In March, Peter Hargreaves raised fears that the recent glut of advice firm consolidation could result in a smaller number of “mediocre” adviser practices. This would ultimately be bad for client portfolios, he claimed, as investors would be left with a more concentrated pool of funds to choose from.

As the backer of a small fund house trying to get on to as many buy lists as possible, Mr Hargreaves now has a different kind of stake in this area. But there is no doubt consolidation activity continues to affect intermediaries.

The most eye-catching deal has been Quilter’s purchase of adviser network Lighthouse for £46m, but small firms as well as large ones have been looking to get in on the act. With regulatory costs continuing to rise and the Financial Conduct Authority casting a keen eye on adviser charges, many firms may feel that survival lies with achieving greater scale. Whether this will ultimately benefit consumers is another matter.

Stuart Dyer, chairman at Soprano, which offers consultancy on advice firm acquisition, echoes Mr Hargreaves’ concerns, but says the trend towards investment outsourcing may have more of an impact when it comes to portfolios.

“[The concentration of investment offerings] has been happening for some time. If you go back perhaps 10 years, it was quite frequently the case that individual advisers would be constructing portfolios for clients. But you rarely see that anymore.”

The jury is still out on whether concerns over discretionary fund managers’ charges and performance will change that dynamic. Regardless, there are other aspects of adviser consolidation that mean some businesses are welcoming the uptick in deal-making activity.

Kay Ingram, director of public policy at LEBC Group, says: “Consolidation of advisory businesses will make them stronger and provide consumers with a sustainable source of ongoing independent advice. While many smaller firms have been able to provide a local and highly bespoke service to their clients, the sustainability of this model is under pressure.

“While consolidation of micro advice businesses would in one sense reduce consumer choice, it is likely to leave the advice sector in better shape and make affordable advice more sustainable and accessible to the mass affluent.”

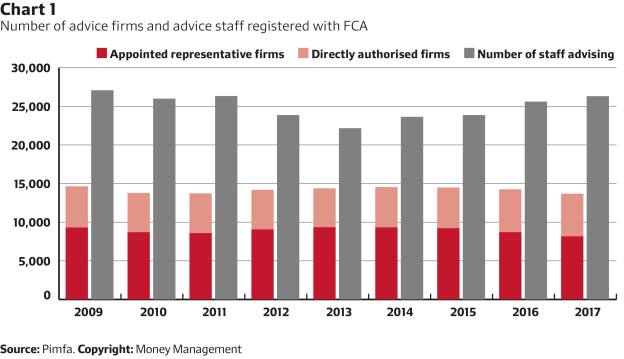

The data, at least, is unequivocal. A report by the Personal Investment Management and Financial Advice Association shows that the number of companies declined every year between 2014 and 2017, dropping to a 10-year low of 13,690 at the end of 2017. This was in spite of the total adviser population rising from 22,168 to 26,311 in the four years to that date, as Chart 1 shows.

Does this mean the future of small practices is hanging in the balance? Philip Hanley, director and independent financial adviser at Philip James Financial Services, feels smaller firms should sit tight. “Those that hang on in there will see yet another industry and corporate ‘full circle’,” he says.

“The privately owned predators will be keen to float or sell to a giant before regulation and complaints make their business model untenable. And the next change of chief executive at the giants will, no doubt, ditch the move back to vertical integration, which means we’ll be back to an industry dominated by the small IFAs and St James’s Place.”

At everyone’s expense

For small outfits, the decision on whether to sell up or retain independence is not so straightforward. Regulatory costs, for one, can mean that running a small advice business proves an expensive venture.

The FCA is well aware of this, but must weigh its concerns on this front against other priorities. On January 17, the regulator announced it would be speaking to smaller businesses, including advisers, specifically to ensure its “cost-benefit analyses and judgements of proportionality take into consideration smaller firms’ circumstances”.

Those who welcomed this news would have been conscious that the regulator’s annual sector views document, published a week earlier, saw it criticise what it called “expensive” advice costs.

The cost of advice has been under scrutiny ever since the RDR was introduced in 2013, with the resulting advice gap proving to be a puzzle that appears no closer to being solved. Offering advice at a lower cost remains a serious challenge, and the problem may be getting worse.

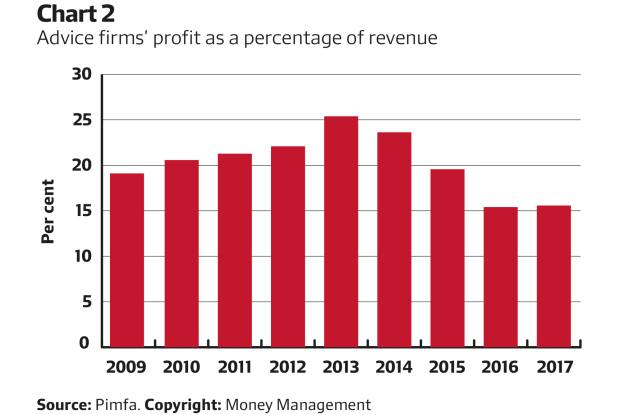

A peek at profit trends helps reveal why. According to the Pimfa report, advice companies’ profit as a percentage of revenue dropped from 25.4 per cent in 2013 to 15.4 per cent just three years later. A 15.6 per cent figure recorded in 2017 suggests the situation is starting to level off, but as Chart 2 shows, this remains far below both levels recorded at the time of the RDR. This means that scale is becoming a vital factor.

