MPs have urged the government to facilitate the creation of collective defined contribution (CDC) schemes after an agreement on a potential blueprint was reached earlier this year.

In a report published today (16 July) the Work & Pensions select committee set out how such a scheme could work for employers and their staff and called on the government to implement a swift timetable for their creation.

The committee said CDC schemes should be governed by a board of trustees and be authorised and supervised by The Pensions Regulator.

These should be required to publish their benefit calculation rules and funding position and strategy at least annually.

The MPs also called on the government to consult on benefit adjustment and risk sharing policies, and on the regime for transfers out of CDCs, including whether they should be permitted once pensions are in payment and whether members transferring out should have to take financial advice.

Another idea mooted was whether CDC scheme trustees should be required to have a specific qualification.

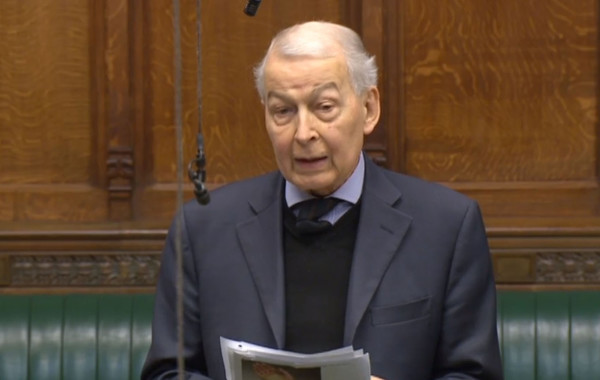

Frank Field, chair of the committee (pictured), said: "The idea of a ‘new beveridge’ has been overused and under-delivered during most of the welfare state’s life.

"But the report published today by the select committee offers that opportunity for pensions: how to combine decades of individual pension ownership and provision with collective security.

"The report centres on collective defined contribution schemes specifically in relation to the breakthrough at Royal Mail."

Royal Mail and the Communication Workers Union (CWU) reached an agreement to set up the UK’s first CDC scheme for workers in January, which was given approval by postal workers in April.

The agreement included the closure of its defined benefit (DB) pension fund to future accrual on 31 March 2018.

CDC schemes differ from defined benefit pensions in the sense that they do not guarantee certain incomes in retirement.

Instead, CDCs have a target amount they will pay out, based on a long term, mixed risk investment plan.

These schemes also differ from the traditional defined contribution plans, since they do not produce individual pension pots. Instead they invest savings in a larger collective pot, which provides an income to individuals during their retirement.

The Pension Schemes Act 2015 created by the coalition government defined CDC as a distinct pension category, but secondary legislation to bring them into effect was never introduced.

In its report, the committee called the Royal Mail agreement "ground breaking" and said it could "transform the UK pensions landscape".

The government has already indicated it will seek to enable CDC for Royal Mail in a way which will allow other companies to follow suit.

But pensions minister Guy Opperman told the committee in March that changing the underlying legislation was complex and there was still a long way to go to achieve this.

Some critics have said the collective approach of CDC ran counter to the spirit of pension freedoms, which gives everyone the right to spend their pension pot in any way they wish from age 55, subject to certain tax charges.

But the MPs said it could be regarded as “adding a further attractive pension choice to the mix”, potentially providing a further boost to pension saving.

They said CDC pensions offered advantages in the middle ground, between declining defined benefit schemes and individual defined contribution schemes, which offer no guarantees.

They also said CDC schemes could offer more generous and predictable benefits than individual DC provision, through their feature of risk pooling.

But they warned the case for transferring out, especially in the decumulation phase, needed to be looked at, as it could erode the longevity pooling effects of the model. Transfer value calculations also needed to be carefully considered.

The MPs said compulsory advice for transfers out of CDC schemes should be considered because the transfers would be similarly complex to their DB equivalents, where all transfers worth more than £30,000 have to be done on an advised basis.

However, another consideration is that CDCs do not promise pensions of a set value and the legislation could include the freedom to transfer in during the accumulation phase, which would mean a transfer out would not be irreversible.

"Given the novelty of the CDC proposition, more work is needed to determine whether extra protection is warranted for members considering transfers out of CDC," the report stated.

It also stated there was a “strong case” for members to be obliged to take financial advice on a non-contingent basis.

Nathan Long, senior pension analyst at Hargreaves Lansdown, said the concept might not work for everyone.

He said: "Both Royal Mail and the Commercial Workers Union see merit in collective pensions for the firm’s employees, but this shouldn’t be confused with this pension blueprint holding universal appeal.

"CDC pensions offer a target benefit, without any guarantee which could be confusing for members and potentially damaging for the pension industry if the targets are not met."

He said there were "uncomfortable similarities" with the with-profits pensions of the 80s and 90s "which often left policyholders disappointed".

He said: “Pensions are currently riding high because of the success of the government’s auto-enrolment programme, the last thing we want is anything to damage this.

"Today’s retire-as-you-go generation demand more flexibility from their pension to match their modern working patterns, meaning many could turn their back on CDC pensions when retirement comes."

Royal Mail and the CWU, meanwhile, welcomed the report.

Terry Pullinger, deputy general secretary of the CWU, said: "We are delighted the select committee has come out in support of our CDC scheme and has recommended the government introduce the legal changes we need to provide CWU members with a decent wage and security in retirement.

"Our scheme will be the first of its kind in this country and will provide an exciting and important innovation in pension provision that offers an alternative and not a replacement for DC and DB provision. It is certainly the solution for our members and we will continue to work with all concerned to secure its introduction ASAP."

carmen.reichman@ft.com