Finding a way to provide cover is a pressing issue. Since 1996, when 1.4m people had a diabetes diagnosis, the number has almost trebled. Further, Diabetes UK predicts that if nothing changes the figure will exceed 5m by 2025.

Adding to the pressure is the fact that the age at which diagnosis for type 2 diabetes occurs is starting to fall. For years, it has been regarded as a disease that mainly affects the over-40s, but latest figures from the NHS show 715 people aged under 25 were receiving care for type 2 diabetes in England and Wales in 2016-17 – a 41 per cent increase on three years earlier.

With the number of people with diabetes on the rise, insurers have stepped up their approach to providing life insurance. A handful of providers, including AIG, Old Mutual, Royal London and Vitality Life, now promote the fact that they can offer cover for people with diabetes.

Helen Croft, underwriting and claims strategy manager at AIG Life, says: “We have covered diabetes since we launched 10 years ago. It is the 11th most common disclosure, with around three per cent of our applicants declaring that they have diabetes.”

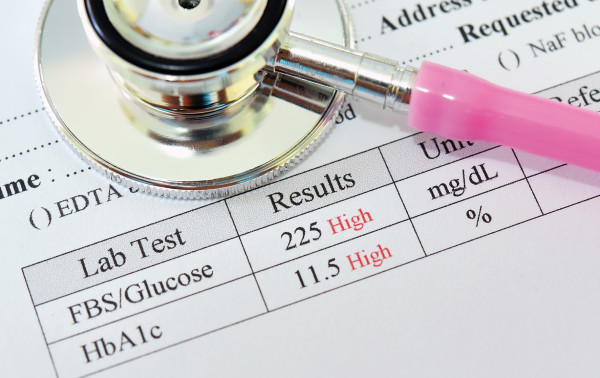

Given the increased risk, more information is required during the application process. This typically includes details such as when they were diagnosed, which type of diabetes they have, the latest glycated haemoglobin (HbA1c) reading, and whether there are any complications such as neuropathy or kidney disease.

These details will be assessed alongside other medical information such as height, weight, blood pressure and cholesterol levels to determine whether someone can be covered.

Alan Knowles, managing director of Cura Financial Services, says: “Most insurers are comfortable offering cover to individuals with type 2 diabetes, where it is well controlled and there are no major complications. Some will even get standard rates.”

Although this is unusual, he says this might be the case where someone is in their 60s, has been diagnosed in the past couple of years and is controlling their condition. Otherwise, loadings are the norm, with insurers able to increase premiums by up to 400 per cent dependent on the risk.

Tailored cover

Some insurers have developed specific products for people with diabetes. These include Royal London’s Diabetes Life Cover and The Exeter’s Managed Life.

These products work in a similar way, enabling customers to reduce future premiums if they can demonstrate they are managing their condition. To do this, they need to provide their HbA1c results every year.

At Royal London, customers can reduce their premiums by up to 40 per cent if the results show their condition is improving. At The Exeter, policyholders are given a target HbA1c to achieve, and if they successfully reach this by their one-year anniversary they are entitled to a discount, which can be up to 35 per cent.

With both these products, there is also a guaranteed maximum premium, so there is no risk that premiums will become unaffordable if the condition is not managed well.

Although Royal London will underwrite clients with diabetes on its standard product, the insurer’s product specialist, Christina Rigby, says it is important to have a specific product, too.

“Customers with a health condition will often automatically exclude themselves from cover,” she says. “They think it will involve a laborious underwriting process at the end of which they will be declined. We need to show them that cover is available.”

Protecting income

Finding affordable income protection for a client with diabetes is more difficult. Given that many of the complications associated with the condition, such as kidney disease, strokes and eye problems, can affect their ability to work, many insurers see the risk as just too high.

Where an insurer is prepared to offer cover to people with diabetes, Mr Knowles says the acceptance criteria are often tight, squeezing out all but those who have their condition well under control.

“Insurers will also apply exclusions,” he adds. “This is a common way to approach any medical condition on income protection but, with so many complications associated with diabetes, clients need to be aware exactly what is, and is not, covered.”

On the back of their experience in the life insurance market, some insurers are getting bolder about offering income protection to clients with diabetes. As an example, AIG started underwriting diabetes on its income protection product in 2018.

Rather than slap exclusions on policies, it prefers to load the premium. “We always prefer to rate than exclude,” says Ms Croft. “It is much easier for a policyholder to understand.”

Critical cover

While exclusions and tight acceptance criteria can make sourcing income protection tricky, the additional risks associated with diabetes mean very few insurers are prepared to offer critical illness insurance. Their fears are supported by figures from Diabetes UK, which show the condition causes 680 strokes and 530 heart attacks each week.

Only a handful of insurers, including Aegon, Old Mutual and Zurich, will entertain an application from a client with diabetes, and even then acceptance criteria are very tight. “Premiums will be loaded by 75 to 100 per cent,” says Mr Knowles.

“When you are talking to a client about a critical illness policy that is already five times the cost of life insurance and you have to double the price due to the loading, it becomes a very difficult sell.”

Although the insurers’ approach is understandable given the increased risk, it leaves clients with diabetes without affordable cover for critical illnesses that are not linked to their condition. This includes cancer, which accounts for around two-thirds of all critical illness claims paid.

Increasing cover options

As insurers gain a better understanding of the risks diabetes presents, this will translate into a more comprehensive product range for this market. Already some are pushing the boundaries, with Old Mutual offering life cover for diabetes alongside a heart attack or stroke.

Critical illness insurance is also likely to see more development, with Craig Paterson, underwriting manager at Royal London, accepting that insurers need to be more creative. “We need to look carefully at what can and cannot be included in a policy,” he says. “Customers would rather be offered something than nothing.”

A product designed specifically for people with diabetes could be an option, helping to keep the premium affordable by excluding any related conditions. Similarly, a cancer-only product could provide them with valuable cover for the condition that generates most claims.

Support systems

Across the board, more focus is being put on the additional support insurers can provide for policyholders with diabetes. This could include health and lifestyle support, but also devices such as flash and continuous glucose monitors that make it easier to manage the condition. “People want to do more to manage their diabetes,” adds Ms Croft. “A lot of health conditions are modifiable and insurers can support this.”

There also need to be more options for people with type 1 diabetes. As this is regarded as potentially more harmful than type 2, it can be even more difficult to find affordable cover. For example, while The Exeter can accommodate people with type 1 or two 2 diabetes on its life cover, its income protection is only available to those with type 2.

Protection options have improved significantly over the past few years but, with the number of diagnoses increasing, it is essential that the insurance industry finds ways to enable more people with diabetes to access affordable cover.