Although there may be other charges and so careful analysis is required because costs are not always obvious.

In the FCA consultation paper 19/25 (July 2019) entitled Pension transfer advice: contingent charging and other proposed changes it is proposed that workplace pension schemes should always be considered in the advice process.

You should update your advice checklist accordingly.

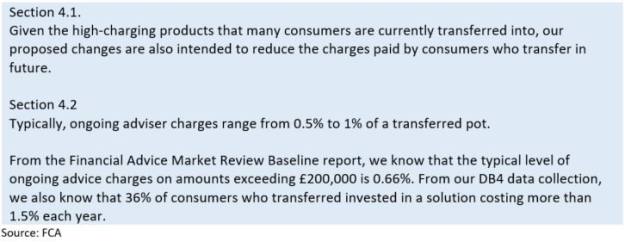

The FCA rationale for this is quite detailed so we have picked out some of the key points, which all focus on charging:

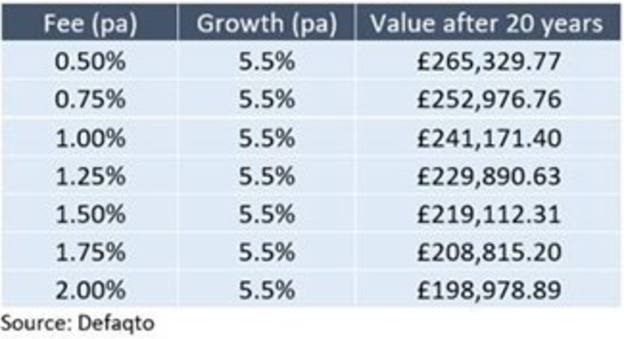

Let’s put that into perspective and look at the compounding effect in the pounds and pence costs incurred using different percentage rates, charged on an initial value of £100,000:

Bearing in mind the need to evidence ‘value for money’ in a suitability report, a pension switch out of a workplace pension solution using a default fund into an alternative personal pension will need careful analysis.

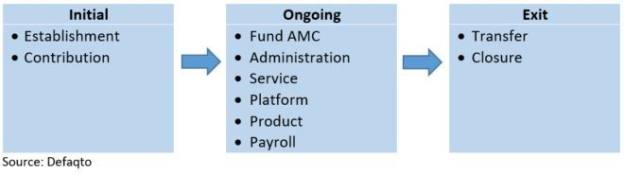

Understanding the fees charged is not always straight forward.

Some providers set a standard AMC, while others charge a combination of fees.

In addition not all schemes publicly state their fees, requiring an application to be made before ‘bespoke’ rates are offered.

This is an issue because for advice to be accurate and for ‘value for money’ to be evidenced, advisers need to include all costs in their research.

Commonly, the charge levied to the employee and/or employer depends upon many factors, including the size and profile of the employer and the adviser’s relationship with the provider.

Interestingly, none of these factors are in the payers', (employees), control.

There are three stages of fees to consider and below we illustrate some of the more common ones to consider:

We suggest advisers look to ascertain the cost for both the employer and the employee’s.

As a rule of thumb if the AMC is comparatively low, it may be worth checking to see if any additional fees apply.

There are three different common fee structures in use.

The old adage: "Costs reduce returns so should be avoided" is certainly true in this sector.

Our analysis indicates that based on just one isolated measure is unlikely to be sufficient due diligence to evidence value for money.

Effective management of the default fund

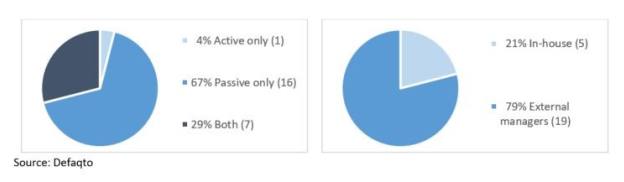

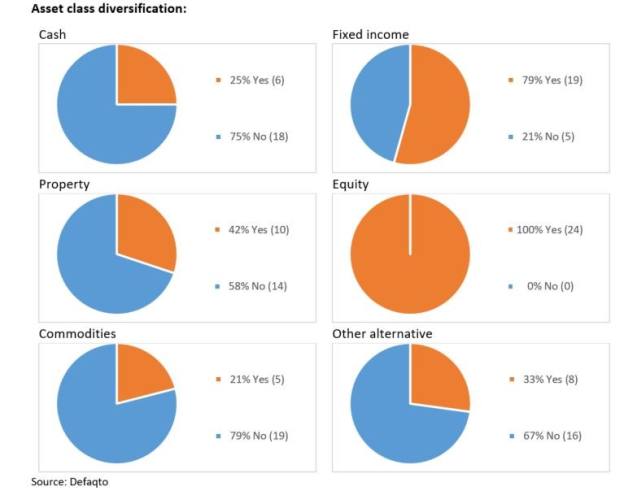

In this section we have analysed the default fund solutions from 24 different providers, concentrating on the growth stage.

Asset class diversification

Investing Responsibly

This is difficult to quantify as a selection criteria as there is little data currently available evidencing how those funds that invest responsibly have improved their performance.

Also, how is investing responsibly physically done?