The pensions provider said the scheme would not only help potential buyers take their first steps onto the ladder but would also increase awareness and engagement around pensions.

Research from Scottish Widows shows that almost 3.8m people aged 22-29 are saving below the recommended level for a comfortable retirement but that 38 per cent of under-30s say they would save more into their pension if they could access the savings for a deposit.

According to the provider, this would be the equivalent of 3.5m young people increasing their long-term savings level and ensuring a more comfortable retirement.

The idea first came to light earlier this year when MP James Brokenshire, minister for Housing, Communities and Local Government, suggested that first-time buyers should be able to use their pension pots to top up their savings for a house deposit.

The proposals caused a stir in the industry, with many experts unhappy about muddying a pension pot with a housing deposit.

But Scottish Widows yesterday (July 15) called for flexibility within the pension system to allow young savers to withdraw up to half of their early retirement pot and put it towards a deposit.

The provider stated that as it becomes increasingly difficult to get onto the property ladder — the average deposit is a third larger than a decade ago and the average age of a first-time buyer is the highest it has ever been — more people could end up renting in retirement.

This would mean they needed to save a significant amount more during their working life, according to the provider, whereas some homeowners could have paid off a mortgage in that time.

To achieve this, Scottish Widows has urged the industry to reduce the age of auto-enrolment to 18 and increase the minimum contribution levels (employer and employee combined) to 15 per cent by 2030.

Currently, the age of auto-enrolment is 22 and the minimum contribution is currently 8 per cent in total — 5 per cent from the employee and 3 per cent from the employer.

On top of this, the government should provide a top-up of £500 per year, according to the firm.

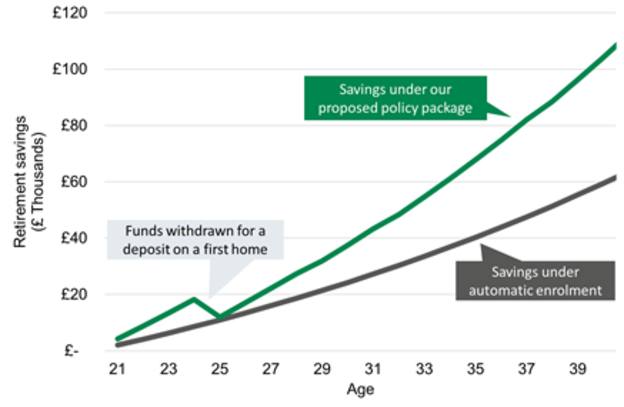

Scottish Widows provided an example of a first-time buyer under these ‘higher savings’ levels.

In this example, a pair of 25-year-olds on £25,000 per annum purchase a property for £228,000 (the average property in Southampton).

If they use pension savings to fund a 10 per cent deposit, this would be £11,400 from each of their saving pots.

According to Scottish Widows, the pair's saving trajectory looks like this:

Source: Lloyds Banking Group

Scottish Widows said: "While this depletes some of their retirement savings, they would still have broadly saved as much as they would under current automatic enrolment levels.

"From this point, they would rapidly accumulate far more savings, with behavioural finance suggesting few would stop or reduce pension contribution rates."

Pete Glancy, head of policy at Scottish Widows, said while property ownership was a "national obsession", it was also a long-term investment that could support people into old age.

"We should recognise the fact that many young people will prioritise getting onto the property ladder ahead of saving into a pension, despite the powerful positive impact of compound interest by saving at an early age," he said.

Mr Glancy noted this was a "radical idea" but stressed Scottish Widows had done the necessary testing and models to demonstrate that, alongside the other proposals to increase overall savings levels, the approach could provide a secure financial future for millions of people.

But Tom Selby, senior analyst at AJ Bell, was not convinced. He said: "The last thing pensions need are greater levels of complexity and confusion. While this proposal seems to have noble aims it risks adding both in spades.

"Allowing people to access up to 50 per cent of their pot early would could cause huge damage to their retirement prospects.

"Given the significant implications raising minimum auto-enrolment contributions to 15 per cent of total earnings would have on the wider economy, it also appears far from certain any government would back such a move."

Mr Selby thought encouraging greater levels of savings and helping people get on the housing ladder were "laudable policy aims", but conflating the two would be dangerous.

He added: "The government should focus its guns on improving the existing regime. We already have the Lifetime Isa which is designed to help first-time buyers via a government bonus — making this simpler and more generous would be a better way. Pensions should be left to what they are designed for helping people save for retirement."

Product technical manager at John Charcol, Nick Morrey, agreed. He said the concept that the government would fund housing deposits alongside a pension was "flawed".

He added: "Why would the government or regulators allow people to use a long-term savings vehicle to fund a short term deposit scheme, especially when there are other vehicles such as Help to Buy Isas?

"I cannot see how any authority could sanction pensions for this usage, nor how it could be easily policed given the tax breaks that pensions attract."

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.