“One-man band companies will find it difficult to survive from a cost perspective; to maintain levels of service, clients’ costs would need to increase,” says Dhawal Chandan, director at Just Financial Group.

From an investment perspective, increasing scale can also help secure better deals from asset managers for their funds, the savings from which can then be passed directly on to the client.

Mr Dyer adds: “Mifid II legislation is an administrative headache. For advisers using simplified investment propositions, the administrative costs of rebalancing [client portfolios] is substantial.”

He also points to additional issues for small companies. He says the Financial Services Compensation Scheme levy, recently set at £175m for the coming year, is making it tougher for firms to obtain professional indemnity insurance cover.

Recent deals

Quilter’s acquisition of Lighthouse is anticipated to complete in the second quarter of this year, and will see 400 advisers join Quilter’s Intrinsic network. This deal represented the fourth acquisition the company had made this year alone, adding to the purchases of Freedom Financial Planning, Stephen Spires Financial Consultants, and Charles Derby.

Dominic Rose, strategy and acquisition director at Quilter Private Client Advisers, explains that the outfit has a “target demographic of wealthy to high net worth clients”, and therefore scale is a vital factor.

Other companies have been following suit, with Fairstone among the more active: in early May, the firm announced it had made its second purchase of 2019, Brett & Randall Financial Services, adding 420 clients and beefing up its assets under management by an additional £200m in the process.

Mr Hanley says: “The consolidators are cash-rich at the moment and able to make increasingly attractive offers to an ageing population of small to medium-sized advisers. Many don’t necessarily want to sell or leave their clients and the industry, but are worried that if they don’t jump on the gravy train, it will puff out of town before they do.”

Mr Dyer, however, suggests activity, over the past 12 months, at least, has been far from unusual. “If you have a look at the data, there have been surprisingly few [deals]. Last year there were fewer than 100,” he says.

“The RDR accelerated the exit of firms that were not capable of operating in a professional environment. Until more recently, there hasn’t been the tremendous imperative to leave. Activity has been sporadic.”

But he adds that the recent acquisitions are certainly a sign of things to come, with 500 to 700 companies in total expected to leave over the next three years.

Some onlookers’ prime concern with this activity is that independence is being swapped for restricted advice. This is likely to be more relevant to larger outfits, as was the case with the acquisition activity of Standard Life’s advice arm 1825 in recent years. Yet firms of all sizes are now looking to grow their practices.

“We are finding a lot of retiring IFAs who want to ensure that their clients are retaining their independent status,” says Mr Chandan. His company is in the process of trying to purchase three companies, and only targets those with investment propositions and charging structures that he is happy with. But he explains that the process is far from straightforward.

“You need to kiss a few frogs first because you want a company that makes sense from an ethos and culture point of view,” he says.

Advising advisers

Intermediaries looking to sell generally fall into two categories: those looking to retire and therefore leave the industry, and those hoping to continue working as part of a larger business. For the latter, an important consideration to digest is how an adviser would feel no longer being at the top of their firm’s pile.

“If you’re staying, you’re moving from being your own boss to working for somebody else – that should not be underestimated as a massive challenge,” says Mr Dyer. “I ask them, ‘have you really thought through how you’re going to feel reporting to somebody else?’”

Another factor, interestingly, is whether to seek out professional advice on the sale itself. “IFAs are smart people, but very few have been through a sales process,” says Mr Dyer.

For advisers looking to exit, a different set of considerations applies. Chief among these is ensuring that the deal provides sufficient value and incentive for existing advisers to remain with the consolidated company. If this isn’t successfully navigated, problems can arise for clients as well. Deals can often collapse at the last minute after consuming months of time and resource.

Mr Rose says clear client communication is imperative. “If the adviser is retiring, it is important they conduct face-to-face handovers. If you ever lose sight that’s it’s a relationship transfer, that’s when it fails.”

Getting techy

The impact of technology on the financial sector needs little introduction. For intermediaries, the real benefit has been a slicker and more sophisticated advice process. But some of these developments have only been incorporated in the past decade or so, with many companies scrambling to have RDR propositions in place to ensure they could function in the new regulatory environment.

Implementing new technology comes at a cost, and often a substantial one at that, which means bigger and more financially resourced companies are better placed to absorb such charges without needing to hike advice fees as a result.

Mr Rose says: “For advised businesses, they need to be embracing technology to enhance client experience. My belief is scale is important to make these viable financially.” However, he does concede that the future is not entirely bleak for anything other than large advice companies: “There is also a place for boutique local firms. It depends on the experience clients want.”

Ms Ingram agrees, and suggests that if firms can get on top of technological advancements it will lessen the need to sell up.

“The risk to the independent advice sector is that unless economies of scale can be achieved through investment in technology, and sustainability can be assured through recruitment and training, it will cease to be relevant to the mass affluent market,” she says.

“Following cost increases in regulatory processes and PI cover, the trend in the advice sector since RDR has been for fees to rise and for advice to be less accessible to those who have not yet accumulated wealth. This may be a viable strategy for IFAs in the short term, but it does not address the needs of most consumers, nor the long-term viability of independent financial advice.”