They form the backbone of a new assessment of how well financial advice is working across the country – six years after the Retail Distribution Review and three years on from the Financial Advice Market Review.

Opinion is divided on how well the advice sector has fared since the RDR in particular. According to the latest statistics from the Personal Finance and Investment Management Association, published in 2018, the financial advice sector garnered £4.5bn in consolidated revenue in 2017, while wealth managers reported £975bn in assets under management or administration.

However, the trade body simultaneously reported a significant decline in the total number of financial advisory companies, down from 14,254 in 2016 to 13,690 at the end of 2017.

This decline has been an ongoing trend since the RDR, which came into force on January 1 2013. Looking back at figures from Pimfa’s previous incarnation, the Association of Professional Financial Advisers, shows there were a total of 27,080 IFAs (as opposed to advice businesses) in 2009. Following the RDR, this dropped to 22,168 in 2013.

“While the number of advisers has increased somewhat since 2013, there is still a substantial lack of supply,” says Andy Thompson, chief executive of Quilter’s advice business.

This relative lack of supply was cited in the FAMR as one of the reasons why many people in the UK are not receiving quality, independent financial advice.

FAMR was intended to kickstart a consumer return to advice, restoring faith in financial services and providing more affordable avenues to receiving guidance or advice. But according to Mr Thompson and other professionals, this has not happened. This is the context in which the Financial Conduct Authority has issued 24 questions as part of its Call for Input: Evaluation of RDR and FAMR.

Have other aims been met?

So did the FCA achieve its aims in making sure customers always get the best result? Did the RDR meet the regulator’s goals “to establish a more resilient, effective and attractive retail investment market that consumers have confidence in and trust”?

Keith Richards, chief executive of the Personal Finance Society, thinks the RDR has achieved greater success “than was perhaps envisaged by many”. He explains: “We have seen a greater number of advisers do better post-RDR than was anticipated. Demand for professional financial planning services has increased, even before the subsequent introduction of pension freedoms.”

Barry Neilson, chief customer officer at Nucleus, agrees: “RDR has broadly been a positive force for change. It has served to ‘professionalise’ advice and financial planning through higher qualifications.

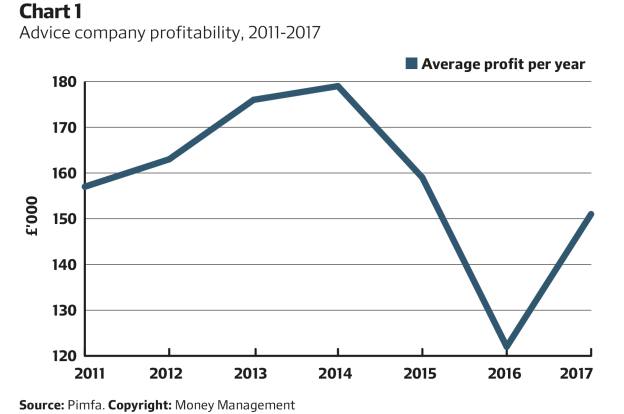

“The move to fees, already underway before being introduced under the RDR, has helped propel firms to become more business-minded.” The company’s latest Census publication showed a jump in advisers with turnover of £750,000 a year or more last year. When it comes to profitability, industry-wide figures for 2018 are not yet available, but Chart 1 shows a notable uptick in 2017 – perhaps aided by pension transfers – after several years of stagnation.

However, Mr Neilson does not believe all the RDR’s aims have been met, describing the overall picture as “nuanced”. He explains: “It is hard to see how the market is more resilient now in light of the difficulties advisers are facing in securing professional indemnity insurance.

“The related issue of poorly defined benefit transfer advice has done little to help with consumer confidence and trust, despite the great job most advisers do daily.”

Nick McBreen, an IFA with Worldwide Financial Planning, thinks the aims of RDR were laudable but ultimately too lofty to be realised. He says: “For the business world post-RDR, the regulator’s aim was indeed a big ask and for the most part has not been achieved.”

Mr Thompson agrees, highlighting an ever-increasing demand for advice, thanks to a combination of political, economic and social factors, including an ageing population, pension freedoms and intergenerational inequality. Approximately 750,000 people across the UK now retire each year.

Derek Bradley, founder of forum PanaceaAdviser, comments: “In terms of professionalism, it was positive, but it was not resilient, especially for smaller firms, as regulatory costs and limit increases from the Financial Ombudsman Service continue to have a negative effect. Regulation is a hungry beast and needs to be fed a lot, and often. Without that burden, advice would be cheaper.”

