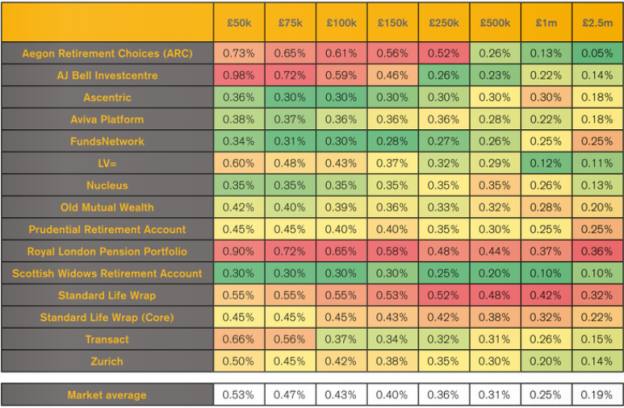

Royal London charges the most for large pension pots entering drawdown, while AJ Bell is the most expensive for small pots, according to the Lang Cat.

The financial services consultancy mapped how much providers charge clients on various pension pot sizes when entering drawdown, in a report commissioned by Scottish Widows, published this month (July).

It found that Royal London had the highest fees for individuals with a pot size of above £2.5m, charging 0.36 per cent.

Standard Life was not far behind at 0.32 per cent, and FundsNetwork and Prudential charged 0.25 per cent.

The providers with the smallest fees on a pot of this size were Aegon (0.05 per cent) and Scottish Widows (0.10 per cent).

Lorna Blyth, head of investment solutions at Royal London Intermediary, said: “We operate a bundled structure which includes investment costs.

“Other providers do not do this and their platform costs and investment costs are shown separately. As a result you cannot compare these figures on a like for like basis.”

In comparison, AJ Bell had the highest fee on a pension pot worth £50,000, charging 0.98 per cent.

Royal London had the second highest fee at 0.9 per cent, followed by Aegon which charged 0.73 per cent.

Tom Selby, senior analyst at AJ Bell said: “It’s important to consider charging structures as a whole when considering value for money, and AJ Bell is widely acknowledged as being among the most competitive when it comes to pricing.

“It’s also worth noting that on the advised side our average account size is around £330,000, so for most customers our charges are the lowest available in the market.

"This isn’t a coincidence – our charging structure has been designed to ensure it represents excellent value for the investors who use us.”

Scottish Widows had the lowest fee on a £50,000 pot, charging 0.30 per cent, followed by FundsNetwork who had fees of 0.34 per cent.

Out of the 15 providers, only four charged an additional fee specifically for drawdown on top of other administration fees. These were ARC, AJ Bell, LV and Royal London.

In total, fees were 0.53 per cent on average for a £50,000 pot and £0.19 per cent for a £2.5m fund.

Steven Nelson, consulting director at the Lang Cat, said: “When it comes to investing for and in retirement, our analysis shows that total costs differ enormously and can have a significant impact on the size of a client’s pension fund.

“Although the array of provider charging formats can make due diligence difficult, by selecting the right provider for each client’s needs, advisers can add a huge amount of value to the individual’s future financial position."

He added: “Obviously costs alone should not form the basis of suitability decisions; quality and breadth of proposition are both crucial elements of the retirement solution.

"For some clients it may be worth paying more for additional tools, while for others a lower cost solution will be more appropriate.”

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.