Article 4 / 4

Guide to pensions and ESGThe similarities between attitude to risk and sustainability

There is a view that asking clients about their attitude to environmental, social and governance issues may sway them into incorporating an ESG approach, out of peer pressure or guilt.

But in a discussion paper on sustainability disclosure requirements and investment labels, the Financial Conduct Authority said in November that it recognised the “important” role that advisers play in providing consumers with sufficient information to assess which products meet their needs, and that it aims to consult on proposed rules in the second quarter of this year.

“We are also exploring how best to introduce specific sustainability-related requirements for these firms and individuals,” the discussion paper reads. “Building on existing rules, a key aim will be to confirm that they should take sustainability matters into account in their investment advice and understand investors’ preferences on sustainability to ensure their advice is suitable.”

Jim Thompson, senior investment consultant at Defaqto, notes: "Understandably, this is an area that regulators are looking at extremely closely to ensure retail clients are treated fairly, with a raft of new rules in the pipeline for the UK market.

“Hopefully, this should mean clients receive the most suitable advice, and importantly, ensure product providers are representing their offerings in a clear and consistent way.”

But in the meantime, is the onus on advisers to proactively gauge a client’s ESG preferences, or on clients to express an interest first?

“Far too many financial advisers believe that the onus is on clients to bring up the subject of ESG and sustainability,” says Lee Coates, co-founder of compliance consultancy ESG Accord. “The assumption is that if they were interested, they would mention it.”

Will Thompson, chief sustainability officer at Pacific Asset Management, which co-developed profiling tool Enlighten ESG, agrees the onus is on the adviser to introduce the discussion of ESG with clients, but acknowledges that some clients may want to lead the discussion.

“What is needed is a repeatable way for an adviser to both ask important questions around ESG, and also to help educate clients, as their knowledge levels can range a lot,” he adds.

Attitude to sustainability

Coates also warns of poor client outcomes and an increased potential for complaints if an uncoordinated approach to ESG advice is adopted.

“There is no point asking for someone’s views on something they don’t understand,” he adds. “Advisers need to provide clients with enough information to make an informed decision.”

Andy Miller, an investment specialist at Quilter, who describes it as “very prudent” to proactively raise ESG with clients prior to any specific regulatory proposals, draws a comparison between attitudes to risk and sustainability preferences.

“Advisers are very used to having a risk discussion with clients. The way we think advisers should probably approach [ESG] is to think about it in the same sort of terms.

“When you introduce risk, what you’re trying to say to a client is that there’s a balance to be struck here between risk and reward. In the same way, what you’re trying to introduce to a client is the concept that they might have views that would cause them to want to invest in a certain area, or avoid investing in certain areas.”

Miller adds that many advisers he has spoken to say they ask, as part of the fact find, a binary question along the lines of whether the client has any ethical views that might influence their investment selection.

“Our view is that’s a fairly poor question. Probably what you should be doing is trying to find out where they are on a range, in the same way as risk profiling.”

Jim Henning, sustainability proposition consultant at Dynamic Planner, agrees. “A binary ‘yes/no’ questioning approach around sustainability preferences at the outset misses some very important opportunities to discuss wider motivations clients may have surrounding their investment decisions, alongside the potential risk/reward outcomes.

“Psychometric questionnaires are now pretty routinely used for understanding risk tolerance, but an increasing number of advice firms are adopting a similar approach for evaluating sustainability preferences.”

According to Henning, psychometric techniques can be used to establish:

- Personal values: how important it is that a client’s values and beliefs should be taken into consideration.

- Psychological distance: the importance of their decisions benefiting others as well as themselves.

- Emotional benefit: how they would feel knowing they are having a positive or negative impact on the environment and society.

- Positive impact: the extent to which they would like their investment to deliver a positive impact.

- Financial considerations: their willingness to restrict their investment opportunities considering these potential benefits for themselves, the wider society and environment.

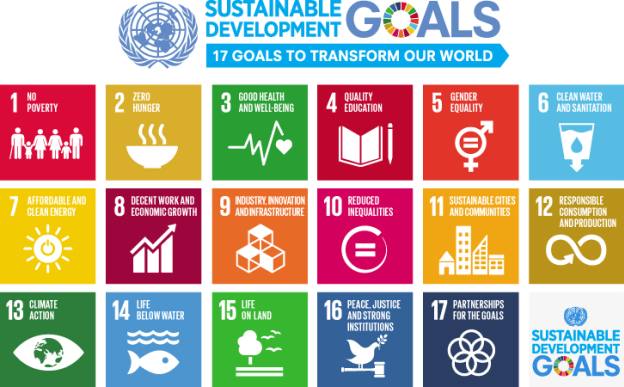

Daniel Green, operations director at My Pension Expert, also cites a sustainable model portfolio service used by the advice business that aims to invest in companies aligned with the UN sustainable development goals.

“They look at the goals, ranging from zero hunger to climate action. That’s a really good way to speak to clients. It puts it in a nice, simple-to-understand way for clients. It’s almost a little bit like a menu of what you care about.”

"Advisers have always taken a wide range of risks and considerations into account when supporting their customers’ investments," says Lily Morris, responsible investing manager at Scottish Widows. "While some customers will proactively ask about ESG, others may be assuming that the adviser will be taking ESG-integrated decisions, and still others aren’t aware of how ESG risks could affect their investments.

"An interesting comparison is inflation risk. While not all clients will actively ask their advisers about inflation risk, a prudent adviser will be taking this into account when supporting their clients’ long-term financial planning.

"Looking at the direction in which regulation and government policy are going, we believe advisers should be increasingly aware of the need to talk about ESG with their clients."

chloe.cheung@ft.com