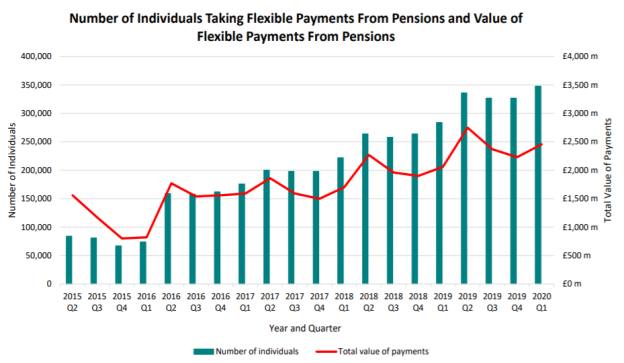

A record number of 348,000 savers made withdrawals from their pension in the first quarter of this year with the average value steadily rising, but the full effects of the Covid-19 pandemic remain unknown.

Data published by HM Revenue & Customs today (April 30) showed between January and March, £2.5bn was withdrawn from pensions under the pension freedoms, a 19 per cent increase from the £2.1bn taken in the same period in 2019.

In total more than £35bn has been withdrawn from schemes since the introduction of the freedoms in April 2015.

In the 2019/20 tax year withdrawals amounted to £9.81bn, which is a record for any single tax year in terms of value of payments.

The data showed the average amount withdrawn per individual from their pensions in Q1 2020 was £7,100, up slightly from the £6,800 withdrawn in the previous quarter but down 3 per cent from the £7,300 in Q1 2019.

Covid-19 impact

However, these figures do not show the full impact of the ongoing coronavirus crisis, which may yet trigger further withdrawals.

Stephen Lowe, group communications director at Just, said: “Only the latter part of this quarterly period covers the coronavirus lockdown, but it will be interesting to compare this quarter’s figures with the next to see if there is a spike in pension access.

“Flexible access is likely to make pensions seem a more tempting solution in times of financial stress."

He warned: “Using pensions for emergency funds means less retirement income later and it can also restrict a saver’s ability to refill their pension fund if they become subject to the strict Money Purchase Annual Allowance rules that limit annual contributions receiving tax relief to just £4,000 a year.

“We would urge people to consider other options first, such as checking what state benefits may be available to them or first using cash accounts which they may have put aside for a ‘rainy day’ like this.”

Ian Browne, retirement expert at Quilter, said: “It may be volumes increased as people, nervous about stock market volatility or Covid-19 in general started withdrawing more money.

“Next quarter’s figures should further illuminate the picture and in fact we could see the numbers go either way.

"People may withdraw less from their pensions as their expenses have declined or we may see that people are tapping into their pensions more as they are looking to fill a gap left due to being furloughed or some other unforeseen circumstances."

However, while Covid-19 could cause an uptick in withdrawals next quarter, it is common for there to be a peak in Q2 as it is the beginning of a new tax year.

HMRC said overall average withdrawals have been falling steadily and consistently, with peaks in the second quarter of each year.

This is because people phase their withdrawals to minimise the amount of tax they have to pay.

But the average withdrawal tends to be higher after the start of a new tax year as that is when individuals tend to plan their withdrawals.

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.