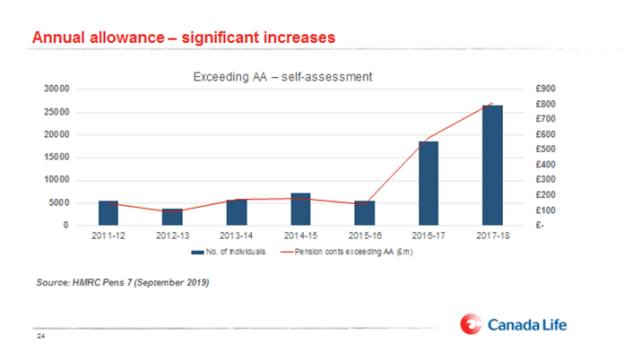

The number of savers hit by pension tax charges is on the up, with £812m in contributions exceeding the annual allowance limit in 2017/18, according to official data.

Data from HM Revenue & Customs, published today (September 26), showed that in 2017/18 26,550 individuals in their self-assessment tax return reported pension contributions exceeding the annual allowance to the tune of £812m, up from £578m in 2016/17, and amounting to an average of £30,584 per person.

The number of people reporting such a breach was up 11,000 per cent in a decade as just ten years ago a mere 230 people faced the tax charge.

Those affected face a potential tax charge of 40-45 per cent on their savings if they fall in the higher income brackets.

There are two ways of paying this tax. One is via scheme pays where the individuals can ask the pension scheme to pay the charge on their behalf with a corresponding reduction in benefits. The other is through an individual’s self-assessment tax return.

The total value of annual allowance tax charges paid by schemes increased from £104m in 2016/17 to £173m in 2017/18.

There are three different annual allowances depending on the individual’s level of income.

The standard annual allowance, which is currently £40,000 a year; the tapered annual allowance, which gradually reduces the allowance for those on high incomes, meaning that for every £2 of adjusted income above £150,000 a year £1 of annual allowance will be lost; and the money purchase annual allowance which is £4,000 a year.

This applies to those who have ‘flexibly accessed’ their benefits, for example by taking a taxable income from flexi-access drawdown.

The HMRC data is not broken down to show how much was raised as a result of breaching the standard annual allowance, and how much was down to the tapered annual allowance or money purchase annual allowance.

But industry experts have blamed the significant increase in the number of annual allowance breaches on the introduction of the tapered annual allowance in 2016.

Tom Selby, senior analyst at AJ Bell, said: “The staggering impact of the Treasury’s pension tax grab have been laid bare by today’s figures.

“Twice as many people were clobbered with an annual allowance charge in 2017/18 compared with the previous tax year, with hundreds of millions snatched from the grasp of hard-working savers.

“The culprits behind this spike in pension tax are almost certainly the taper, which lowers the annual allowance for high earners, and the money purchase annual allowance, which penalises those who take taxable income from their retirement pot.”

Andrew Tully, technical director at Canada Life, said: “Even something which sounds as simple as an annual allowance is complicated by the fact we have three different limits – a standard allowance, a very low allowance for those who have flexibly accessed their benefits, and a fiendishly complicated position which reduces the limit for higher earners.

"This complexity means many individuals may be unintentionally caught by the annual allowance.

“This is a complicated area of pension planning and it is all too easy to get caught out, so anyone concerned about these limits should consult a professional financial adviser.”

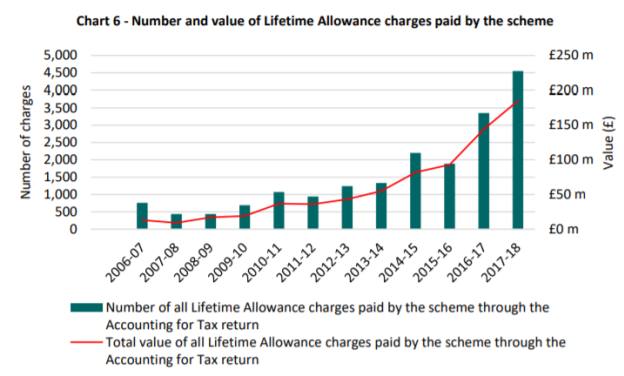

HMRC's data also showed the total tax take from the lifetime allowance tax charge increased from £13m in 2006/07 to £185m in 2017/18, with most of the increase having taken place since 2012 when the government started to cut the lifetime allowance.

However, not as many people were impacted by the lifetime allowance compared to the annual allowance as only 4,550 paid tax charges.

After being introduced in April 2006 at £1.5m, the lifetime allowance grew to £1.8m in 2012 but was then cut to £1m. Since then it has edged up in line with inflation to the current £1.055m.

Mr Tully said: “The numbers paint a stark picture of how the lifetime allowance has impacted savers. There is an obvious link to make between the increase in the tax receipts and the slashing of the lifetime allowance since 2012.

“It seems clear the government’s tax take from the lifetime allowance will continue to grow substantially over the coming years.”

He also called for the allowance to be scrapped to remove the complexity surrounding pensions legislation.

Mr Tully added: "The lifetime allowance is an arbitrary tax which penalises individuals who have enjoyed good returns on their investments.

"There is also a significant disparity in the way benefits are measured against the lifetime allowance depending on whether the individual is a member of a defined benefit or defined contribution scheme.

"With a relatively low cap on contributions to pensions of £40,000 a year, and less for higher earners, the government should consider scrapping the lifetime allowance.

"This would massively simplify pensions for schemes, providers and, most importantly, customers, by removing a huge amount of complexity around areas such as benefit crystallisation events.”

Tim Holmes, managing director at Salisbury House Wealth, flagged it was not necessarily the more affluent who were hit by this tax but also people who may be unaware of the limits.

Mr Holmes said: “The number of individuals being hit by this very punitive tax for trying to save into a pension is growing rapidly. This cannot go on.

“It’s not the super-rich that are being hurt by this tax. A lot of middle England that do not see themselves as affluent are getting hit by breaching both annual and lifetime limits.

“When the government started cutting the lifetime allowance limit I’m not sure they realised what problems they were going to cause. Now the problems are clear, it is time to move to wholesale reform."

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.