The pensions triple lock, which protects state pension uprating, should be scrapped following the coronavirus crisis so that all generations pay their fair share to meet the costs of the pandemic, according to a think tank.

A briefing paper from the Social Market Foundation, published this morning (April 14), has called on the government to replace the triple lock with something more affordable as a way of reducing the deficit that has built up due to Covid-19.

The think tank said the significant economic cost of the emergency measures and financial aid deployed to handle the crisis must be shared fairly between the older and younger generations, and cutting the triple lock could be a good way of ensuring this.

Scott Corfe, research director at SMF, said: “There is a clear case for intergenerational reciprocation when it comes to meeting the fiscal costs of the crisis – something that could be a feature of the policy landscape for years to come.“

Under current rules, the state pension is increased by the triple lock which is the highest of earnings growth, price inflation or 2.5 per cent a year.

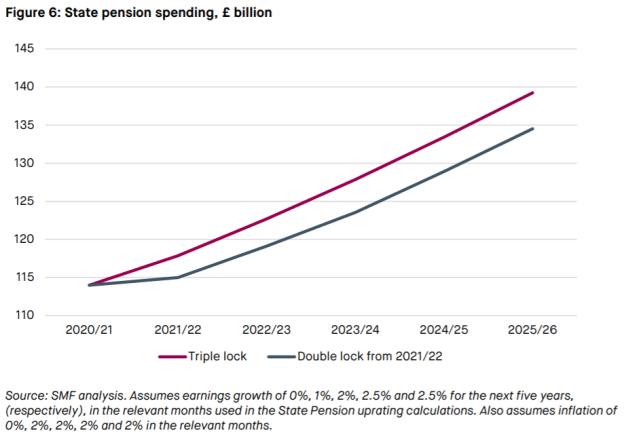

Mr Corfe has suggested replacing this with a double lock which would tie increases to earnings of inflation (whichever is higher).

He said: “This could contribute £20bn to deficit reduction over the next five years. Pensions would still rise, but less quickly, reducing the fiscal burden on the working-age population.

“In the context of an annual deficit that could reach £200bn as we emerge from the crisis, this is not too much to ask. It would also demonstrate reciprocity from a group whose wellbeing was, rightly, prioritised during the lockdown phase of the crisis.”

He added: “This current economic sacrifice is the right thing to do, not least given the social contract between generations: members of a good society look out for each other and are prepared to sacrifice some welfare for others.

“As we emerge from the crisis, older generations must uphold their part of the contract by bearing a fair proportion of future tax rises and welfare reforms.”

The Institute for Fiscal Studies recently suggested that a government deficit of over £200bn could be expected once this crisis is over and could surpass levels seen during the financial crisis in 2008.

SMF has said this raises the prospect of “Austerity Round Two” as the government attempts to get a grip on the public finances.

According to data from the Office for Budget Responsibility, £222.9bn was spent on pensions, tax credits and working-age welfare in 2018-19, with the state pension accounting for almost £100bn.

Mr Corfe said this would need to be addressed before raising any other taxes.

He said: “Given the size of the overall welfare budget relative to other items of state spending, any future fiscal consolidation on the spending side would have to start with the welfare bill. Alternatively, taxes might need to increase significantly if there is reluctance to cut government spending.

“It would be a terrible mistake to repeat the unbalanced austerity seen after the financial crisis as we emerge from the coronavirus crisis, particularly as the working age are making a huge economic sacrifice to protect (largely) the nation’s elderly.”

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.