Three provider's defined contribution products are the most recommended plans for the bulk of money being transferred from defined benefit funds over the past two years, according to Selectapension.

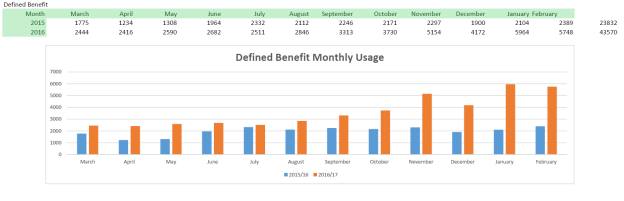

Selectapension, which is used by 7,000 IFA firms and processed 43,570 transfer reports for clients in 2016 taking each client through a range of questions about their retirement needs, risk appetites and approaches to fees, has revealed the "big winners" of the current pension transfer stampede.

At the end of the transfer report process, Selectapension recommends a particular product from one of 60 individual providers across 240 products.

Peter Bradshaw, national accounts director at Selectapension, said that over the past two years the Royal London pension portfolio range had been the most popular choice from this process being selected for 12 per cent of clients in 2016 and 14.3 per cent of clients in 2015.

For both 2015 and 2016 the second most popular choice was the Scottish Widows Retirement Account (7 per cent 2016 and 10 per cent 2015) and the third most popular was the Prudential Flexible Retirement Plan (5.9 per cent in 2016 and 5.5 per cent in 2015).

He added the figures maybe skewed in that some IFAs work on a restricted basis that would exclude other providers from their searches.

Mr Bradshaw noted the number of reports produced by his firm has doubled over the past four months year-on-year, which coincides with elevated pension transfer values being offered after interest rates were cut to 0.25 per cent.

Simon Webster, managing director of Facts and Figures Financial Planners, a Kent-based IFA firm, said the Selectapension figures reflected the risk bias of clients who were moving from a pension that offered a guaranteed level of income.

All the providers, he said, offered smoothed investment propositions that would be perceived as lower risk than other choices.

"The Royal London's governed portfolio range is a low cost option with relatively low volatility and a decent fund manager behind it," he said.

However, he was not sure such choices were the wisest options for those switching out of defined benefit pensions to put their cash into.

"I tend to work on the assumption that if you are coming out of a final salary pension at age 50 you have another 35 to 40 years you have to manage for and over that time you can afford to be a little bit more aggressive in your investment strategy, in the hope of an overall better return longer term," he said.

This would be particularly true for a client that had a wide range of income options in retirement that might include income from a buy-to-let property and other pension pots, he added.

When asked about Selectapension's figures, Sir Steve Webb, policy adviser at Royal London, said: "It is encouraging that impartial advisers are looking across the market and recommending Royal London products as a home for their client’s money.

"Within each product, advisers will be able to tailor the particular investment mix to meet the client’s risk appetite."

Ronnie Taylor, distribution director at Scottish Widows, said his firm had been actively supporting advisers to help increase their knowledge in the specialist area of defined benefit transfers.

He said: “Scottish Widows and Retirement Account represents a secure proposition for customers of advisers looking for a flexible home for their retirement savings."

david.rowley@ft.com