Four years on from the introduction of pension freedoms, the Financial Conduct Authority says that up to 100,000 consumers drawing benefits are losing out on potential pension income.

Most exposed are those who enter the retirement arena without taking advice.

So, are the FCA’s proposed ‘investment pathways’ the solution to this issue?

Cash is king

According to FCA figures, up to 60 per cent of people in income drawdown are merely accessing their tax-free lump sum option.

Not only are they not taking any income, the consideration as to what investment plan will give them the best chance of future retirement success appears, all too often, to be ignored.

In addition, it has been common practice for providers to default drawdown customers into a cash fund – to the extent that a third of non-advised drawdown customers are wholly holding cash.

With growing concerns over these issues, the FCA has now proposed – in Consultation Paper 19/5 – the creation of investment pathways.

These are a proposed mandatory set of investment options offered to non-advised customers by pension providers to help ensure they invest appropriately for their income and/or lump sum requirements.

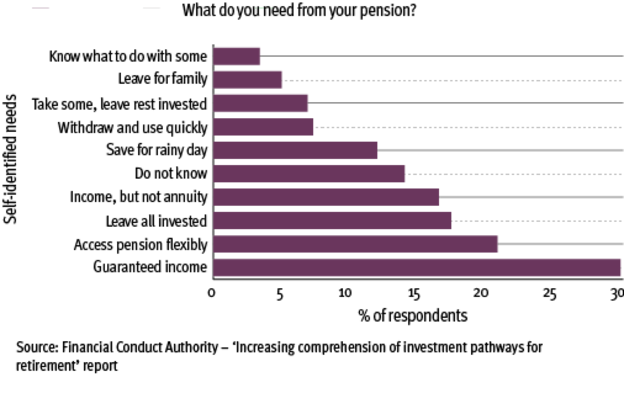

As part of its research for Consultation Paper 19/5, the FCA asked consumers what they need from their pension – a quarter chose more than one option, suggesting they would need more than one ‘type’ of income in retirement.

While helping consumers navigate the complexities of retirement planning is to be welcomed, there are several hurdles that these pathway solutions would have to overcome to ensure they help provide better customer outcomes.

Design

The proposals suggest four different pathways that broadly allow for members who have the following objectives over the next five years:

- Doing nothing and remaining wholly invested;

- Drawing guaranteed income (for example, annuity);

- Drawing non-guaranteed income (for example, income drawdown); or

- Fully encashing all funds.

There will be no obligation on providers to provide pathway funds if they have fewer than 500 non-advised customers entering drawdown a year.

However, such providers – typically ‘full’ self-invested personal pension operators – then have a decision to make as to whether they signpost clients to the single financial guidance body drawdown comparison tool or to another provider’s pathways solutions.

Those providers not exempt under the 500-member limit will have to provide pathways solutions for at least two of the four objectives. For any they choose not to provide, they will need to refer consumers to another provider’s pathway solutions (and the SFGB option will not apply here).

It is not entirely clear how providers who do not create their own pathways solutions will select their referral partner.

And the prospect of the providers who do not offer their own pathways – especially those that fall into the ‘small’ category – potentially being forced to open up their client bank to attack from a ‘full’ pathway solutions provider does not sit particularly comfortably.

It also seems strange that, despite the majority of respondents to the FCA’s CP 18/17 seeking the option to provide more than one option per pathway (for example, offering risk-rated options), the FCA has stuck to their guns for now and proposed only one fund per pathway can be offered.

This potentially over-simplifies matters as it assumes everyone on each pathway will have the same risk outlook.

While this approach may be suitable for an auto-enrolee during the accumulation phase, offering a single default fund is less likely to be appropriate for those at the retirement stage, even if their primary income objective is to stay invested. We will watch with interest how this unfolds.

Pick and mix

The research paper issued alongside the consultation paper highlights the fact that 25 per cent of consumers would ideally choose more than one ‘type’ of income, for example a combination of drawdown and guaranteed income.

It is a little surprising therefore that providers will not be mandated to support more than one option being selected – though may do so if they wish.

There has been a conspicuous absence of innovative solutions that combine different types of income within a single tax wrapper brought to market post-pension freedoms, despite the ingredients appearing in place to do so.

We hope the regulator’s work will be a catalyst for change in this area, otherwise the clear customer demand must surely force innovation eventually.

Right solution, wrong problem

While the proposed pathways have a laudable aim, we can not help but feel they miss the bigger picture – namely the lack of holistic guidance for non-advised clients regarding how best to consume all their assets.

Is the duty of care on providers wide enough at the moment, or should more be done?

For example, take a client who has both an Isa and pension with the same provider seeking a lump sum payment of £20,000.

Regardless of which pathway option the client takes, it might make more sense for them to use their Isa assets before drawing on their pension, but under the current proposals, there is no compulsion for the provider to help the customer with this decision.

There is little point in ensuring we have got the right fuel for the journey, if the tyres are flat and we have no oil or water.

Unintended consequences

Pathways funds can be applied to both pre and post-retirement portions of pension savings if desired. In some instances that may be acceptable, but in others it may be unavoidable.

Some pension schemes work on a segmented basis where the pre and post-retirement funds are split into separate pots. With this structure, there will be no issue with applying different investment approaches to pre and post-retirement savings.

However, many personal pensions operate on a “proportionate” basis and hold all savings in a single pot, which is divided into pre and post-retirement funds on pro-rata basis, for instance 75 per cent of funds in pre-retirement and 25 per cent in post.

Due to the nature of these plans, they will not be able to apply different investment approaches to pre and post-retirement funds.

With wider aspects such as charge disclosure and potential extension of the remit of independent governance committees also on the agenda, it appears the retirement arena is set for an interesting year ahead.

David Simpson is head of Europe, the Middle East and Africa at GBST