Tools used to assess clients’ attitude to risk and cashflow, are “too crude” to accurately plan a client’s income in retirement, particularly with regards to income drawdown, according to pension consultancy Hymans Robertson.

It warned the regulator could uncover suitability failings further down the line from people running out of money in retirement or not achieving the retirement they wanted.

In particular, the firm, which has a background in defined benefit actuarial work, said risk profiling tools failed to take a long-term perspective, while cashflow modeling relied too heavily on data from the Office for National Statistics (ONS).

The firm had pitted its own data ("Club Vita") against consumer research carried out by Opinium in September last year and found gaps in life expectancy predictions as wide as 20 years.

The table shows the consumers’ views on how long they will live and the discrepancies with the real analysis of life expectancy from Club Vita:

| Baby Boomers (1946-1964) | Generation X (1965-1979) | Millennials (1980-1994) | |||

| Male | Female | Male | Female | Male | Female |

Club Vita Median life expectancy age | 87.2 | 90.3 | 88.6 | 91.8 | 90.6 | 93.4 |

Consumer Survey* Median age to which people expect to live | 80.3 | 80.0 | 79.8 | 79.8 | 69.9 | 80.0 |

Difference | 6.9 | 10.3 | 8.8 | 12.0 | 20.7 | 13.4 |

Chris Noon, partner at Hymans Robertson, said: “Most advisers substantially underestimate how long clients live because they are using crude stats.

“The tools and infrastructure available to advisers to support the drawdown conversation are poor. Ultimately there could be a suitability issue there."

Rory Percival, former technical specialist at the Financial Conduct Authority (FCA), who now runs his own consultancy, also pointed to inconsistencies in the way some tools determined risk ratings and asset allocations.

This was something the regulator could turn its attention to, he said.

Mr Percival advised against using life expectancy in a cash flow planning.

“You want to run a plan to make sure you don’t run out of money to an age you are sure you won’t be around at anymore,” he said.

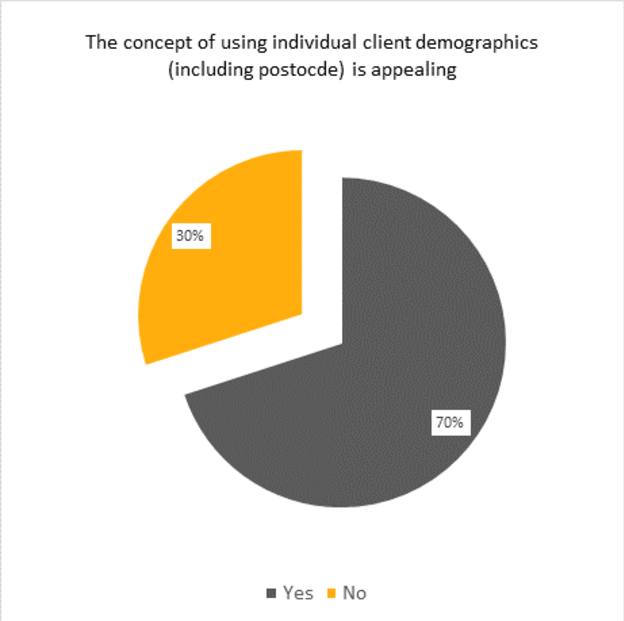

Hymans is launching its own white label tool with Parmenion, allowing advisers to incorporate features such as postcodes into the client demographic data used to determine life expectancy.

Terry Huddart from financial services consultancy the Lang Cat, who has reviewed the tool, said advisers were looking for new options in the market.

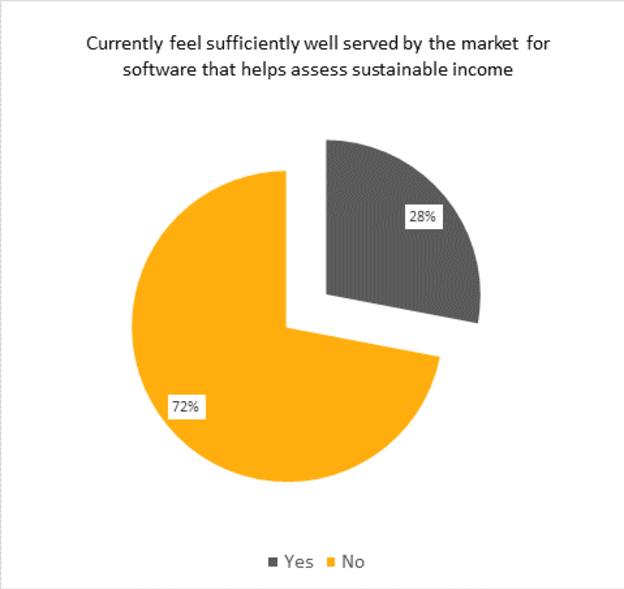

He had consulted a panel of 36 advisers and found 72 per cent felt their current tools were insufficient. They also thought tools were unable to replace the level of detail arrived at by speaking to a client face to face.

Mr Huddart said: “A lot of people were expecting a raft of new software come to market after the pension freedoms.

“[But] there seems to be a broader group of advisers that don’t feel they are being served well enough.”

European regulation the Markets in Financial Instruments Directive, or Mifid II, has also raised the bar for adviser tools.

The rules, effective on 3 January, demand all the tools advisers choose are fit-for-purpose, "with any limitations identified and actively mitigated [by advisers] through the suitability assessment process.”

But software providers hit back at Hymans’ allegations, questioning the need for extra granularity.

Paul Resnik, co-founder of risk profiller FinaMetrica, branded warnings the FCA would come back to haunt advisers over risk rating tools "pure scaremongering."

He said institutional funds with simple asset-liability matching could not be compared to individuals, who changed their needs and goals over time.

“Cash flow planning and that trusted relationship with a financial planner is much better than saying we need a sophisticated tool that [nobody is interested to use],” he said.

Greg Davies from rival Oxford Risk said current cash flow modeling tools "at the higher end" using stochastic modeling for example worked well. He dismissed calls for institutional level models.

“Just because they are sophisticated does not mean they are necessary the right thing to deploy on the individual level," he said.

But Mr Davies pointed to potential dangers with risk-rating tools if they are set up with options to capture daily moods instead of long-term personality traits.

Distribution Technology stopped using life expectancy in its cash flow modeling a while ago deeming ONS averages as insufficient data. Instead the firm allows the adviser to set an imaginary date, typically age 99.

The firm's chief executive, Ben Goss, agreed with Mr Percival there were issues with risk matching that needed to be tackled.

Alistair Cunningham, financial planning director at Wingate Financial Planning, said he felt well served by the tool he is using, Voyant, but was concerned others may be over-relying on tools or not understanding them properly.

He said: “I hear advisers explaining their tools help their clients ‘live their life without fear of running out of money’, and I cannot see how anything other than a very small tranche of clients should ever be in this situation.

“Making a plan more complicated does not make it more accurate, and some tools model an absurd level of detail but are still reliant on hugely variable parameters like longevity and average expected investment returns.”

carmen.reichman@ft.com