Defined benefit (DB) pension transfer activity reached feverish levels last year. Nearly £21bn of safeguarded benefits were shifted into defined contribution (DC) schemes – more than double the amount from the previous year – according to a Financial Times freedom of information request.

But this has been a boom plagued by fear rather than accompanied by excitement, as the suitability issues raised by the FCA amid the British Steel Pension Scheme (BSPS) saga demonstrate. Advisers, scrupulous or otherwise, have been thrust under the spotlight for the wrong reasons.

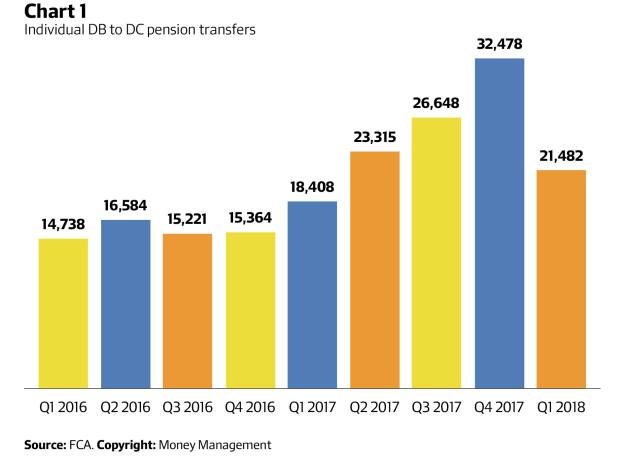

Many could be forgiven for assuming transfer volumes would continue on the same trajectory this year, but more recent data reveals a different pattern: the number of DB pension transfers plummeted by more than a third in the first quarter of this year.

The number of individuals trading final salary benefits for money purchase schemes fell 34 per cent in the three-month period to 21,482, according to figures released by the FCA following a Money Management freedom of information request.

Whether the DB transfer balloon has well and truly popped, as opposed to merely releasing some air, is not yet clear. The numbers are still higher than in any three-month period during 2016. Chart 1 outlines the findings in more detail.

The latest figures do, however, put an end to five quarters of successive climbs, and represent the lowest quarterly level since the 18,408 transfers reported in the first quarter of 2017. The total number of DB transfers last year topped 100,000, according to the watchdog, peaking at 32,478 in the final three months.

The question is whether this represents a blip or the start of a trend. Tom Selby, senior analyst at AJ Bell, thinks the latter.

“I would expect transfer levels to tail off as time passes,” he says. “In the short-term this is likely, because regulatory scrutiny will inevitably constrict the supply of advisers willing to carry out pension transfer business due to the risks involved.

“Over the longer term, you would expect transfers to slow as savers who are entitled to move their money to a DC scheme will have made a decision one way or the other. Furthermore, the fact DB schemes are almost entirely extinct in the private sector means the number of people with DB rights will naturally fall as members retire.”

It is regulatory pressures that are perhaps the most significant driver in the short term. The FCA has been accused of neglecting the sector in light of the BSPS debacle, but the watchdog is now seemingly intent on making up for lost time. Several pension transfer specialists have pulled their advisory services amid the perception that the FCA is now cracking down on the sector. But not all believe this will translate into an immediate slump in activity.

“The genie’s out of the bottle now, and regulation will struggle to intervene against consumer behaviour even if it isn’t always right,” says Greg Kingston, group communications director at Suffolk Life, who says more time is needed to gauge if transfer volumes have truly started to go into reverse.

But he adds: “These levels are only likely to continue for this generation – the next won’t have similar levels of DB pension provision.”

Of equal importance is evidence that the bad publicity has made professional indemnity [PI] insurers less likely to give their backing to transfer specialists of all stripes. Absent this insurance, many advisers are effectively unable to continue with DB transfer business.

Paul Gibson, chartered financial planner at Granite Financial Planning, says: “It seems clear that many firms are now either giving the market a wide berth, either by choice or indirectly by prohibitive PI terms and exclusions. You do wonder how many transfers were at the advisers’ instigation.”

“There will still be a market for DB transfers, but the ‘boom’ may be over, which in my view is no bad thing.”

Steely exploitation

The scrutiny is unlikely to let up in the near future. A recent parliamentary report said BSPS members were “shamelessly” exploited by unscrupulous advisers who encouraged them to give up lucrative benefits in exchange for inferior plans. The FCA, which deemed only half of the BSPS transfers it assessed to be suitable, is now pondering a ban on contingent charging practices.

Mr Selby suggests the figures for the fourth quarter of 2017 may, in retrospect, prove artificially high due to December marking an original transfer deadline for BSPS members. Around 2,600 steelworkers had transferred out of the scheme by the time of the final February 2018 deadline, but he noted that other factors could now be quelling transfer activity.

“The FCA is obviously placing a lot of focus on this area at the moment,” he says. “[It also] U-turned on plans to reverse its initial assumption that DB transfers were not in members’ best interests, which might also have spooked some advisers from the market.”

Other data bolsters the argument that a softer transfer market is developing. The Lang Cat consultancy’s latest Platform Market Scorecard found that gross pension inflows were 16 per cent lower in the first quarter, compared with an average 5 per cent quarterly drop across all investment wrappers.

