Technology and automation permeate all areas of modern life, and the pensions industry is catching up.

But exactly what benefits will this bring, and how will savers see things differently?

Disruption and innovation have not traditionally been terms naturally associated with the long-term world of savings, but the era of artificial intelligence (AI) is now upon us.

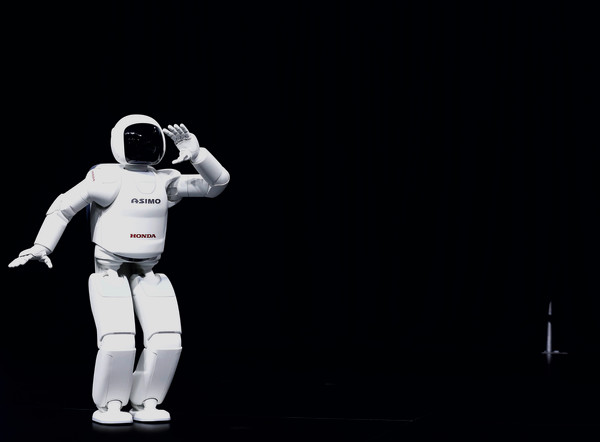

Whether it is driving our cars, executing smart contracts, delivering groceries or responding to our voice commands, robots are increasingly doing the legwork for us.

On the one hand, having automated systems to help us is good news: the UK, along with many other western democracies, is facing a demographic time bomb that will see many more people over 65 being looked after by relatively few people under 65.

If all the work is to be done, then a helping hand is welcome.

But there are also clear consequences of automation on the nature of employment, and therefore for savings.

With the transformation that automation is bringing to working methods, policymakers and future pensioners themselves must start to think about what retirement looks like in a future dominated by AI.

The opportunities presented by AI could lead to a sharp uptick in engagement on retirement savings as well as considerable improvements in UK productivity. But long-term thinking will be required to harness that potential.

Will robots pay tax?

There are several regulatory challenges to consider – for example, if employment taxation reduces due to fewer jobs, how will the tax man continue to raise sufficient tax in the future?

Will more of the burden fall on other forms of taxation, such as an increased level of VAT, and fewer tax-breaks for pensions saving?

Should robots pay tax on the work that they do?

I don’t think they should. I think we need more investment, and more automation. AI could be used to get the next generation saving.

To harness the full potential of automation, the pensions industry needs to step-up its investment in technology. For example, the ability to track and monitor retirement savings and investments using AI and in real-time could make pensions more of a routine concern.

Saving with Siri

Aside from the engagement benefits, this will also increase transparency and people’s ability to understand their pension provision. For example, an artificially intelligent pensions assistant – a retirement robo-consultant of sorts – could answer technical questions or provide suggestions for products and investment options.

We know there is a way to go before the possibilities AI may provide are fully realised, and LCP's recent research – conducted with YouGov – shows that more than half (57 per cent) of people are not yet prepared to trust savings advice from a robot, while around a quarter (28 per cent) would trust automated counsel.

Overcoming scepticism and mistrust is an issue for the whole savings industry to conquer, starting with greater financial education.

There is a big intergenerational divide on this subject – our research showed that among younger people, defined as 18 to 24-year-olds, the percentage that would trust robo-advice rises to 45 per cent.

The next generation therefore seems set to embrace the power of technology in driving financial management and boosting retirement preparedness.

Advisers and pension providers need to leverage this appetite and use it to engage future pensioners while they are still young.

It is worth noting that some countries are ahead of the UK and Europe on this. In Asia, for example, where the pace of technological change is often quicker, and regulations provide more flexibility, we already see the use of robo-advisers and, anecdotally, the signs are that this is helping to win over public opinion.

In the UK, some banks have already invested in, and unveiled, robo-advice platforms.

RBS and Santander were early adopters, while demand for low-cost investment has seen fund supermarkets like Fidelity International look at launching similar services for retirement savings. The robo-revolution has begun.

No more saving, just “deferred consumption”

No-one can be certain what they will be doing in 30, or even 10 years’ time, but what we can do is to make preparations now so as to improve our options later.

For future pensioners, that means saving as much as reasonable, as early as possible. Automation tools can also make saving more of a habit, and the impact that ‘gamification’ can have should not be underestimated.

The key is in making savings technology as immediate and as relevant as possible.

One provider in South America has de-linked savings from income – and linked saving to spending. The app gets data about the amount you are spending – which is increasingly done through your phone anyway – and saves a proportion of that amount automatically for your future.

The logic is simple: the more I spend today, the more I will want to be spending in the future. Nobody really likes saving, but most people like spending.

Policymakers and the industry can, with proactive forward planning and risk modelling, help us meet these challenges head on.

The sooner we can embrace the new technological reality, the sooner we can reap the benefits.

Alex Waite is a partner at LCP