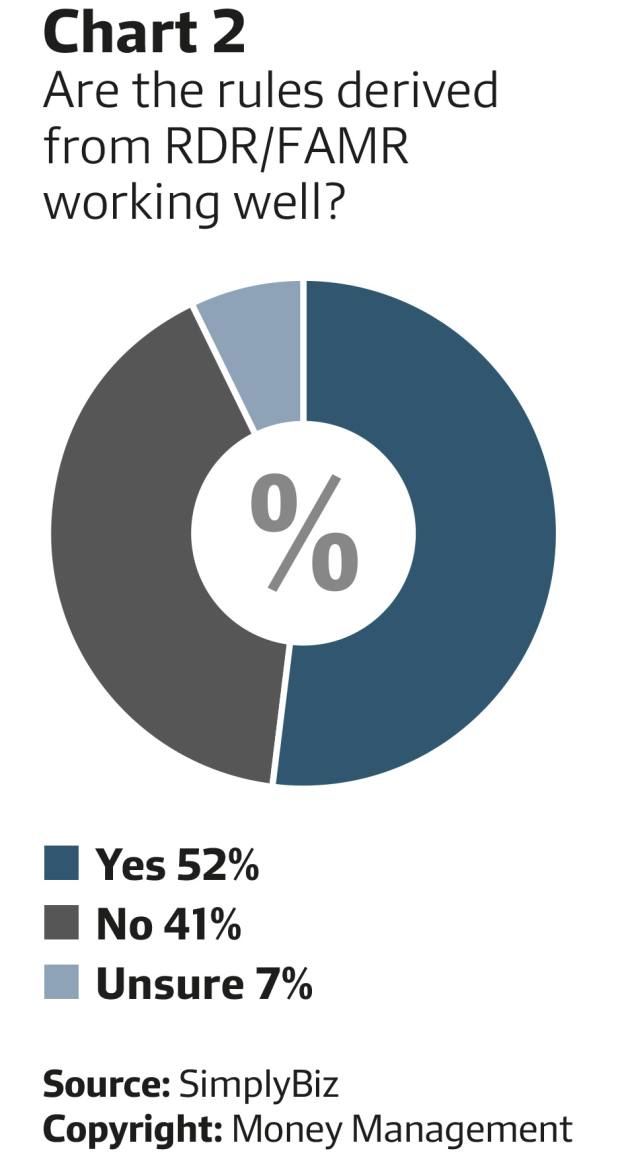

In a poll of 140 member companies, SimplyBiz members were divided over whether the rules derived from RDR and FAMR were working well. As Chart 2 illustrates, 52 per cent said yes, 41 per cent said no and 7 per cent were unsure.

Anonymised comments included: “It’s been relatively successful, but costs are far more expensive for clients and many have been priced out of the advice market.”

Earlier this year, a report produced by Garry Heath, director-general of trade body Libertatum, found that, despite the positive-sounding FAMR objectives, 5 per cent of advisers, a total of 1,650, have immediate plans to retire. Another 16 per cent, a total of 5,280 advisers, hope to retire in the next five years.

And advice is still urgently needed, as Mr Thompson adds: “FAMR was tasked with finding avenues to provide affordable and accessible advice and guidance to everyone. However, to date FAMR has not achieved its goals and has not enabled the industry to offer meaningful financial guidance in support of a public service.”

The FCA was asked for its views on these comments, but did not provide a response.

According to Mr McBreen, falling adviser numbers, an ageing IFA cohort and ever-increasing regulatory pressures and process changes have not made the advice sector any more resilient or effective, despite FAMR findings.

“The mad race to the bottom by many businesses to reduce their fee levels further exacerbates the crazy obsession with the price of everything and the value of nothing,” he claims.

For veteran adviser Pete Slater, managing director of Uberrimae Fidei, the advent of fee-charging as opposed to commission under RDR has had the opposite effect of meeting the regulator’s aims, and FAMR has not changed that.

“It has led many advisers to only offer advice to those with in excess of £200,000 to invest,” he explains. “The man in the street who has just inherited £30,000 is the person who actually needs professional help and advice and yet he is the person who is being turned away.”

Can the advice gap ever be closed?

The 85-page FAMR final report, issued in April 2016, recommended ways to close the advice gap, including a new definition of regulated financial advice and ways to improve self-directed ‘guidance’ services. It said: “The advice market can be made to work better. It is important to expand access to high-quality guidance services.”

HM Treasury and the FCA also recommended modifying time limits for employees to attain an appropriate qualification, giving businesses more flexibility to “develop a new generation of advisers”, and building on the regulator’s Project Innovate to help develop automated advice models.