Previously, sharp rises in cash equivalent transfer values, some reported to be in excess of 50 times annual income, caused heads to turn. Values remain at elevated levels, but those increases have now tailed off. According to data compiled by actuarial firm XPS Pensions Group (previously Xaffinity), the average transfer value dropped slightly from £235,000 to £232,000 between March and April of this year, before rising again in May. Chart 2 shows the increase in values since 2016.

A fall-off in activity has not been witnessed by all advice firms, however. Patrick Connolly, head of communications at Chase de Vere, says the level of enquiries received by his firm has remained consistent. “It’s important to note that we haven’t been actively targeting DB transfer business, we have a robust analysis system in place, non-contingent charging, and we advise against transferring more often than we recommend that a transfer takes place.”

Whatever the current direction of travel, are absolute levels of transfer activity still concerning?

Mr Kingston believes the wider issue is still to be addressed. “The level itself may not be a concern – what is a concern is that history tells us a proportion of these transfers will not be suitable, and there’s nothing to suggest that proportion has decreased, possibly quite the opposite in fact,” he says.

A review by the FCA earlier this year deemed just half of pension transfers in its sample analysis to be suitable. But others maintain the ability to transfer should be maintained in the face of these issues.

Mr Selby says: “The whole point of the pension freedoms is to give people flexibility and choice over how they spend their retirement fund. Ultimately, pensions belong to individuals, and provided those who transfer do so with their eyes wide open and receive appropriate advice, it is entirely up to them what decision they make.”

Red light spells danger

One factor that could further dampen transfer activity is more positive: the hope that better education will stop so many savers from giving up valuable benefits in return for a poorer deal. The FCA said this spring it was consulting on a “triage” system to provide factual and generic information for consumers considering a transfer, in the hope that many could grasp a greater understanding of the pitfalls of such moves.

Aegon then proposed a more comprehensive version of this system in its submission to the watchdog’s latest DB transfer consultation paper. The insurer has suggested creating a “traffic light” system to pose a number of questions to consumers, such as, ‘Do you have more than enough secure regular income to cover your regular outgoings in retirement?’.

Answers will show whether the need to seek advice on a transfer is consequently ‘more likely’ (green), ‘neutral’ (amber) or ‘less likely’ (red). Aegon says this could help consumers reach an early decision, and potentially limit the amount of unnecessary or insistent transfer requests.

Not all advisers are convinced of its merits. Mr Gibson says: “Another provider offering ‘help’ with final salary transfers? It would be more helpful if they contributed to the FSCS [Financial Services Compensation Scheme] levy appropriately. Anyone googling medical conditions thinks they are likely to die instantly, and self-diagnosing a final salary transfer may have similar consequences. A traffic light system is too simplistic, and open to interpretation.”

Run for cover

Are advisers still able to cope with current levels of demand? The answer is unclear. Last year a number of firms suspended transfer permissions in light of rising demand and increasing regulatory uncertainty. Cases of this kind had eased off more recently, until national advice firm Mattioli Woods said on 4 June it had done likewise. The firm said its decision was taken in response to discussions with the FCA about its review of the DB to DC transfer market.

“While this review is in progress, the group has taken the decision to cease providing advice in relation to the transfer of safeguarded benefits,” the firm said in a statement.

Other companies are experiencing struggles on other fronts, not least in relation to PI cover. DB transfers are prime candidates for this kind of insurance, because of the inherent risk involved in savers giving up guarantees.

According to data from the FCA, published on 7 June, advice firms paid an average of £17,540 in PI premiums in 2017, absorbing 1.9 per cent of revenue. Unsurprisingly, the costs were heavier for smaller firms: those with revenue of £100,000 or less paid an average of 4 per cent of revenue (see page 8).

Nor have larger firms been immune to the impact of changes in the PI market. In May, O&M Pension Advice was forced to stop providing transfer advice because its PI insurer plunged into administration and – crucially – it was unable to find cover elsewhere.

“No PI cover, no [DB transfer] market,” says Mr Gibson. “You do not want to be in this market without suitable PI cover, but if excess levels increase too much you are effectively self-insuring, which is a dangerous place to be.”

This activity has caught the eye of the watchdog, which recently proposed plans to force insurers to cover some of the compensation costs. Mr Kingston suggests that the FCA needs to be prompt in tackling this issue: “Some providers will take the risk with direct transfers, as a few do today, assuming that insurance would still be available and affordable for them. That could create significant concentrations of risk that would give the regulator cause for concern.”

Others warn that the real problems could surface if and when investment conditions take a turn for the worse. “I am worried that when a market correction arrives, the ambulance chasers will come calling and DB transfers will be targeted,” says Mr Gibson, adding that the costs of such could inevitably drip their way down to advisers.

“Given the sheer number already transacted and the FCA findings showing poor outcomes in some cases, I am fully expecting there to be another FSCS bill in the horizon.”

DB transfers are likely to continue hogging the headlines for the foreseeable future, come what may. But there is a good chance that advisers will ultimately look back on 2018 as the beginning of the end of the boom.

IN NUMBERS

£21bn

Amount of safeguarded benefits that were moved into DC schemes in 2017

100,000

Number of DB transfers last year

£232,000

Average pension transfer value between March and April of this year