A pension pot size of £645,000 is required for a single person to achieve a comfortable lifestyle in retirement, according to calculations by Quilter.

The figures are based on the Pensions and Lifetime Savings Association’s retirement living standards, published earlier this week, which were updated to account for the cost of living.

Quilter’s calculations assume an escalating income of 3 per cent and an annuity rate of 5.1 per cent based on someone who is aged 66 (which is the current age to receive state pension).

It comes after the research by PLSA revealed that retirees trying to achieve a basic standard of living will have seen their expenditure increase over the past year by almost 20 per cent due to high inflation.

A comfortable retirement requires a single person to have an annual income (net of tax) of £26,700 per year on top of the state pension, which in 2023-24 is £10,600 per year.

According to the PLSA, it consists of being able to go abroad in Europe for three weeks a year, have £144 to spend on food a week and be able to gift £56 for every birthday present among other measures.

Jon Greer, head of retirement policy at Quilter, said: “While these figures are only a guide it is worth noting that you need to build up a relatively significant pension pot just to achieve a moderate lifestyle.

“Starting young is key as pension pots have a compounding effect that helps money grow much more the longer it is in the pot,” he said.

For someone looking to achieve what is defined as a moderate retirement lifestyle, a single person will need to build up a pension pot of approximately £301,000, Quilter explained.

A moderate lifestyle includes being able to afford £74 a week on food (including food away from the home) as well as two weeks in Europe and a long weekend in the UK every year.

Finally, for someone looking to achieve a minimum lifestyle which requires someone to have £2,200 in extra income per year on top of the state pension they need to have built up a pot of around £44,000.

A minimum lifestyle enables someone to spend £41 on a weekly food shop, have no car and spend a week away in the UK and a long weekend each year.

Greer said it was worth noting that the figures from the PLSA all assume that retirees are living rent or mortgage free in their homes.

“Therefore, while these numbers make sense now, for future generations these figures will have to rise considerably,” he said.

“This is due to soaring house prices meaning that many struggle to find the money to buy a house or are forced to takeout marathon mortgages with terms that stretch into their 70s to achieve lower monthly mortgage payments.”

Speaking to FTAdviser today, a spokesperson for PLSA said using different assumptions, it has arrived at slightly lower projected pot sizes.

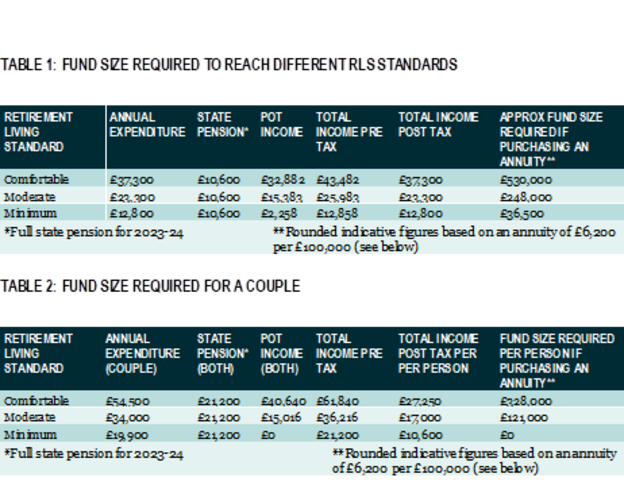

The first table below is for individuals and the second is the amount each person will need to accumulate in a couple.

Source: PLSA

Greer added: “The PLSA’s figures also do not account for the potential costs of requiring social care. According to the ONS, male healthy life is around 62.8 years and for women it is 63.6.

“Meanwhile life expectancy was 79.0 years for males and 82.9 years for females meaning that many people will spend a significant proportion of their retirement in ill health potentially needing to access costly care.”

Elsewhere, a DWP spokesperson said automatic enrolment has succeeded in transforming pension saving, with more than 10.8mn workers enrolled into a workplace pension to date and an additional £33bn saved in real terms in 2021 compared to 2012.

“Our ambition for the future of automatic enrolment will enable people to save more and to start saving earlier,” it said.

“However, we also recognise current concerns with rising prices and are committed to ensuring people have the support and information they need to make informed choices about their financial futures, with free and impartial guidance available via Pension Wise and Money Helper.”

sonia.rach@ft.com

What do you think about the issues raised by this story? Email us on FTAletters@ft.com to let us know