Pension advisers must take vulnerability and the need for long-term care into account when forming a financial plan, a later life specialist has claimed.

Jacqueline Berry, director of My Care Consultant, said it was vital for advisers to factor into their clients' retirement plans provision for costs such as care fees.

Otherwise, she warned, clients could face financial hardship just at a time when they are most vulnerable.

Ms Berry said: "While vulnerability is not restricted to older clients, cognitive decline and the increased need for social and health care makes this group of people particularly vulnerable."

She acknowledged the work the Financial Conduct Authority (FCA) has done in putting vulnerability firmly on the agenda for financial services firms.

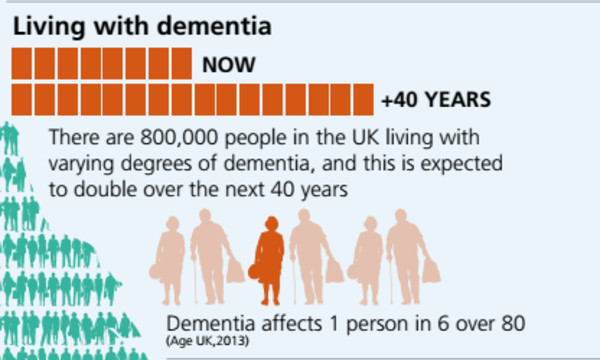

In its 2015 occasional paper on vulnerability, the City watchdog highlighted the growing need for long-term care in the UK, and the prevalence of dementia and cognitive problems among people later on in life.

Ms Berry added: "It is the role of the financial adviser to consider how care might be funded. The average cost per year is currently £30,000 and rising, while the average life expectancy for a private funder needing care is approximately four years.

"A financial adviser is pivotal in helping to change the mindset of consumers who avoid the subject of 'planning for care'."

However, she added it was also the duty of government to play an "even larger" role in helping to change the perception of many people in the UK about care being free.

On Wednesday (20th September), the Work and Pensions Committee launched an inquiry into whether the pension freedom reforms are working.

It considers ways to help prevent vulnerable pensioners from being scammed out of their pension savings by financial crooks.

According to the committee, vast sums have been withdrawn from retirement pots by the over-55s since the 2015 pension freedom reforms were introduced has pushed MPs to act.

The consultation is open until the end of October.

Find out more

To find out more about how the FCA expects firms to treat customers who are vulnerable, and how to ensure investment suitability and better communication, read FTAdviser's Guide to advising vulnerable clients. This qualifies for 60 minutes' structured CPD.

simoney.kyriakou@ft.com