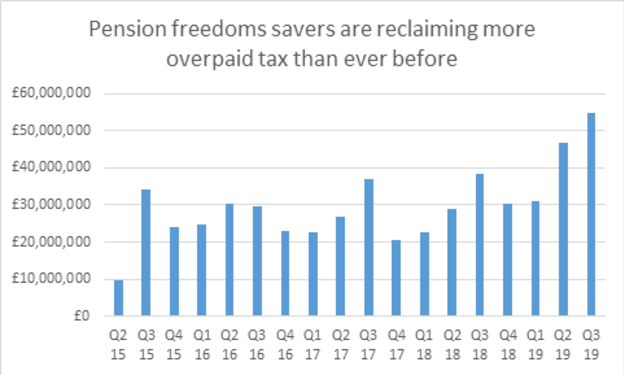

HM Revenue & Customs has repaid £54.9m in pension tax during the third quarter of this year to 17,300 people.

According to data released by the tax authority today (October 30) this was a 15 per cent increase on the overpayments reported for Q2 2019 when the taxman repaid £46.8m to 17,200 individuals.

Overall, HMRC has given back some £536m to more than 220,000 taxpayers since the introduction of the pension freedoms in April 2015.

Data released earlier today showed £30bn has been withdrawn from schemes since the pension freedoms were introduced in April 2015.

Pension freedom rules mean those aged over 55 no longer have to purchase an annuity to access their pension income but can instead enter drawdown, take a cash amount or buy an annuity.

But any withdrawals above the 25 per cent tax free amount are taxable at an individual's marginal rate of income tax.

Tax discrepancies happen when a pension provider does not have the correct tax code for the individual and withdrawals are taxed using a higher rate emergency tax code, to be reclaimed later.

Source: HMRC data from AJ Bell

According to Tom Selby, senior analyst at AJ Bell, the tax system that runs alongside the pension freedoms “is not fit for purpose”.

Mr Selby said: “People risk being left short of money as a result of HMRC’s approach and forced to either take out more cash from their pension, potentially paying extra tax in the process, or seeking the funds from elsewhere.

“At the absolute bare minimum the government needs to urgently review its approach to the taxation of pension freedoms withdrawals, which has never been consulted on formally. Its failure to do this so far represents a serious failure of policymaking which will inevitably have caused people distress and potentially significant financial hardship.”

Ian Browne, pensions expert at Quilter, said the amount of tax being repaid to pensioners rising by 44 per cent over the last year suggested HMRC “is yet to get to grips” on the tax regime following pension freedoms.

He added: “With the complexity and anxiousness of filling out tax returns or reclaim forms, it could be that the number is actually far higher.

“It has been clear for some time that HMRC did not have the processes in place to deal with this new retirement landscape. Tax is an incredibly time consuming subject for individuals, and it seems HMRC have made it as difficult as possible for people to get their own hard-earned money back."

Sir Steve Webb, director of policy at Royal London, said: "Even by their own low standards, HMRC have outdone themselves in the last three months, taking more than £54m of savers’ money in income tax to which they were not entitled.

"It cannot be right that tens of thousands of people each year have too much tax taken out of their pension and then have the hassle of filling in a form to get back money that is rightfully theirs.

"Whoever ends up running the country after the general election needs to tell HMRC to stop this practice as a matter of urgency."

An HMRC spokesperson said: “Nobody will overpay tax as a result of taking advantage of pension flexibility.

“Individuals can claim back any overpayment due to an emergency tax code being applied immediately and we will repay this in 30 days.

“Anyone who does not claim will be automatically repaid at the end of the year.”

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know