The first quarter of 2018 was a remarkable period for mortality in the UK. According to data from the Office for National Statistics, only one day in the quarter failed to trump the five-year average for the number of registered deaths in England – 25 March 2018.

In total, there were 10,000 more deaths registered than would be expected had the rate of mortality been similar to the five-year average. While the second quarter of 2018 was less remarkable, cumulative deaths for the year are still running well ahead of expectations.

It is likely that we will see another year in which life expectancy has only improved marginally. While this is clearly bad for all of us from a human perspective, the recent stall in longevity improvements has spelled good news from a financial perspective, for insurers, pension schemes and the average person retiring in the UK. Let’s understand why and explore the implications.

Slowdown in longevity

We are all familiar with the idea that we are living longer than ever before. What many may not realise is that 2018 looks to be the seventh consecutive year that life expectancy in UK has failed to improve by anything more than a whisker.

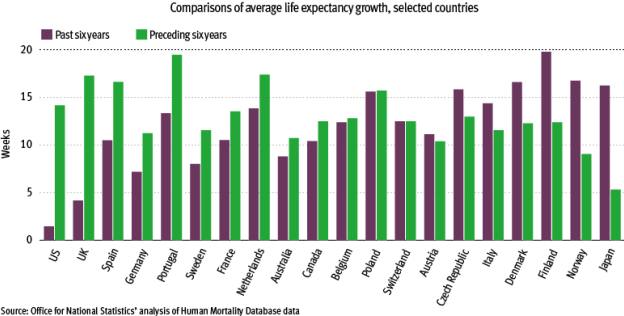

Since 2011, life expectancy at birth in the UK has improved by close to two weeks a year. When you compare this with the average rate of improvement over the previous few decades, with well over 10 weeks of additional life expectancy a year, it is clear there has been a change in pace.

The cause of the recent stall is not fully understood, although there are some clues in the data. First, this is something mainly affecting the oldest members of the population, particularly those aged over 85. Second, deaths from dementia and Alzheimer’s-related complications are on the rise, having roughly doubled and trebled, respectively, since 2000 (albeit partly through better identification), offsetting some of the gains from the other major killers (cancer, heart, stroke and respiratory diseases).

Some blame austerity as a major factor, although it is hard to prove.

Key points

- Life expectancy is decreasing

- Reasons for mortality are changing, with increasing emphasis on diabetes and dementia

- Longevity is likely to have an impact on financial products, reducing the cost of paying pensions

What is certainly a factor is that we are moving beyond the generation which, from the 1980s onwards, stopped smoking and enjoyed the benefits of a revolution in cardiovascular care, among other health improvements. These gains are hard to repeat.

This is not just a UK issue either. Many other countries – including the US, Spain, Germany, Portugal, Sweden and Canada – have also seen a slowdown in the past six years, following a period of strong improvement in life expectancy.

In North America, health spending has continued to grow. It would be remiss not to mention that a notable number of countries have enjoyed continued longevity improvements over the period, including Japan, France and Italy.

Where next?

We have entered a period of slow and steady longevity improvements, but how long it will last and what comes next?

The answer is in the balance of many factors, both positive and negative. For example, there are real concerns regarding diabetes and antibiotic resistance.

Diagnosed diabetes has roughly trebled for men and women over the past 20 years in England, with real implications on life expectancy. Diabetes is itself a driver of other diseases, such as heart disease and cancer in particular – diabetics have mortality rates roughly double those of non-diabetics in older age.

We continue to see new medical advances, and there is great hope for treatments in the pipeline such as immunotherapy or gene therapy. We cannot know what medical breakthrough is around the corner, just as an early 20th Century doctor could not have predicted the discovery and impact of antibiotics. Add to this myriad non-medical factors that affect longevity and you can appreciate that future life expectancy is very uncertain.

Implications

When an insurer is pricing an annuity, they do not look at life expectancy in today’s terms, but try to anticipate what longevity improvements will occur over the policyholder’s life: known as cohort life expectancy. The same can be said for the trustee or corporate sponsor of a defined benefit pension scheme when assessing whether the sponsor needs to plug a funding gap.

Over the past six years, longevity improvements have undershot expectations, making these parties revisit their longevity projections.

The implications of the recent longevity improvement slowdown are wide-ranging. First and foremost, it has meant a reduction in the anticipated cost of paying pensioners in both the insurance and occupational pension scheme worlds. This has been a welcome reprieve for many corporate sponsors of DB pension schemes battling against rising deficits caused by other headwinds – low gilt yields, we are looking at you.

It has also been a source of profit for insurers with large annuity books, such as Legal & General, which earlier this year was able to announce it was releasing reserves of £400m due to lower life expectancy.

Insurers have similarly been able to soften their annuity pricing for the same reason, which means pension scheme trustees and sponsors may find themselves closer to their goal of passing the scheme to an insurer than they realised.

It also means the person in the street looking to buy an annuity from an insurer with their retirement savings will see their money go further.

These financial gains are unlikely to stop immediately either. This year is already on course to be a poor year for longevity, meaning those who refresh their views on life expectancies early next year are likely to see them

fall again.

Further, because of the averaging and smoothing of past data inherent in the longevity projection models, this phenomenon is likely to continue for the next few years unless longevity improvements pick up and return to the healthy rates seen in the early 2000s.

While the financial gains can be positive, the recent slowdown in longevity improvements has made forecasting longevity much more difficult. This causes a headache for all those involved in the industry.

Life expectancy may be decreasing, but uncertainty and risks are most definitely not. For these reasons, it is understandable that those in the industry can sometimes be slow to adopt the latest life expectancies or react to changing trends.

For example, Legal & General’s release of reserves mentioned earlier is based on longevity data up to the end of 2016, even though the data exists to the end of 2017, which would push down their life expectancies even further.

What is more, neither have really changed their views about improvements in the longer term. Pension schemes and insurers alike are understandably wary of recognising longevity profits too quickly for fear of having to claw back reserves should UK longevity start improving significantly again.

It is easy to be wrong if the implications are positive, but harder in the other direction.

Stephen Caine is a director, retirement, at Willis Towers Watson