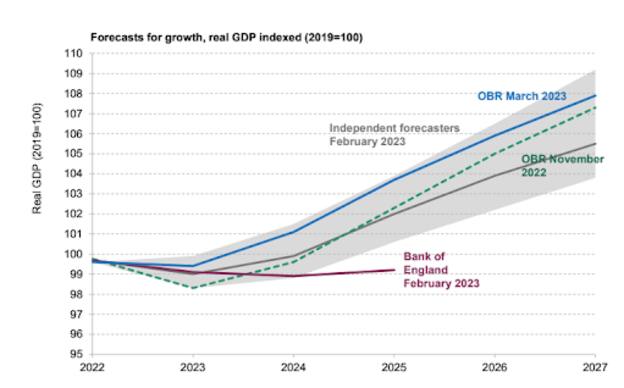

The chancellor should be grateful that the Office for Budget Responsibility’s economic forecast was more upbeat than others, the Institute for Fiscal Studies has said.

Responding to yesterday’s Spring Budget IFS director, Paul Johnson said chancellor Jeremy Hunt should be grateful for the “small mercy” that the OBR’s forecast was much more positive than the Bank of England and many other forecasters, about medium-term growth.

In yesterday’s address in the House of Commons, Hunt said that based on the OBR’s forecast the UK economy will shrink this year, but not fall into a technical recession.

In his analysis of the Budget, Johnson said despite this the overall outlook for the public finances “still looks difficult”.

“Tax continues to rise to its highest ever level, and to much higher levels than in recent decades. Yet even with very tight spending pencilled in from 2024, debt is barely falling.

“That’s because a high debt level, high debt interest payments, additions to debt that are not included in borrowing, and sluggish nominal growth, make it hard to get debt on a decisively downward path,” Johnson said.

In its forecast, the OBR said it is now harder for this chancellor to deliver a falling path for the debt-to-GDP ratio in the medium term than it has been for any of his predecessors since the OBR was established in 2010.

As a result of this, Johnson noted that Hunt was “hemmed in by his own fiscal target to get debt falling in the last year of the forecast period”.

“While its level is expected to be lower than in November, its trajectory remains stubbornly flat. That has led him to rely on a combination of tight spending plans, imaginary future increases in fuel duties, and a fiscal gain from unwillingly undoing his corporation tax change at the end of the period, in order to appear to meet this rule,” Johnson said.

He added: “This is not a terribly sensible way of being guided by such rules.”

Despite this concern, Johnson said he felt the Budget did lay out “some elements of a sensible strategy to support growth”.

“There is plenty to quibble with, but if you want to focus on growth there is at least some of what you might want here, attempting to deal with incentives to work and to invest,” he said.

As part of yesterday’s Budget, Hunt announced £94bn worth of cost-of-living support for households over the next two years, including an extension of energy supports until June.

Pensions

He also announced significant changes to the pension system, including the abolition of the lifetime allowance in a move the opposition Labour party branded as a “huge giveaway” to the wealthy.

Johnson noted that while a significant focus of the Budget was getting people back into the workforce, as evident through the extension of free childcare, the increase in the pension tax annual and lifetime allowances “probably won’t play a big part” in expanding the workforce.

“Even on OBR’s, in my view optimistic, assumptions this will come in at £100,000 per job there is a case for allowing people to save more in a pension, even if those who gain will generally be on high incomes up to £250,000 a year or more.

“While it was sensible to accompany this change with a limit on the size of the tax-free lump sum to 25 per cent of the existing lifetime allowance, it was disappointing that other over-generous aspects of pension taxation – not least complete freedom from inheritance tax – were not reined in,” Johnson said.

“The lack of any coherent strategy here remains deeply disappointing. Don’t forget these changes are largely a rowing back on changes made just a few years ago by this government,” he added.

jane.matthews@ft.com