This jumps to 40 to 45 per cent for higher and additional rate taxpayers, so saving into a pension is sort of a no-brainer.

But as the well-known saying goes, nothing in life is for free, which is why there are annual allowances in place to limit the amount of money a saver can build up tax-free in their pot in any one tax year.

While there is no dispute that allowances are needed, there is an argument that the government has gone too far with these and the rules surrounding them have become so complicated that now people would rather avoid contributing to their pension full stop than have to attempt to navigate them.

Currently, the annual allowance is £40,000 for most people but higher earners also have to consider the tapered annual allowance, which further limits the amount of tax relief they can claim on their pension savings by slashing their annual allowance to as low as £4,000 in some cases.

And when people think that is the end, then comes along the money purchase annual allowance. This sees a person's allowance limited to £4,000 once they have started to draw their pension.

Tom Selby, head of retirement policy at AJ Bell, says it makes perfect sense to control the amount that is spent on pension tax relief as failing to do this would effectively leave the Treasury with an open-ended liability. But he questioned whether the current system is the right way to do this.

“The question then is not whether pension allowances should exist, but how they are applied and if the current system is really the most sensible way of controlling tax relief,” Selby says.

“If you were starting from scratch, would you really create a framework with three different versions of the annual allowance, a lifetime allowance and a plethora of protection regimes to boot? I’m not sure anyone could say with a straight face that’s a sensible construction – and it most certainly isn’t simple.”

Complex rules catch savers out

Those brave enough to try and navigate these rules often face punitive tax charges by exceeding their allowance and could even miscalculate what they owe, according to industry experts.

Divisional director of retirement and holistic planning at SJP Claire Trott has come across clients where they had not realised they had issues. “That's why a lot of their tax charges seemed to be so high because they were paying three or four years of allowance breaches in one go,” she explains.

Trott went on to say that if schemes provided data on allowance breaches, and HM Revenue & Customs collated it, it would make more sense than it being a sort of “honesty tax” where people have to understand the rules.

“People have probably over-declared [the tax owed on breaches],” she added. “The amount of people I have spoken to who have said ‘I’ve gone over my annual allowance, I need to put it on my tax return’ but this is not the case because they have got plenty to carry forward”.

Recent HMRC data has shown that the number and value of annual allowance breaches has skyrocketed since 2015, suggesting more people are being caught out by the complicated rules.

There has been a 676 per cent jump in the number of taxpayers reporting pension contributions exceeding their annual allowance through self-assessment, from 5,460 in 2015-16 to 42,350 in 2019-20.

Likewise, the total value of contributions reported as exceeding the annual allowance stood at £950mn in 2019-20, a 564 per cent hike when compared with £143mn registered in 2015-16.

Andrew Tully explained that the big issue people with a defined benefit pension have with the allowance is when they get a big salary increase.

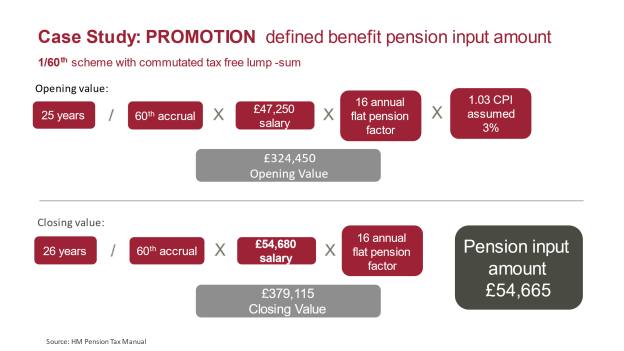

For example, someone who starts the year with a salary of £47,250 with a pension opening value of £324,450 but closes the year with a salary of £54,680 and pension of £379,115 would exceed the annual allowance by more than £14,000.

Allowance pushes doctors out

This is why some people choose early retirement, or turn down promotions and extra hours so their salary does not push them above the allowance.

It has been seen in the health industry, where senior clinicians are choosing to end their careers early because of the tax hit they are facing on their pensions.

This comes at a time where the country is already facing shortages of doctors, with NHS England urging senior doctors to delay their retirement to help tackle the Covid-fuelled backlog of patients.

But despite this, one MP says the annual allowance is not the main cause of doctors leaving the NHS.

Edward Argar says in a written answer: “Data from the NHS Business Services Authority shows that while the number of consultants taking voluntary early retirement as a proportion of all consultant retirements has increased since 2012, it has not changed significantly in more recent years.”

This has been disputed by industry experts after data revealed at least 34 per cent of all people who exceeded the annual allowance in 2019-20 were members of the NHS pension scheme.

Graham Crossley, NHS pension specialist adviser at Quilter, predicts that in April doctors left in their droves but the data showing this has not been published just yet.

He says: “Lots of doctors during the pandemic held on to help the nation but were already looking to leave because of the taxation implications and everything else. Added to that is the immense workload they have had so I would not be surprised if we've had significant numbers leave in April.”

Crossley says a lack of “joined up thinking” is harming the profession, explaining that pension taxation can have unintended knock-on effects.

“Take a nurse who is working full time at the moment but then gets told, ‘You can only work part time otherwise we're going to reduce your pension pound for pound’. They are going to drop their hours and suddenly the NHS has lost half a nurse and I think it's absolutely crazy.

“Then at the other end you have the annual allowance problems which are just going through the roof.”

Will the allowance problem get solved?

Tully estimates that by 2026, the annual allowances will bring in about £1.5bn a year.

“It has suddenly become a substantial tax earner for the government, so to abolish it now has become much more difficult,” Tully says. “Particularly in the current environment where government finances are stretched, to ask them to abolish a tax that is likely to bring them £1.5bn a year in the future is a big ask.”

Pension technical manager at Curtis Banks, Jessica List, says if the government were to improve how the money purchase annual allowance and taper annual allowance works, then any fix would need to achieve the original goal without the added unintended consequences.

List says: “I don't think making adjustments to current rules is necessarily the wrong way to go. Fully overhauling the system is a massive, massive undertaking, regardless of what policy aims you're trying to achieve or what changes you're trying to make.

“There is just no way of doing a full overhaul without it being enormously disruptive. So, as a sort of lesser of two evils, adjustments to the current rules is probably better and easier, but it has got to be the right thing.”

Amy Austin is news editor at FTAdviser