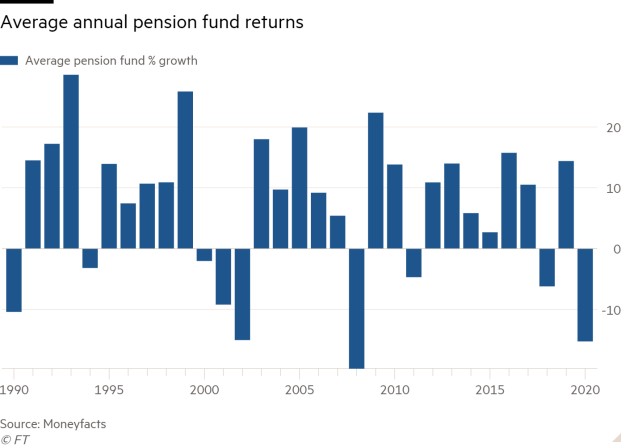

The average pension fund fell by 15 per cent in the first quarter of this year, with savers in both the accumulation and decumulation phase of retirement encountering the toughest conditions of any generation yet.

Data from the latest Moneyfacts UK Personal Pension Trends Treasury report, showed the impact of the coronavirus pandemic on global stock markets had caused the average pension fund value to plummet by 15.2 per cent in Q1 2020, the worst quarterly performance on record, even surpassing the falls seen during the global financial crisis of 2008.

The majority of these losses occurred in March, when the average pension fund fell in value by 11.6 per cent.

As a result, Q1 2020 has already undone the positive pension fund growth of 2019, where all four quarters saw increases.

A number of ABI pension sectors were hit particularly hard, with UK Smaller Companies (-31 per cent), UK All Companies (-29.8 per cent) and UK Equity Income (-28.4 per cent) experiencing the largest losses.

In total, only 11 per cent of all pension funds avoided posting losses during Q1 2020.

The best performing sectors were UK Gilt (7 per cent), Global Fixed Interest (4 per cent) and UK Index Linked Gilts (3.9 per cent), showing that lower risk assets were more resilient to market shocks.

Impact on retirement incomes

Those in drawdown would have been affected by these falls and may now have to consider taking smaller payments than originally expected.

Meanwhile, those wanting to purchase an annuity to have the security of a guaranteed income are faced with record low rates.

The average annual standard annuity income for an individual aged 65 (based on a single life £10,000 level without guarantee annuity) fell by 6 per cent in Q1 2020, leaving the average annuity income 1.7 per cent lower than its previous record low in October 2019.

The combination of falling fund values and low annuity rates has significantly impacted the retirement incomes available for those looking to retire, according to Moneyfacts.

For example, an individual who had saved £100 gross per month into a personal pension for 20 years would have built up a final pension fund of £41,388.

Using this to take an income through an annuity at age 65 means that they will now receive just £1,663 per annum, down by 18.7 per cent on the start of the year, and 14.4 per cent lower than the previous all-time low in October 2016.

Richard Eagling, head of pensions at Moneyfacts, said: “Whether it is individuals saving into a pension scheme or currently in drawdown, or retirees looking for the security of an annuity, the coronavirus pandemic has had a devastating impact on potential retirement outcomes.

“The hope is that these will prove to be short-term shocks, but for those planning for retirement now and looking for a retirement income immediately, they present unenviable challenges.

“UK pension policy has increasingly moved towards placing more onus on individuals to take personal ownership of their retirement finances in recent years and take on the risks associated with this, but unfortunately recent events have shown how vulnerable they can be to major world events.”

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.