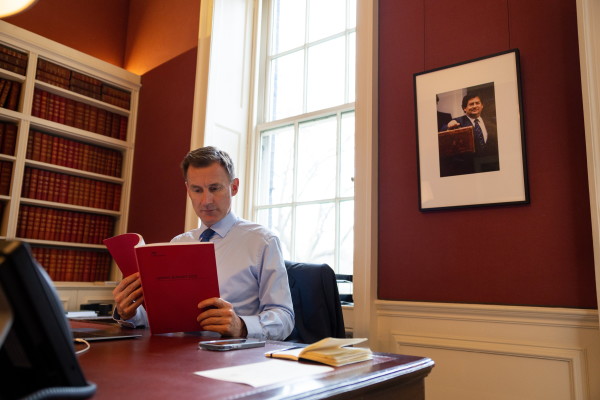

'Advisers must spring into action following chancellor’s Budget'

Earlier this month Jeremy Hunt announced a number of changes in his first spring Budget as chancellor that will have knock-on effects for individuals and businesses alike.

One of the boldest announcements was the abolition of the lifetime tax-free pension allowance, and the increase to the annual cap on tax-free contributions.

These are long and overdue reforms to make the UK pension system more attractive and simpler.

Higher-paid workers who might have felt forced into early retirement or reducing hours to avoid higher tax rates are now incentivised to continue working and contributing to the UK’s economy.

While Labour have suggested that they would reverse this generous change, previous restrictions have allowed taxpayers to protect their pension savings at the higher limits, at the cost of not being able to make further contributions, so there is a window of opportunity for those able to maximise their contributions.

In the small print, we can also see that the chancellor has updated the taper mechanism for the annual allowance.

This taper was previously at £4,000 and restricted the amount that high-earning individuals could save into their pension without losing the tax relief on the contributions. This has now reverted to its 2020 level of £10,000.

Also in the finer detail is a restriction on the tax-free lump sum that can be taken. The 25 per cent limit has been supplemented by a cap of £268,275.

This limitation sets a new precedent for pension policy and a new opportunity for fiscal drag to boost the government coffers in real terms if it isn’t increased by inflation each year.

Subtle changes to inheritance tax

Less obvious was the chancellor’s subtle changes to IHT with regards to agricultural property relief.

It's aimed at a niche market, which explains why it has gone slightly under the radar for most, but it’s an important one for property advisers to be aware of.

The government is organising a consultation to explore the taxation of ecosystem service markets, and the potential expansion of agricultural property relief from IHT to cover certain types of environmental land management.

HMRC will also restrict the geographical scope of agricultural property relief and woodlands relief from IHT to property in the UK from April 6 2024.

Expect more detail to follow, but this could provide some comfort to clients who fear that the increasing focus on environmental projects – as opposed to traditional farming – might restrict the availability of IHT allowances.

For businesses

Many had hoped that the chancellor would delay the increase to corporation tax scheduled for April 1, or at least adjust the thresholds at which companies start to pay the higher rate.

By not doing so, he has missed a huge opportunity to ease the pain for all businesses across the country – not just those in the new investment zones.

Instead, he has added an extra burden to British businesses at a time when they need all the help they can get.

There was some relief with the new scheme announced for full capital expensing. This allows every pound spent by a company on IT equipment, plant or machinery to be deducted from its taxable profits.

The Office for Budget Responsibility predicts that this measure will increase business investment by 3 per cent a year, but we’ll need to see the small print to see how much this benefit, in reality, will offset the increase in corporation tax.

At the very least for advisers, it will bring a long overdue simplification of the current complex rules around capital allowances for companies, while leaving unincorporated businesses such as partnerships still relying on the £1mn annual investment allowance.

All eyes are now on which specific areas will become investment zones in the regions listed by the chancellor.

Likely it will be an area in close proximity to a university, where the local government bodies believe that a high-tech hub could be developed – with a particular focus on creative sector, green industries and advanced manufacturing.

The next step for local councils is to apply to become an investment zone. If successful, they would be allocated funding to attract businesses to the zone.

This can be through incentives such as zero stamp duty land tax, reduced business rates, enhanced capital allowances and employer national insurance contributions relief.

There will also be relaxations for planning applications, potential grants for research and development, and similar support.

These new investment zones – primarily in the Midlands, Yorkshire, Liverpool, Manchester and the Tees Valley – will create new employment opportunities, but residents and business leaders in these areas need to recognise that the process to become an investment zone takes time.

Advisers need to be aware that it could take a while for the benefits to be felt by businesses operating in the area, and for any clients in the South West of England, they should be forgiven for feeling forgotten in this latest Budget.

There was some relief for the hospitality sector after three incredibly tough years with the chancellor’s ‘Brexit pubs guarantee.’

The latest duty rate freeze means that from the first of August the rate on draught products in pubs will be about 11p lower than the applicable rate for a draught product in a supermarket.

The new tax year is around the corner

Last week’s Budget felt relatively light in comparison to recent budget announcements.

The reality is that a lot of the heavy lifting took place in the Autumn Statement.

The priority for advisers should now be preparing for the start of the new tax year where a lot of the changes announced over recent budgets will be coming into effect, including revisions to income tax, dividend and capital gains tax thresholds.

It is not only the chancellor who has a balancing act.

After a decade of low inflation and interest rates, those factors have increased in prominence in tax planning.

Deferrals of liabilities need to be weighed up in light of the advantage in paying tax later on but tax thresholds being frozen or cut in the new year.

Tim Walford-Fitzgerald is a private client partner at HW Fisher