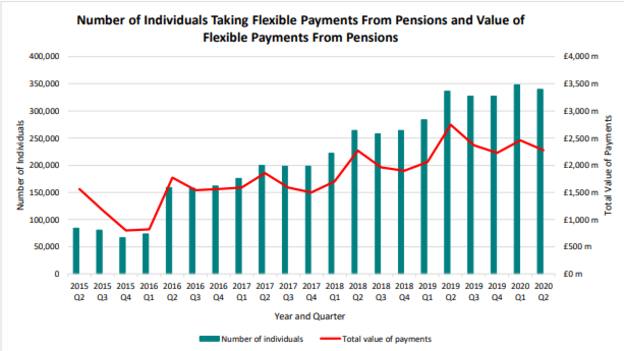

Data published by HMRC today (July 31) showed £2.3bn was withdrawn from pensions flexibly in the second quarter of 2020, and in the peak of lockdown, down from £2.8bn in the same period last year.

The total value of flexible withdrawals from pensions since pension freedoms were introduced in 2015 has now exceeded £37bn.

The average amount withdrawn was £6,700 in the quarter, an 18 per cent decrease from £8,200 in Q2 2019.

While average withdrawals have been falling steadily, there is normally a peak in Q2 as it coincides with the beginning of the new tax year.

But according to HMRC, the impact of Covid-19 has caused a reversal of this trend this time around.

The number of people accessing their pension year-on-year increased by 1 per cent to 340,000 (336,000 in Q2 2019), but this was down from 348,000 savers who dipped into their pensions in the previous quarter.

Again this went against the normal Q2 trends as a result of the coronavirus pandemic.

The tax authority only collects information on taxable flexible payments, any other tax free funds are not included in the data.

Nathan Long, senior analyst at Hargreaves Lansdown, welcomed the fact savers were restrained with their withdrawals throughout the crisis.

He said: “Normally April to June sees a spike in pension withdrawals as personal tax allowances are reset. This year has been a little different as Covid 19 caused stockmarket wobbles that reduced pension fund values.

“Rather than panic and rush for the exits, savers have been restrained and reduced their withdrawals to offset falling investment values and dividend payments.

“Payouts are now the lowest per person since records were introduced. It’s exactly the approach savers should take, using their emergency cash reserves to supplement income from their pension in the tough times.”

Meanwhile, Steven Cameron, pensions director at Aegon, said it was positive to see average withdrawals fall so people are not at risk of depleting their pot before retirement.

Mr Cameron said: “When stock markets have fallen, there is a risk that if people continue to take the same level of income, their pension pot will be depleted too quickly.

"So it’s particularly positive to see average withdrawals down broadly in line with stock markets. Anyone concerned over how to best use their pension pot to secure an income for life should consider seeking financial advice.”

Today’s data has shown that even in tough times savers are able to use their “common sense”, according to Tom Selby, senior analyst at AJ Bell.

He said: “This runs counter to previous trends and suggests that, when faced with the ultimate retirement income test, many people were ready to pause or cut withdrawals in order to keep their plans on track.

“For those taking an income while staying invested in drawdown – and particularly people in the early years of retirement - it is absolutely critical they stay engaged and are prepared to adjust withdrawals if markets plunge in order to stay on a sustainable path.

“Ploughing on regardless is a highly risky strategy and could result in you running out of money early.”

amy.austin@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know