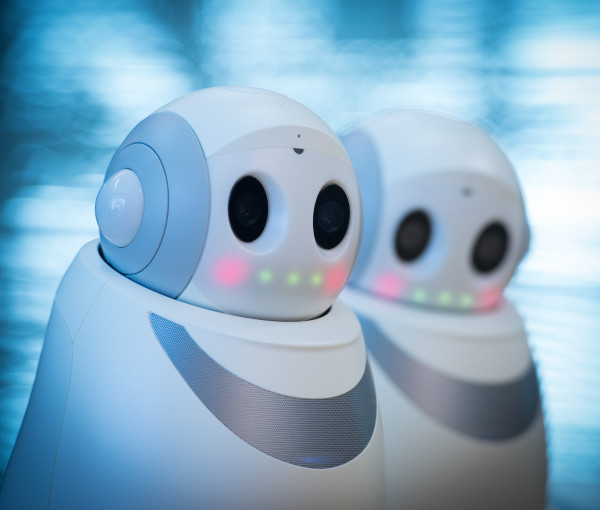

Technology firm Dunstan Thomas is advocating the development of an artificial intelligence (AI) robo-device for the pension dashboard, which could be instructed to buy annuities at the best price or to calculate the best day to drawdown the pension monthly payment.

Adrian Boulding, director of retirement strategy at Dunstan Thomas, believes that the pension dashboard will be just as useful for people that are already in retirement, as it is for those who are building their pension pots.

The plan behind the pension dashboard, which is due to be launched in 2019, is to create the technology to enable savers to see all of their retirement pots in one place at the same time, giving them a greater awareness of their assets and how to plan for their retirement.

Mr Boulding told FTAdviser that it will be especially helpful for people who are in ‘modern retirement’ – individuals that will start to buy retirement income, but they won't necessarily buy it all in one go.

He said: “People are starting with income drawdown, but those people will probably want to move later on in their retirement journey into a secure income product, like an annuity.”

This phased annuity purchase creates “the way for some type of AI robo-device to sit on the dashboard and to watch for the most favourable point to buy the next slice of annuity,” he argued.

He added: “It will be watching for two things: how are your drawdown funds doing - it might be a good time to do it when those funds have gone up -, and the annuity market, to look at how rates are moving.

“This bot could spot the day where these two conditions are met. The bot would be executing this strategy of phased purchase as agreed between the adviser and the client.”

The other use for an AI device would be in the income drawdown space, to help people to manage the levels of monthly withdraw, Mr Boulding argued.

He said: “We are all very aware of the risks, but there isn’t a tool that looks at this for you.

“It would be an AI device that says what is a sensible and sustainable level of income to take this month, given on where your funds are today.”

Mr Boulding advocates that these tools should be used after financial planning with an adviser, but he also noted that he doesn’t see “any reason why a switched-on customer couldn't do it under guidance”.

Since the Department for Work and Pensions (DWP) took over the pension dashboard project from HM Treasury, it has been focusing "very much on users," and looking at what other countries have been doing in this field.

Industry experts have told the government the project should be phased-in and be accessible first-hand to people at retirement.

The DWP is aiming to publish a feasibility study on the dashboard this spring.

Mr Boulding argued that government should pay for the basic dashboard, which should be hosted on the government's Single Financial Guidance Body website.

He added: “What I think we will then see is providers, advisers and platforms will want access to that dashboard, in a seamless manner for their clients - so they don't have to exit their website - and there is where I think we will see those bodies having to pay something for access.

“And I think they will pay for the tools, because they want to host the tools on their own platform.”

Mr Boulding is predicting that AI-driven tools could be developed as soon as 2020.

He said: “2019 will be for early adopters, legislation should be out by 2021, which will obviously give schemes some time to comply, so a fully compulsory dashboard should be running in five-years’ time.

“But if we got an early version of the dashboard running in 2019, then I see no reason why by 2020 we couldn't say that schemes, providers, platforms and advisers that want to link through to that dashboard shouldn't be able to.

“We should build those links, we shouldn't wait for the full compulsion and for every pension scheme to be on the dashboard.”

maria.espadinha@ft.com