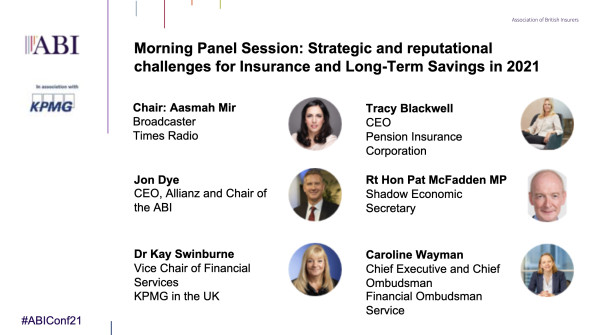

Speaking at the Association of British Insurers' virtual conference 2021, Caroline Wayman, chief executive and chief ombudsman of the Financial Ombudsman Service, said it was important that insurers communicated with policyholders and were clear about how they processed claims.

Referring to the Financial Conduct Authority's recent test case over business insurance claims amid the coronavirus crisis, Wayman said while press coverage may have created a "challenge in managing expectations" thanks to people's tendencies to just read the headlines and not the small print, it was vital for the industry to communicate and restore trust.

She said: "From where I sit, it is important it does not turn into a big complaints area. Communication is crucial."

Responding to a question on how to improve clarity in policy wordings in the insurance sector, she agreed businesses should be doing more to improve them.

Wayman said: “If you want policyholders to engage you can't give them ridiculously long policies with pages and pages of detail. You need to be able to deliver that detail in a clear and simple way that helps them to engage."

She added: “We are seeing a number of customers experiencing particularly difficult circumstances and are vulnerable, and this is something we all need to work together to overcome.”

Fellow panellist Tracy Blackwell, chief executive of the Pension Insurance Corporation, said the insurance industry needed to remember "what the purpose is of our company. What do our clients need? This is what we should focus on".

She commented: “We need to communicate with clients in a clear fashion and ensure the client is at the centre of all that we do."

Dr Kay Swinburne, vice-chairperson of financial services for KPMG, was also on the panel. She said: “You need to build back trust and disclosure is important. You need to understand what your customers' needs are and fit the product to that, rather than the other way round.

“Caroline is right that it takes a long time to read some of these insurance documents. People do not often get to the end of these so you need to have fairness and demonstrate that how you are taking the customer's information and using it is non-discriminatory, you need to be transparent in the process, and you need a good governance process to ask 'am I doing the right thing for the client?'

"Given that trust takes a long time to build up and is lost easily, the insurance sector must look very carefully at itself as it comes out of this crisis" and examine how it is treating customers, Swinburne explained.

Also on the panel was Jon Dye, chief executive of Allianz and chairman of the ABI. He was asked whether the sector was too fragmented and tribal to have a co-ordinated approach to tackle the reputational issues and rebuild trust.

He said: "The UK insurance industry is fragmented, by the standards of the world, and we are in competition. This is true for insurers, brokers and other actors.

"But there is no trouble with that, because competition drives better outcomes for consumers. However, this competition and fragmentation has not stopped us working together to do just that."

He pointed to situations such as the recent flooding in the UK, where companies came together to help customers get flood cover, and heralded the ABI's various recent initiatives to bring the industry together to improve trust and clarity and the language of financial services.

simoney.kyriakou@ft.com