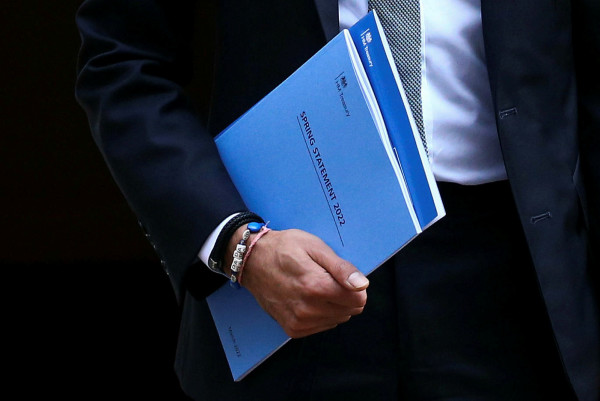

Last week’s Spring Statement gave chancellor Rishi Sunak an opportunity to address the cost-of-living crisis and ensure consumer confidence holds up in the face of soaring inflation.

Following the pandemic and the huge wall of savings that was accumulated by UK consumers, the chancellor will have been hoping that households could fuel the economic recovery from Covid and drive forward growth.

However, inflation and geopolitics have combined to present the UK with a huge headache that isn’t going to go away easily.

Last week’s Spring Statement did see a number of welcome measures to help households cope with this cost-of-living crisis.

The rise in the national insurance threshold and the cut in basic rate income tax at the end of this parliament will go some way to put more pounds in the pockets of voters ahead of the next general election – no doubt conveniently timed – but these measures do not necessarily help with the here and now.

With the rate of national insurance still going up, many will still be faced with a hit to their disposable incomes.

> It does feel as if we are entering somewhat of a stagflationary period

And the outlook doesn’t appear to be improving either. With the war in Ukraine continuing to push up the oil price and utility bills due to rise sharply in the spring, and later in the year, inflation is beginning to bite for businesses and households, and as such more drastic measures may have been required.

No doubt Autumn’s budget will be watched keenly for what more can be done.

But in the present day, the economic picture is becoming murkier.

According to the latest figures, inflation in the UK is already at more than 6 per cent and will remain at worryingly high levels for most of the year.

Meanwhile, the Office for Budget Responsibility also slashed its GDP forecast for this year from 6 per cent to 3.8 per cent.

As such, it does feel as if we are entering somewhat of a stagflationary period. It will be difficult for the economy to emerge from this without some additional stimulus, but with interest rates on the rise it is a tricky balancing act for the government and the Bank of England.

Not all bad news

The picture is not entirely bleak, however. Employment continues to hold up and shows no signs of weakening.

The fact that following the end of the furlough scheme saw no rise in the number of redundancies shows an employment market in good health.

While this will ultimately contribute to inflation pressures, it should mean spending and consumption can remain strong, especially as inflation begins to tail off in the latter part of the year.

Furthermore, corporate earnings remain robust, and while these will tail off as a result of post-lockdown numbers, we expect them to remain in good health.

Inflation will be an issue to contend with for many of these businesses too, but we are seeing evidence that the rise in costs can be absorbed by the consumer and thus margins remain intact.

As a result, for investors it can be a tricky market to navigate. Inflation and rising interest rates are making fixed income a tough asset class to be in, and as such it is vital investors take an adaptive approach in order to find the best opportunities to bolster their portfolios.

Equities, meanwhile, can struggle in times of high inflation, but as earnings remain strong and they offer the best opportunities for growth, they remain the place to be.

With 2022 set to be defined by rising interest rates, we see a scenario where value continues to outperform, and this is another reason the UK outlook is not as bleak as it could be.

The big names in the FTSE will benefit from rising interest rates, and foreign investment may begin to return in a larger quantity than has been seen in the past.

Furthermore, Sunak maintains he is a low-tax chancellor: he still intends to cut taxes as we get closer to the next election, and he will be hoping that the improvement in the public finances is not blown off-course by geopolitical events.

So while an uncertain outlook could get even foggier in the months ahead, the government will be hoping it is a short-lived pain and that better times lay ahead.

Richard Carter is head of fixed interest research at Quilter Cheviot