The pension freedoms have resulted in a total of £30bn being withdrawn from pensions in the past four years, although the average amount that savers are withdrawing has dropped 5 per cent in the past year.

Pension freedom rules mean those aged over 55 no longer have to purchase an annuity to access their pension income but can instead enter drawdown or take a cash amount.

Data published by HM Revenue & Customs today (October 30) showed in total, more than £30bn has been withdrawn from schemes since the introduction of the freedoms in April 2015.

While the overall amount being withdrawn from pensions has grown year-on-year it was down slightly in Q3 on the previous quarter.

In Q3, £2.4bn was withdrawn from pensions flexibly, a 21 per cent increase from the £2bn withdrawn in the same period last year but down on the £2.75bn taken out of pensions in the second quarter of 2019.

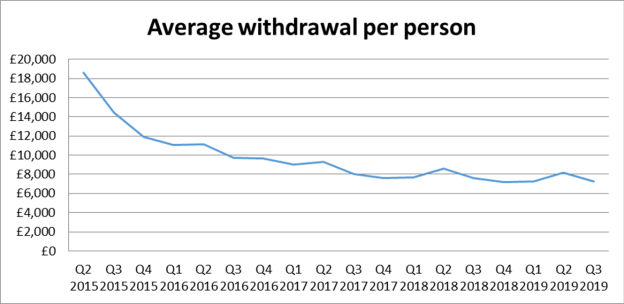

The data also showed the average amount withdrawn per individual from their pensions flexibly in Q3 2019 was £7,250, down from £7,600 in the same period last year and a fall of 12 per cent from the last quarter.

HMRC said average withdrawals have been falling steadily and consistently, with peaks in the second quarter of each year.

This was because people were phasing their withdrawals to minimise the amount of tax they have to pay, it stated.

The average withdrawal tends to be higher after the start of a new tax year as that is when individuals tend to plan their withdrawals.

Source: AJ Bell

Meanwhile, 327,000 individual withdrawals were made from pensions in Q3, a 27 per cent increase on the 258,000 in the same quarter last year but a 3 per cent decrease from the 336,000 individual withdrawals in Q2 2019.

Sir Steve Webb, former pensions minister now director of policy at Royal London, said: “Pension freedoms have been hugely popular and allow hundreds of thousands of people every quarter to draw on their pension savings in a flexible way.

“There is also evidence that people are being savvy about the timing of their withdrawals, spreading them over more than one tax year to reduce their overall tax bill. But it remains the case that we need to increase the proportion of people who take financial advice or guidance before making decisions about how much of their pension to withdraw.”

Nathan Long, senior analyst at Hargreaves Lansdown, said: "New pensions rules came along in a hurry, but they are bedding down and for the most part working well.

“With the beginning of tax year pension drain accounted for in the last quarter’s figures, we see withdrawals in line with the on-going trend for drawing out less.

“The real test of people’s behaviour is when the stock market suffers some turbulence, a crash could cause panic among retirees and a dash to encash their pension savings.”

But Andrew Tully, technical director at Canada Life, said people must be wary of taking too much out of their pension due to large tax bills and other unintended consequences.

He said: “People continue to be attracted to stripping cash out of their pensions. This is often before planned retirement ages, and will inevitably in many instances be triggering large tax bills.

“On the one hand it shows the pension freedoms are working, but it also shows an emerging picture of large amounts leaving the pension system potentially leaving very little for people to live on by way of a regular income. People are not sticking to the rules as there are no rules.

“Stripping cash from a pension can trigger unintended consequences including limiting the amount you can subsequently save into a pension. This can be very restrictive for those people who have plans to continue working and they and their employer continue to pay in.”

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know