Article 2 / 4

Guide to advising the self-employedHow to help the self-employed plan a pension

Pensionhood could last 30 or 40 years - or even longer - as mortality rates improve.

While this sounds fun, the problem of how to pay for all those years in retirement rears its head.

For the employed, at least there has, since 2012, been an automatic enrolment programme to make it a legal requirement for all employers to have a contributory pension scheme for staff.

This has already set 9m more people on the path to pension savings, according to the Department for Work and Pensions (DWP).

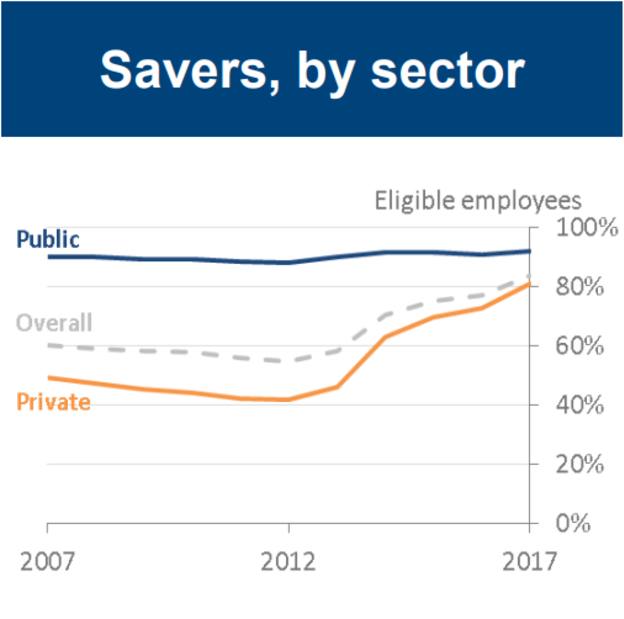

In fact, figures released earlier this week (5 June) by the DWP, found private pension participation has risen significantly thanks to auto-enrolment, as figure 1 shows. The DWP found overall 84 per cent of eligible employees were participating in a workplace pension in 2017, up from 77 per cent in 2016.

Figure 1: Workplace pension participation on the rise

Source: DWP

But the same sort of auto-enrolment mechanism has not been able to be extended - as yet - to the self-employed to make provision for themselves (although, of course, if the self-employed employ others, they will have to provide a pension for their staff, which could eat into the bottom line).

Last December, a parliamentary report into auto-enrolment raised the issue of working out ways to help the self-employed make better pension provision, perhaps through the tax system, although any concrete proposals in this direction are a long way off.

In fact, figures from sister publication Pensions Expert recently found that 45 per cent of self-employed people aged between 35-54 do not have any private pension at all.

So how can the self-employed make appropriate pension provision?

Tough starting point

Tom Conner, director at Drewberry, comments that, with such a worryingly large proportion of the self-employed being without a pension, the first step is starting a pension in the first place.

However, it's not always easy for the self-employed to save, with one in three self-employed respondents to its survey citing affordability as the reason they hadn't started saving yet.

Mr Conner says: "It’s tough for anyone to lock away cash that they could spend now into an arrangement that they won’t be able to touch until the future, but what needs to be remembered is that the state pension isn’t overly generous by any stretch of the imagination.

"By itself, it’s unlikely to be able to provide an individual with the type of retirement they want, so making your own provisions is a must. There needs to be far more consumer awareness around this issue among the self-employed."

For Martin Stewart, director at London Money, the first thing is to help people get into "good habits as early as possible".

He explains: "The real risk with people working for themselves is the classic 'my business is my pension' line.

"It may well be, but there were a large number of people that were crushed by the downturn in 2008 and they lost everything, including their business, sorry, their pension."

Financial and tax planning

As a self-employed person himself, Mr Stewart says he was always encouraged to make sure that not only did he have multiple income streams but also avoided having just one income stream.

He says: "I have seen clients whose business had one client and they did very well. Until that client stopped doing well themselves and both businesses went under.

"We suggest to people that they should use their limited company as a financial planning tool and that would include pension planning. Better to have tax relief than a tax bill surely?"

Tax is an important point for people to consider, according to Jamie Smith-Thompson, managing director of self-employed specialist adviser Portafina.

He advocates setting up some form of a personal pension on the grounds of tax relief on the way in. "The tax relief available for pension contributions is huge," he states.

"So, if they haven’t got an immediate need for the money and they don’t foresee needing access to it before they reach 55, sticking the money into a pension is the most tax efficient way of saving it."

Mr Conner agrees. "The principal attraction of pension saving is the tax relief available on contributions – the government tops up contributions with tax relief at your highest marginal rate.

"The government doesn’t give much back these days, so it makes sense to take advantage of this. A lot of self-employed people we speak to aren’t aware of this tax benefit, which is one of the key selling points of pensions," he adds.

Technology

Steve Andrews, head of managed services at Focus Solutions, believes it is important to use the technology available to help self-employed people see how on-track they are to meet their retirement goals.

This can help the adviser in making recommendations as well as provide a clear visualisation of how much the individual will need to save - and the investment strategy needed - in order to achieve the sort of pension pot they want.

He comments: "Good cash flow planning tools can help the self-employed identify and make the necessary savings provisions to support their retirement goals.

"Advisers can build up a variety of tax-efficient models to maximise savings, and constantly review contributions as financial circumstances change."

According to Mr Andrews: "Having powerful tools that can help model life events, market crashes, the impact of income changes and a range of other events that could affect overall savings goals, will help the self-employed have greater control of their retirement goals."

simoney.kyriakou@ft.com