interests and profits.

Five years into the freedoms and we have not seen the dash for cash as was predicted, but that is not to say some consumers are not at risk of draining their pots.

So the FCA must conduct a proper study so we can see for good what really is happening.

Pensions ‘success’

There was much crowing from the Department of Work and Pensions about the success of auto-enrolment in an annual assessment recently.

While the numbers enrolled are terrific, we must not be complacent.

When defined benefit schemes were more common, the average total contribution of employer and employee was around 22 per cent.

Today the average total contribution across defined contribution is 5 per cent. You do the maths.

James Coney is money editor of The Times and The Sunday Times

@jimconey