George Osborne’s pension freedoms announcement took the industry by surprise and saw sales plummet. With the “freedom and choice” agenda riding roughshod over the promise of a guaranteed, if limited, income, many predicted that annuities would become extinct in the coming years.

The bad news for the market did not end there. As providers exited en masse, annuity rates experienced a further slump as loose monetary policy, record low bond yields and a lack of competition had an impact.

The number of firms offering guaranteed income products has also shrunk. There are now five main companies – Aviva, Canada Life, Just Group, Legal & General and Scottish Widows – actively scrapping it out over what the regulator estimates to be 60,000 to 80,000 people buying annuities each year.

But while the market is more concentrated, individual company results suggest claims of extinction are still far-fetched. Last year, Legal & General increased its annuity sales volumes by 78 per cent, with annuity premiums jumping £293m to £671m.

“We believe there’s room for the market to grow,” says Emma Byron, managing director of individual annuities at the firm.

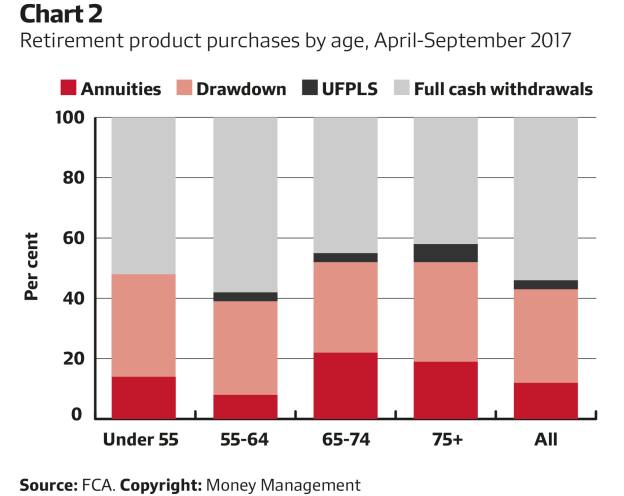

A recent data bulletin published by the FCA shows annuity sales are still falling. From April to September 2017 volumes were down 13 per cent from the same period in the previous year. In contrast, new drawdown plans and uncrystallised fund pension lump sums were up 17 and 34 per cent respectively.

But a variety of factors have been tipped to drive growth in the annuity market, lending it greater longevity.

Rate expectations

Two political and economic uncertainties may prove pivotal to sustaining the growth enjoyed by the likes of L&G.

The Bank of England’s (BoE) decision to raise interest rates in August, albeit by only 0.25 per cent, should boost the annuity levels providers are able to offer. In itself the increase will make little difference to annuity rates, but further base rate hikes would start to change the equation.

The severity of the tumbling annuity rates has been a telling factor in the products’ slump. Chart 1 highlights the extent of their downward trajectory, with rates almost halving between 2008 and 2016. The BoE’s decision to loosen monetary policy in response to the financial crisis, resulting in lower gilt yields, was a key component of this, as well increasing life expectancy across the UK.

However, the chart also indicates a reversal of this trend. While much lower than they were 10 years ago, rates have risen 20 per cent over the past two years due to a recent rise in 15-year gilt yields. Life expectancy trends have also started to reverse, though these are unlikely to have been factored in at this stage.

The second fundamental factor which could drive growth centres on investment markets that are now looking more fully valued. An increase in volatility would boost the attraction of a guaranteed income. The potential for market uncertainty is exacerbated by the current state of Brexit negotiations, where a lack of progress has meant even the staunchest Brexiteers are showing signs of jitters. Kim Lerche-Thomsen, founder and chief executive at Primetime Retirement, says: “Sometimes people don’t understand the investment risks they’re taking and their capacity to take the loss on it. Can you really put your hand on your heart and say people should be going fully invested into the equity market, given that no one has the slightest idea what’s happening on 29 March next year?”

The FCA has already raised concerns about the non-advised drawdown market, but largely benign economic conditions have meant these concerns are yet to feed through to consumers. Steve Lowe, group communications director at Just Group, feels that annuities will gradually increase in popularity, though customers may be older rather than younger.

“We’re going to see some people that have expressed their freedom and choice to perhaps enter drawdown in the earlier parts of their life. When they get towards later life we’ll start seeing more people buying annuities rather than at the traditional perceived wisdom of [ages] 65 and 66.”

As it stands, FCA figures suggest guaranteed incomes hold little favour with those under the age of 65, as Chart 2 indicates.

Other changes to the way in which annuities are viewed could stem from advisers’ own practices. Mr Lowe notes a growing number of intermediaries are using centralised investment propositions, but as he points out, these generally only cater for the accumulation stage. He explains that this is starting to change, which could ultimately portray annuities in a different light.

Mr Lowe says: “Over time, firms will start to view annuities more as an asset class. So rather than an adviser, for example, suggesting to a client that they invest part in equities and part in bonds, they might suggest part equity, part annuity. This might help to optimise the return rather than advisers taking bets in the bond market.”

Compare the market

As with many financial products, regulation is also having an impact on the shape of the market.

A persistent challenge for the FCA, providers and clients alike has been creating an annuity market where consumers are getting the highest amount of income possible. All policyholders have an ‘open market option’ enabling them to shop around for the best rates, and the regulator has obliged providers to point out better rates available elsewhere, but differences are often negligible.

Enhancements – where those with a condition that could shorten life expectancy (such as a smoking habit) are offered a higher rate – are more likely to provide a meaningful uptick in income.

Despite the clear benefits, the message is still failing to reach the ears of those making decisions at retirement. The FCA’s thematic review into annuity sales practices, published in October 2016, found around 39 to 48 per cent of consumers who purchased a standard annuity from their existing provider may have been eligible for an enhanced annuity.