But clients do not always understand the different types of advice, guidance or signposting that FAMR aimed to provide. According to SimplyBiz’s member companies, 76 per cent do not think clients have a clear understanding of the advice available post-FAMR.

Given this, is the closing of the advice gap achievable? “In a nutshell, no,” says Mr Bradley. “It never will be, despite the good intent.”

Mr Neilson says a twin-track approach is required if matters are to be improved. “People need to know to seek advice and the difference it can make to them.

“Equally, there has to be enough supply to meet demand, and this is not necessarily about having more advisers or relying on robo-advice services. Closing the advice gap completely may be a tall order, but that’s not to say it isn’t worth trying.”

The PFS’s Mr Richards acknowledges the RDR widened the advice gap and furthered “social exclusion”. He does not believe the FAMR has achieved – or can achieve – its objectives, given the current political climate.

“When I first met with Harriett Baldwin [then economic secretary to the Treasury] ahead of the FAMR announcement, it was clear she understood the issue and only with government intervention could the advice gap be addressed. Unfortunately Brexit got in the way of progress.

“Government has been sidetracked by Brexit, but as the elected representatives of the UK public and leaders of strategy we need it back on the case of FAMR. It’s not the job of the FCA. There is little doubt, in my view, that the profession has come of age. But the advice gap will get wider unless the government gets engaged.”

Mr McBreen goes further; his fear is the aims of RDR and FAMR will never be achieved unless more is done at all levels to come up with proper solutions to the advice gap.

He comments: “The closing of the advice gap remains a huge challenge, and over-reliance on technology and algorithms will not solve what are very human problems. They require adult conversations to come up with appropriate solutions and outcomes.”

Otherwise, he claims, too many people will be shoehorned into generic solutions that do not meet their individual, ever-changing needs; hardly a beneficial way to attempt to close the gap.

Far enough, deep enough

Another big question mark is whether FAMR goes far enough, or deep enough, to ‘make the UK’s financial advice market work better for consumers’, in the FCA’s own words.

Mr McBreen thinks it hasn’t, and calls for a “fundamental change” in consumer mindsets. He explains: “One of the intended outcomes of RDR was to move away from transactional product sales and adopt holistic advice for everybody. But this has a price and the end user still struggles.

“The situation is not helped by the regulator seemingly allowing certain firms to continue with their sales-led business model, which is totally out of kilter with the rest of the IFA sector.”

In his mind, the regulator needs to get tougher post-FAMR if it wants the market to work better for consumers.

Simon Harrington, senior policy adviser for Pimfa, says the FCA needs to acknowledge the need for a supportive regulatory regime, not a restrictive one: “If the regulator is serious about closing the advice gap, making advice more affordable and encouraging more people into this market, it needs to also consider what role it can play in overseeing a regulatory landscape that encourages this.”

It is hard to gauge whether FAMR has gone far enough, as a lot of work has gone on behind closed doors within working groups and practitioner panels.

Mr Neilson says: “There is a willingness to make the advice market work better for consumers, but it’s hard to see whether this has translated into real change.”

Moreover, as he points out, the industry is still waiting for the pensions dashboard, and there are deep-seated issues yet to be adequately resolved, such as a consumer compensation scheme framework that is widely seen as unfit for purpose.

What more is needed?

So if the RDR and FAMR have not met their desired goals, what could help the regulator meet its aims?

Mr Neilson admits: “There are probably no quick wins in making the market work better,” but adds: “Demonstrating and quantifying the value of advice is a must, and the continued development of services that appeal to a broader range of clients will also help to make advice more accessible.”

He hopes the new Money and Pensions Service will build on the good work that has been done to date in terms of guidance and wider financial capability, and that the greater transparency required by the likes of Mifid II might help to clean up the investment planning market further.

Mr Slater has a wish list: “I would like to see a return to a home-service style of offering. Allow brokers to receive commission. Some clients will still want to pay a fee as they do when receiving legal or accountancy advice, and should be allowed to do so. Maximum limits on commissions should be reintroduced and initial commissions should be reduced.

He continues: “Compliance should be restructured so the emphasis is on looking after the client and not just protecting the company. Advisers should be encouraged to come up with innovative solutions for individual clients. Above all, education is the key.”

But Mr McBreen is pessimistic. “A considerable amount of time has passed since implementation of RDR and the UK advice sector is still a long way from offering a consistent and value-based proposition.

“If I had the magic formula I would be more than happy to share it but, alas, I don’t.”

Nor, it seems, does anyone in the sector. As all parties continue to search for answers, a pattern of two steps forward and one step back may be as much as can be hoped for when the FCA’s findings are revealed next year.

Simoney Kyriakou is deputy editor of Financial Adviser