A trial by the Department for Work and Pensions (DWP) to encourage more self-employed workers to save into a pension pot has been unsuccessful as many workers are still failing to log into their accounts.

A 121-page report from the DWP, published today (February 24), revealed the number of self-employed people actively contributing to a pension has decreased steadily since the late 2000s, from 27 per cent in 2008-09 to 15 per cent in 2017-18.

According to the report, which is carried out on an annual basis, the main reason behind the fall in the self-employed pension participation rate was due to the number of over 50s who stopped saving once becoming self-employed.

The DWP has been working with both Nest and the Association of Independent Professionals and the Self-Employed (Ipse) to encourage long-term saving behaviours amongst the self-employed, who are not covered by automatic enrolment.

This was after in 2018 in published a strategy paper which explored using invoicing and accounting systems to enable automatic pension contributions for this group.

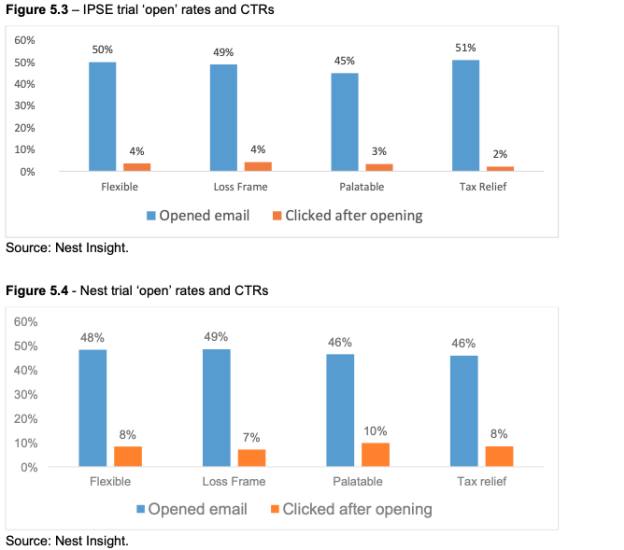

The trials involved sending four different email messages to self employed individuals to understand which was most effective in encouraging people to save.

The messages included describing pension contributions as a daily rather than monthly amount, emphasising that payments can be flexible, explaining tax relief on contributions and highlighting what workers could lose if they failed to save.

However the trials were unsuccessful as although self-employed workers initially opened these emails they failed to click through and sign into their pension account and make any changes to their contribution levels, the DWP stated.

The report stated: “Initial findings from messaging trials suggest that initial ‘open’ rates of messages are relatively high in comparison with analogous industry marketing emails. However, the percentage of recipients engaging further by then logging into their accounts is lower than expected.”

Further analysis from the trials is expected in due course with Nest planning to publish a full findings report later in 2020.

The DWP said these findings will inform the next stage of trialling, with plans for technology-based trials to test tools and solutions which would make it easier for self-employed individuals to save.

On a more positive note, the report found since the start of auto-enrolment in 2012, more than 10.2m workers have been enrolled in a pension scheme and more than 1.6m employers have met their duties.

The annual total amount saved in workplace pensions stood at £90.4bn in 2018, which is an increase of £7bn on 2017.

Last year, auto-enrolment minimum contribution rates rose to 8 per cent, made up of 5 per cent from the employee and 3 per cent from the employer, but this has had little impact on opt-out rates.

In the three months following the April 2019 increase, the opt out rate only rose slightly to 0.76 per cent, up from 0.72 per cent.

Those aged 22-39 were most likely to opt-out following the increase.

Secretary of state for Work and Pensions, Therese Coffey, said: “Automatic enrolment has been an unparalleled success, transforming pension saving for millions of people.

“The saving habit is sticking too, as people recognise the importance of putting money towards their retirement.

“I want people to save even more, if they can, to make sure the retirement they get is the retirement they want.”

Gregg McClymont, the director of policy at The People’s Pension, said: “It's encouraging to see that opt-out rates remain low, following last April’s increase in contribution rates and that saving for a pension has become the ‘norm’ for more than three quarters of those surveyed by the DWP.

“While automatic enrolment has been a great success so far, the government must provide a timeline for when it will act on its own recommendations to reduce the eligibility age from 22 to 18 and make contributions count from the first pound earned. Reducing the earnings threshold from £10,000 to £6,240 should be a priority too.

“There are millions of under-pensioned workers who can only be helped by these changes to policy.”

Earlier this month (February 13), the government opted to maintain the earnings trigger for automatic enrolment at £10,000 for 2020-21, despite long-held industry concerns that the current level is limiting pensions coverage among underprivileged demographics.

Minister for Pensions and Financial Inclusion Guy Opperman also opted to keep the qualifying earnings bands in line with the national insurance thresholds of £6,240 and £50,000.

Mr Opperman said: “The main focus of this year’s annual review of the AE earnings trigger and qualifying earnings band (the AE thresholds) is to ensure the continued stability of the policy, while learning from the April 2019 AE contribution rate increase.”

This is the last annual review being published by the DWP as the implementation period for auto-enrolment is now over.

The DWP stated that employer staging and the phased increases in minimum contributions have been delivered and the policy has “moved into steady-state”.

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.