Ms Byron says: “We see that in the majority of business we write. Most people would have gained some uplift for some lifestyles or medical conditions.”

Mr Lowe explains that advisers are pivotal to tackling this issue. “At the heart of modern financial planning is a client’s health. If you’re an adviser thinking about your client’s future, then should you be doing health assessments every year, a bit like when you’re doing an investment review?” he asks.

Regulator’s proposals

In its much-awaited retirement outcomes review, published in June, the FCA proposed an overhaul of existing procedure. Currently, firms are required to provide a statement in the information pack that states customers may receive access to buy an enhanced annuity if they decide to shop around. But the FCA noted many were failing to act on the prompt, and so has proposed that firms ask questions that will help determine whether the consumer is eligible for enhanced rates.

It concluded that the previously introduced prompt, which shows the difference between the firm’s quote and that of the market leader, should now include enhanced eligibility information (see Table 1).

Table 1: Potential impact of proposed change on firms that only provide standard annuities

Do firms need to ask questions to determine eligibility for enhanced annuities? | No | Yes |

Do firms need to use this information to generate a market-leading comparison quote? | No | Yes |

What market-leading comparison quote is required? | Market-leading standard annuity quote | Market-leading enhanced annuity quote (where relevant) |

Source: FCA. Copyright: Money Management

Ms Byron welcomes the recommendation: “We strongly believe that all clients should be underwritten when they’re buying an annuity. We’ve also been making significant changes to our underwriting capabilities in the last year to ensure more and more people qualify for an enhanced annuity, with small things such as ex-smokers,” she notes.

However, Mr Lerche-Thomsen says that underwriting all annuity applications would create a market with winners and losers. “It has swings and roundabouts, because if everybody is underwritten then the people who are super healthy will get worse rates than if they’d had a pooling effect.”

Stuck with you?

Other changes are on the horizon. Buying some annuities, suitably called lifetime annuities, is an irreversible choice. But another type, available since the mid-2000s, is only now starting to gain traction with providers and consumers alike.

Fixed-term annuities are exactly as the name indicates. The retiree selects a term between three and 25 years, and can choose whether to receive the annuity payments or allow them to roll up. At the end of the term the initial premium is returned and the customer can then make further decisions about what to do with the pot.

Mr Lerche-Thomsen’s firm is dedicated to the fixed-term annuity market. “I’m a believer in the lifetime annuity, but I wanted people to go into that product with their eyes open and at the appropriate time in their retirement, which for most healthy people in their 50s and 60s is far too early,” he says.

He explains that fixed-term annuities are commonly used to bridge the gap between the date of retirement and receipt of the state pension, with one in five opting to roll up income. “People typically buy it in order to guarantee a certain level of income and capital security and then put other parts of their funds into other things. Our typical customer will give us £60,000 to £100,000,” he says.

This part of the market has also been a key component of L&G’s growth, according to Ms Byron, who describes fixed-term annuities as “the halfway house between drawdown and a lifetime annuity”.

She adds: “It can be quite hard to plan for life. Fixed-term products allow you to plan for five or 10 years, then reassess your options.”

While the market for fixed-term products has been growing, other offerings have proved a damp squib. Hybrid products were initially seen as the remedy for the post-pension freedoms consumer who wanted both flexibility and guarantees. But the reception was muted. Aegon and MetLife both exited the market, with critics suggesting charges for the guarantees were either too high or ambiguous.

Nonetheless, earlier this year Scottish Widows announced it was considering the launch of a hybrid product, with a final decision expected later this year. According to Mr Lerche-Thomsen, providers entering that space face a tough job. He explains: “The products operated [so] that either every customer stayed with you or every customer left, depending on how the market had done during the period. It was very hard for firms to price them. They clearly had to put in charges to cover those guarantees and then worry about the counterparty at the other side. And they were really complicated with diabolical jargon.”

He adds that the demise of hybrid products highlights a key point when trying to engage consumers. “Some people have said we need more market innovation, but I don’t think we do because there’s only a certain number of things you can do with your pension. Most of the solutions are there, it depends how they’re packaged up and how they’re presented in a way that people can understand.”

Back in the bottle

This summer has also raised the prospect of another giant change to the annuity market. The concept of ‘irreversible’ lifetime annuities continues to cause debate in an era in which pension choices are characterised by the word ‘freedom’. Those that have purchased them have no choice but to keep them, regardless of changes in circumstance.

This has been a subject of particular irritation for some of those who annuitised prior to pensions freedoms. Shortly after the introduction of the reforms, the government announced plans for annuities to be traded via a secondary market. Although originally due to be implemented in 2016, the idea was scrapped in October that year, with policymakers saying the “consumer protections required could undermine the market’s development”.

But in July a group of MPs, headed by Paul Masterton, launched a campaign called ‘Your pension your choice’ to reignite calls for a secondary market, designed to help those people stuck with an annuity.

Commentators feel the arguments are likely to be made in vain. “Unfortunately, the Treasury has got no inclination to want to reverse that decision,” says Mr Lowe, who points out that the financial backers of the campaign, an American annuity trading firm named DRB Capital, could stand to profit if the push is successful. A spokesperson for DRB told Money Management it was acting on behalf of consumers wanting to sell their policies.

Ms Byron adds that a secondary market could create fertile ground for unscrupulous firms. “Secondary markets can result in people taking advantage of vulnerable customers. We would need to have protections in place to make sure customers aren’t given a poor deal,” she says.

Advisers, too, are mostly against the creation of a secondary market. But with a national newspaper on board with the campaign, one last big overhaul cannot be ruled out just yet.