The UK pensions system received a C+ grade in the Mercer Melbourne Global Pension Index because of major risks it has warned need to be addressed.

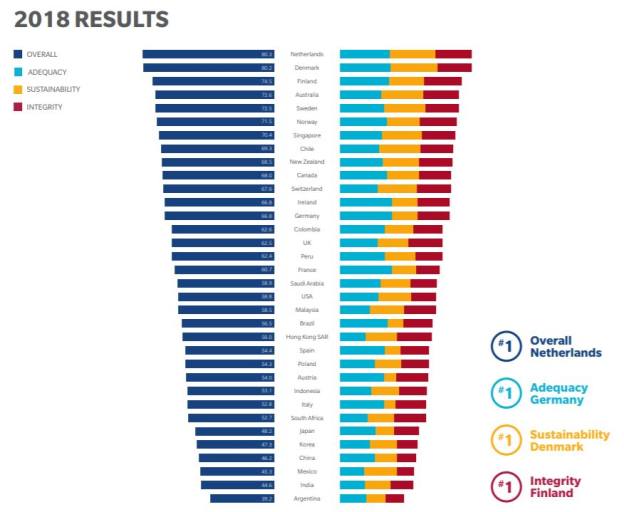

The research, which measures 34 pension systems on adequacy, sustainability and integrity, showed the UK in 15th place behind countries like Colombia and Chile but ahead of France and the USA.

It warned the UK’s pension system was weighed down by factors such as the relatively low levels of provision offered to the poorest pensioners and the self-employed, and the removal of requirements to take retirement savings as an income stream.

The country’s overall score has marginally improved to 62.5, up from 61.4 in 2017, primarily as a result of the increase in the level of auto-enrolment contributions, it added.

Netherlands and Denmark (with scores of 80.3 and 80.2 respectively) were the leaders of the index, with both countries offering A-grade world class retirement income systems with good benefits.

Pension systems graded C+ and C are arrangements which have some good features, but also have major risks and/or shortcomings which need to be addressed.

Without these improvements, its efficacy or long-term sustainability could be in question, the research stated.

Brian Henderson, a partner at Mercer, said the UK scored well on the integrity of its pension system, with a sound approach to regulation and governance, but stressed the need for action to increase provision for low earners and the self-employed.

He added: "Measures are underway to improve the UK’s global standing, but this alone will not be sufficient."

He noted the UK will benefit from the impact auto-enrolment, as the number of employees participating in private pension schemes grows and levels of pension savings improves, particularly with minimum contributions increasing from 5 to 8 per cent in April 2019.

According to data from the Office for National Statistics, pensions active membership increased in five consecutive years and grew from 13.5m in 2016 to 15.1m in 2017, most starkly in the private sector, which was attributed to the impact of auto-enrolment.

Mr Henderson added: "Furthermore, The Pension Regulator's assurance framework for master trusts will drive improvements, and so will the continued consolidation of smaller savings vehicles into larger pools, although employers need to play an active role here.

"More widely, with a tight labour market, employers should attract and retain talent by improving workplace pension schemes. This can improve the financial wellbeing of employees and create a more productive workforce."

maria.espadinha@ft.com