Article 3 / 4

Guide to pensions and ESGCan retirement savers make their pension greener?

Pension savers are apparently turning their attention towards environmental, social and governance factors amid the increasing prevalence of ESG investing.

Two-thirds (67 per cent) of consumers believe it is important to consider ESG factors before investing, rising to seven in 10 (72 per cent) for those with a pension, according to a survey from Aviva last year.

When it comes to defined benefit pension funds, it will be down to the trustees who take advice from a consultant to decide what to invest in, says Karen Shackleton, director at Pensions for Purpose, an organisation that encourages the flow of capital towards impact investment. But for a defined contribution investor, it will be their decision on what to invest in.

Around nine in 10 DC savers remain in their scheme’s default fund, according to Lauren Wilkinson, senior policy researcher at the Pensions Policy Institute.

“For some this will reflect an active consideration that the default fund is likely to be most appropriate for their saving needs,” says Wilkinson. “But for many savers, remaining in the default fund is more likely to be the product of the same inertia that has made automatic enrolment so effective in increasing pension coverage.

“Although it is worth saying that, given low levels of knowledge and understanding around pensions and investment among savers and the way in which default funds have been designed to meet average members’ needs, active decisions about switching funds may not be beneficial for most savers.”

Do default funds accommodate ESG investors?

Shackleton says she has seen platform providers beginning to move towards sustainable investment. “We’re starting to see an industry shift along the spectrum of capital, so many of them are now starting to, for example, introduce low carbon passives to their default funds. Or they might have a sustainable active strategy in the default fund.”

Workers who are auto-enrolled into a pension and want to incorporate an ESG approach should check if a default fund is considering such factors, says Helen Tandy, partner at Castlefield Advisory Partners, which specialises in responsible ESG investing. If the default fund is inadequate, Tandy adds, does the scheme offer an alternative fund?

But Brian Henderson, partner and director of consulting at Mercer, says that most providers offer some form of ESG investing. “The good news is many providers are now starting to integrate ESG into their core offerings. So while it may not state specifically it is an ESG-aware fund, the underlying investments do meet suitable ESG criteria.”

Self-selecting ESG funds

If default funds are insufficient for a pension saver looking to incorporate an ESG approach, self-select funds would be the next step, says Shackleton, who also emphasises the need for clarity on what is meant by ‘ESG investing’.

“Pension savers need to understand the different choices that are available to them and decide. Do they want to just have ESG risks taken into account?

“Do they want to have some themes, and perhaps steer away from oil and gas and towards climate transition stocks? Or do they actually want to be investing positively and intentionally in, for example, climate solutions if they’re following an environmental theme?”

PensionBee is an example of a provider that offers fossil-fuel-free investing, with a plan that excludes the oil, gas and coal industries, among other things, by passively tracking the FTSE All-World TPI Transition ex Fossil Fuel ex Tobacco ex Controversies index.

“Many indexing approaches will still include tobacco and oil companies,” says Clare Reilly, chief engagement officer at PensionBee. “If [savers] don't want to include oil in their pension then they will need to go fossil-fuel free, which can mean going down the active management route.”

Following feedback from customers in its fossil-fuel-free plan, which launched in December 2020, Reilly says the online provider is exploring a new impact plan that goes even further in its exclusionary policy.

The future for ESG-focused pensions

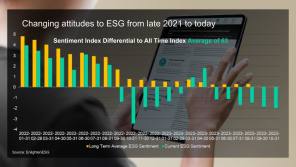

ESG investment strategies are becoming more mainstream, with more funds being created on a weekly basis, says Thomas Lee, an adviser at My Pension Expert.

While awareness of ESG issues is growing among pension schemes and across society more broadly, Wilkinson at the PPI adds that direct engagement from pension scheme members remains low.

“[This] is perhaps unsurprising, given low levels of engagement with pensions in general. However, collective initiatives, such as Make My Money Matter, are working to increase awareness of the ESG impact of pension investments among savers.

“And with younger savers expected to be more engaged on ESG issues, it could be that direct member engagement in this area will increase over time.”

Huw Davies, senior finance adviser at Make My Money Matter, says: “Savers can contact their pension provider using the tool on our website and ask them to make sure that their pension is ‘green’, meaning that it is committed to science-based net-zero targets and is putting climate at the heart of its investment strategy.

"They could also ask if they are going further to proactively invest in climate solutions, cutting deforestation from their portfolios, or exercising their shareholder power at AGM season."

chloe.cheung@ft.com