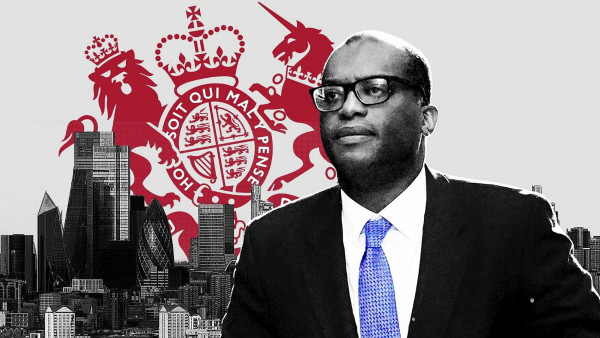

Chancellor Kwasi Kwarteng is set to introduce a cut in stamp duty in the mini-Budget, but industry experts said its impact will depend on whether it is a short or long term measure.

The move will echo the stamp duty holiday that was in place during the pandemic from June 2020 to June 2021. The holiday enabled first-time buyers to avoid stamp duty land tax on up to £500,000 of a house purchase and on average, saved individual buyers £15,000.

The plans to cut the stamp duty are in a bid to encourage more property transactions.

However, it is not yet clear whether the changes to stamp duty that will be announced on Friday will be in the form of a holiday or a longer term reform.

Private Finance technical director Chris Sykes said this will be a key element determining the success of any policy change.

“Long term reform is needed and would have the least impact on pushing up house prices. A short term holiday would likely push them up,” Sykes said.

“One thing that isn’t considered by many when discussing stamp duty is the stock that will be freed up by a longer-term cut. There are a lot of older home owners sitting in large houses with three or four bedrooms that they don’t necessarily need anymore.

“These people will also soon feel the effects of rising bills and may be happy to downsize, but the current system means that they may be disincentivised by a hefty stamp duty bill,” Sykes said.

Put simply, the current system does not incentivise the freeing up of stock, Sykes explained.

He said while a cut in stamp duty may free up much needed housing stock, this impact would be felt more under a longer term reform.

“Property usually holds a sentimental value for people and selling is not a decision they want to rush into as might be the case with a shorter term incentive," he added.

Likewise, Knight Frank’s head of UK residential research, Tom Bill agreed that a long term or permanent cut would be necessary to avoid unintended consequences.

“Nobody can accuse the new government of lacking an economic vision,” Bill said.

“If its low-tax approach extends to stamp duty, recent history tells us it will trigger higher levels of demand in the housing market at a time when mortgages are getting more expensive, which will support social mobility.

“Prices could spike higher in the short term if supply initially struggles to keep up but more balanced conditions will return provided the cut is immediate and permanent.”

Others in the industry were less convinced on the impact of a cut.

Overheated market

“Most people are more concerned about their monthly outgoings rather than stamp duty,” Emma Jones, managing director at Frodsham-based broker, When The Bank Says No.

“Daily conversations we are having are around budget and to be quite honest stamp duty is an afterthought. The stamp duty incentive was a great push during the pandemic but I can’t help but wonder if that’s what has got us to where we are, with significant price increases, bidding wars and people now potentially exposed as they have over-borrowed.”

Jones explained that house prices are higher than ever and now mortgage rates are following.

"More increases in prices, which this move could trigger, will simply make mortgages even more unaffordable and prevent many people from getting on the property ladder at all,” Jones added.

Meanwhile, Samuel Mather-Holgate director at Swindon-based advisory firm, Mather & Murray Financial said he fears that the proposed change may just be a cut to the standard rates which will “please no one”.

"Let's be honest, the reforms to stamp duty land tax by George Osbourne weren't universally welcomed by the property sector,” he said.

“The massive 3 per cent surcharge on second properties dealt a huge blow to buy to let investors. That, coupled with the changes in the income tax regime, made things really unappealing. This will just stimulate an already overheated property market."

Currently no stamp duty is paid on the first £125,000 of any property purchase.

Between £125,001 and £250,000 stamp duty is levied at 2 per cent, £250,001 and £925,000 is 5 per cent, £925,001 and £1.5mn is 10 per cent and anything above this at 12 per cent.

For first-time buyers the threshold at which stamp duty is paid is £300,000.

jane.matthews@ft.com